The Market Outlook for the Week Ahead, or Taking It in the Shorts

I am writing this to you from the British Airways first class lounge at Rome’s Leonardo da Vinci airport. I arrived here early to avoid the hordes of travelers certain to follow.

At the entrance to the departure area, there is a 20-foot-high bronze statue of the great artist and scientist holding a model of his 15th century imaginative helicopter design. He never built it, but I have seen modern-day life-sized copies.

You’re really taking your life in your hands taking a taxi in Rome. The only law seems to be qui audet, vincit, or who dares, wins (the motto of the British Special Air Service).

I know the 140 on the odometer was only in kilometers so I shouldn’t worry. What concerned me was that we were being passed by other cars doing at least 180.

Tighten that seat belt!

One disturbing practice of Italian drivers is that they never commit to a lane. They drive on the center line until they see a gap in the traffic then they go for it.

There’s nothing like coming home, only to be slapped in the face by a wet kipper. That was delivered by a black swan in the form of the Fitch downgrade of US debt from AAA to AA+ which shaved a shocking seven points off the (TLT) in a week.

The (TLT) held up valiantly in the face of the surprise red-hot Q2 GDP figure of 2.4%, indicating that a soft landing was a done deal. But once the Fitch report was out, it was all over but the crying. The (TLT) now looks like it could double bottom at the October 2022 low of $90.

I thought it was a huge overreaction. Fitch was only mirroring Standard & Poor’s identical downgrade in 2011, the last time a default was in the cards. The US economy and its debt remain the strongest in the world.

But with Republican members of Congress threatening a debt default at every opportunity, what was Fitch supposed to tell its customers? Any lender who threatens not to pay gets downgraded, the US Treasury, you, and even me. The real question is why it took so long. Take your trading loss on the (TLT) out of your next campaign donation.

You never argue with Mr. Market, who is always right. What the selloff does is set up the LEAPS of the century, the (TLT) 2025 $90-$95 vertical bull call spread with a certain 100% profit built in. However, given last week’s experience, I’d rather be late in this trade than early.

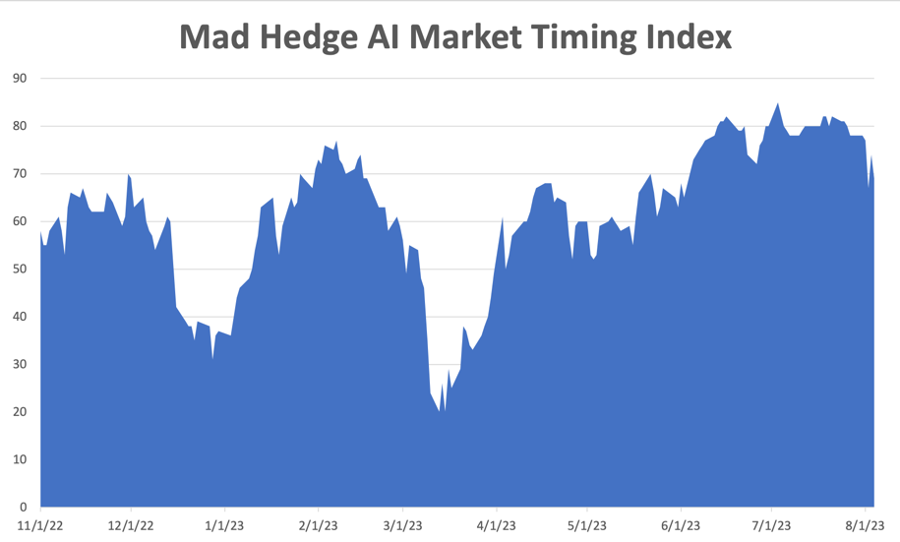

We now have the curious situation with the Mad Hedge AI Market Timing Index stock at an extremely overbought level of 80 for two months, the result of a non-stop melt-up in big technology stocks. The begging question now is how far we pull back before an explosive yearend rally ensues. That will be your last entry point for stocks in 2023.

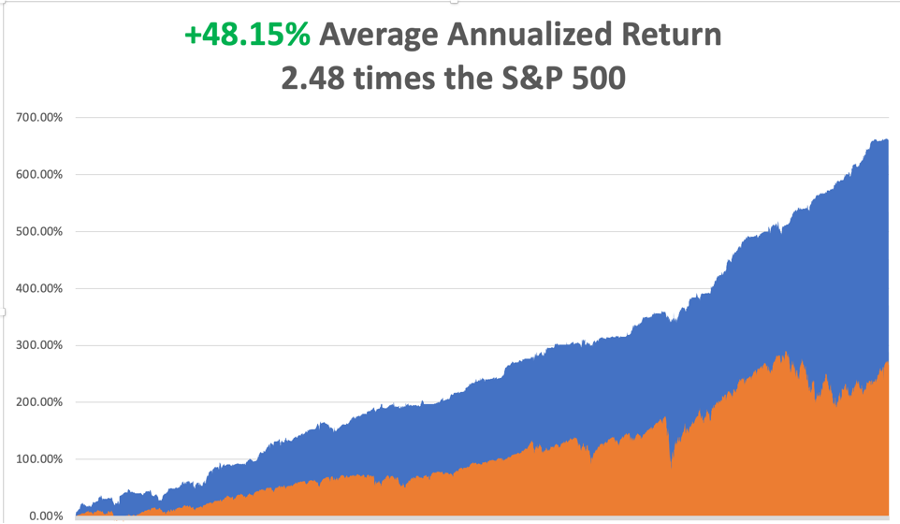

So far in August, we are down -4.70%. My 2023 year-to-date performance is still at an eye-popping +60.80%. The S&P 500 (SPY) is up +17.80% so far in 2023. My trailing one-year return reached +91.08% versus +11.46% for the S&P 500.

That brings my 15-year total return to +657.99%. My average annualized return has fallen back to +48.15%, another new high, some 2.48 times the S&P 500 over the same period.

Some 41 of my 46 trades this year have been profitable.

I really took it in the shorts stopping out of my long position in the (TLT), losing 4.00%, my second largest loss of 2023. Reversion to the mean is a bitch. Every time I break my own risk control rules, I come to regret it. I could have stopped out the day before with only a 1.73% loss. The one consolation is that I went into this correction 90% in cash. I bet the rest didn’t.

See, even old dogs can make mistakes.

The Nonfarm Payroll Drops to 187,000, a one-year low, less than expectations. The Headline Unemployment Rate returned to 3.5%, a 50-year low. The soft-landing scenario lives! That’s supposed to be impossible in the face of 5.25% interest rates. Average hourly earnings grew at a restrained 3.6% annual rate. Half of the new jobs were in health care. At the rate we are aging, that is no surprise.

JOLTS and Layoffs Drop, indicating a slight weakening in labor demand, an important Fed goal. JOLTS fell from 9.62 to 9.58 million in May, a two-year low, while layoffs dipped from 1.55 million to 1.53 million. This is despite red-hot GDP growth.

Panic Buying of Hedge Fund Shorts, drove the markets in July, with many throwing in the towel on bearish bets. This “smart money” has been chasing the market since it bottomed in October. The most extreme buying, like we saw last week, is often the sign of a short-term market top.

US Home Construction Rockets, up 0.5% in June, in an attempt to meet the insatiable demand for new homes. They can’t build them fast enough even though prices are rising fast.

US Debt Downgraded from AAA to AA+ by the well-known Fitch rating agency for only the second time in history. Bonds (TLT) took it on the nose. The January 6 attack on the capitol and standoff over the debt ceiling crisis were cited as the reasons. US bonds are still the safest and most liquid investment in the world when held to expiration.

Uber Announces First Ever Profit on a quarterly basis and $1 billion in free cash flow. The company has emerged as the preeminent ride-sharing company. The shares dropped 5% on a “sell the news” move on top of a double since May. Buy (UBER) on a much bigger dip.

AMD Beats Even as PC Market Slows in Q2 earnings, with revenues down 18% YOY, better than expected. H2 is expected to be hot as data center demand grows thanks to exploding AI demand.

SEC Bans Coinbase from Trading, except in Bitcoin itself. The Federal agency regards all NFTs as unregistered securities. The move is a body blow to the NFT market, which I always regarded as a scam and knocked 25% off the value of (COIN). Avoid (COIN) like Covid 3.0.

Apple Reports Earnings Decline, down 1.4% in its Q3, and expects the same in Q4. iPhone sales took a steep dive, the longest slowdown in its history and knocked 3.2% off of the Teflon stock. Weak foreign currencies also delivered a hit for the most global of companies. But revenues beat at an astonishing $81.8 billion, thanks to rising service sales. Buy (AAPL) on a bigger dip, which was up 47% so far in 2023.

Amazon Soars on Earnings Beat, nearly double Wall Street estimates as its massive bet on AI pays off big time. Aggressive cost-cutting helped. (AMZN) has laid off 100,000 in the past ear, replaced by machines. Amazon Web Services (AWS), the 800-pound gorilla in the sector, also prospered. Buy (AMZN) on dips.

Airbus Delivers an Incredible 381 Aircraft, in the first seven months of 2023 as the global plane shortage worsens. The European consortium booked 60 new orders in July alone. Buy Boeing (BA) on dips, up 105% from the October low.

Airbnb is Looking Good on the back of a massive increase in international travel. In some cities like Tokyo, you can’t even find an Airbnb rental. At a restaurant I visited in Florence last week, 100% of the customers were American, mostly from the east coast. Local regulations banning short-term rentals are also crimping supply. Buy (ABNB) on dips, already up 50% since May alone.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, August 7 at 9:00 AM EST, the Used Car Prices are out, a recent big swing factor in the inflation calculation.

On Tuesday, August 8 at 8:30 AM, the NFIB Business Optimism Index is released.

On Wednesday, August 9 at 2:30 PM, the Crude Oil Stocks are published.

On Thursday, August 10 at 8:30 AM, the Weekly Jobless Claims are announced. The Consumer Price Index for July is printed, the principal inflation indicator.

On Friday, August 11 at 2:30 PM, the Producer Price Index is published. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, one of the great shortcomings of San Francisco is that we only have a theater district with two venues and it is in the Tenderloin, the worst neighborhood in the city, an area beset with homeless, drug addicts, and prostitution.

I was walking to a parking lot after a show one evening when I passed a doorway. Three men were violently attacking a blond woman. Never one to miss a good fight, I dove in, knocking two unconscious in 15 seconds (thank you Higaona Sensei!). Unfortunately, number three jumped to my side, pulled a knife, and stabbed me.

The attacker and the woman ran off, leaving me bleeding in a doorway. I drove over the Golden Gate Bridge to Marin General Hospital, bleeding all over the front seat of my car, where they sewed me up nicely and put me on some strong drugs.

The doctor said, “You shouldn’t be doing this at your age.”

I responded that “good Samaritans are always rewarded, even if the work is its own reward.”

Fortunately, I still had my Motorola Flip Phone with me, so I called Singapore from my hospital bed for a market update. I liked what I saw and bought 100 futures contracts on Japan’s Nikkei 225. This was back in 1999 when anything you touched went straight up.

Then, I passed out.

An hour later, I woke up, called Singapore again and bought another 100 futures contracts, not remembering the earlier buy. This went on all night long.

The next morning, I was awoken by a call from my staff who excitedly told me that the overnight position sheets had just come in and I had made 40% on the day.

Was there some mistake?

Then I got a somewhat tense call from my broker. I had a margin call. I had also exceeded the exchange limits for a single contract and owned the equivalent of $200 million worth of Nikkei. I told them to sell everything I had at market and go 100% cash.

That was exactly what they wanted to hear.

That left me up 60% on the year and it was only May.

I then called all of the investors in my hedge fund. I told them the good news, that I wouldn’t be doing any more trades for the fund until I received my performance bonus the following January and was taking off on a long vacation. With a 2%/20% payout in those days, that meant I was owed 14% of the underlying assets of the fund at a very elevated valuation.

They said, "That’s great, have fun. By the way, how did you do it?"

I answered, “Great drug selection.” No questions were asked.

Then I launched on the mother of all spending sprees.

I flew to Germany and picked up a new Mercedes S600 V12 Sedan at the factory in Stuttgart for $160,000. I then immediately road-tested it on the Autobahn at 130 mph. I made it to Switzerland in only two hours. After all, my old car needed a new seat.

Next, I bought all new furniture for the entire house, each kid selecting their own unique style.

Then, I took the family to Las Vegas where we stayed in the “Rain Man Suite” at the Bellagio Hotel for $10,000 a night, where both the 1988 Rain Man and 2009 The Hangover were filmed.

I bought everyone in the family black wool Armani suits, plus a couple of Brionis for myself at $8,000 a pop. For good measure, I chartered a helicopter for a tour of the Grand Canyon the next day.

At the end of the year, I sold my hedge fund based on the incredible strength of my recent performance for an enormous premium. I then left the stock market to explore a new natural gas drilling technology I had heard about called “fracking”.

Four months later, the Dotcom Crash ensued in earnest.

I still have the scar on my right side, and it always itches just before it rains, which is now almost never. But it was worth it, every inch of it.

It’s all true, every word of it and I’ll swear to it on a stack of bibles.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader