The Market Outlook for the Week Ahead, or The Bottom is In

When the train conductor says “Run”, it’s generally not a good sign.

That’s what happened to me when I had to make a crucial transfer in Visp, Switzerland last month. I’m fine with running. With 200 pounds of luggage? Not so much.

A lot of fund managers started running from their cash positions last week. Tesla (TSLA) shorts ran even faster.

There is a rising sense of panic among money managers today.

The stock market just brought in a blockbuster 7.9% return in July, and they are underweight stocks and loaded with cash. What they DO own are in all the wrong defensive sectors.

A panic is imminent.

A soft landing for the economy is in the cards. There are still plenty of risks out there, as there always are. But bond yields have collapsed, commodity and energy prices are in free fall, and the futures markets are indicating that interest rate hikes ahead will be modest at best.

The Fed is also getting an assist in its tightening efforts from a strong dollar, which pares U.S. multinational earnings, and a recessionary China and Europe. Those two alone are the equivalent of another 100 basis points in rate rises.

The Fed’s work has already been done for it.

The Fed’s Quantitative Tightening is also sucking $120 million a month out of the economy.

The bond vigilantes who were riding hard in the first half have gone to sleep, or at least gone on vacation. That has dropped ten-year US Treasury yields by an amazing 100 basis points in seven weeks. That doesn’t seem to warrant an over-aggressive Fed to me.

Remember also that interest rates no longer have the impact on the economy they once had. The stock of every company I buy has no net debt and are in fact huge net creditors, like Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), and Microsoft (MSFT).

Those that have refinanced their debts at 150-year lows over the last three years, including myself (30-year fixed rate mortgage at 2.75%, some 6.35% under the current inflation rate!).

No credit crunch here, or distressed financial institutions, the fodder of past recessions.

Sure, earnings have come down. But they are being shaved, not decimated. Again, the companies I buy aren’t growing at a modest 5%-10%, but more like 40%-50%, like Tesla (TSLA). Slow growing companies are other peoples’ problems, not mine.

Better yet, they are likely to bounce back hard next year, which is what the market is discounting now.

I’m buying next year’s market, while everyone else is still selling this year’s.

The bottom line is that the U.S. has the strongest economy and currency in the world, making its stocks deserving of a serious premium. Add up rate rises, QT, a strong greenback, a recessionary world, the largest deficit reduction in history, war, and stocks STILL can’t go down.

It's an old trader’s nostrum that if you dump bad news on a market and it fails to go down, you buy the heck out of it. This is one of those times.

That makes my yearend forecast of an S&P 500 of 4,800 by year-end not only possible but likely. Buy every substantial dip in every one of your favorite stocks from here on out. You might be risking 10%-20% over the short term but gain 100% on a three-year view.

The risk/reward is overwhelmingly in your favor.

I hope this helps.

July Nonfarm Payroll Hits a Blockbuster 528,000, double expectations, the best since February. The Headline Unemployment rate fell to 3.5%, a new post pandemic low. No recession here. Average hourly earnings popped 0.5%. The Dow dropped $250 as possible scenarios were already discounted in the market in a classic “Buy the rumor, sell the news” move. Bond yields soared. The difficulty in finding workers is overwhelming recession fears. Hotels and restaurants created enormous numbers of jobs. The Fed now has a license to maintain aggressive interest rate rises. My bond short in the (TLT) is looking good.

Weekly Jobless Claims hit 260,000, an 8-month high, as recession fears fan the flames. That beats the 1 million figure we saw at the pandemic high two years ago. Layoffs are falling. That makes tomorrows July Nonfarm Payroll Report more important than usual.

Fed Says More Rate Hikes Coming but No Recession, says St Louis Fed president James Bullard. I couldn’t agree more. If inflation dips look for only a 50-basis point rate hike in September. Stocks will soar.

England Predicts Major Recession after hiking interest rates by 0.50% to 1.75%. The Bank of England expects inflation to peak at 13.3%. Europe economy is in the toilet and China is weak. It all highlights how America now has the strongest economy in the world and is therefore the first choice for equity investors.

Weak Chinese Data Torpedoes Oil, down 34% from its February peak. Oil is now lower than when the Ukraine War started. Manufacturing PMI dropped from 51.7 to 50.4, barely outside recessionary data. New Chinese Covid shutdowns are the cause. Could this recession go global?

Home Prices fall at a Record Pace, down from a 19.3% annual gain to 17.3% in June, according to Black Knight, a mortgage analytics firm. Some 25% of major U.S. markets saw growth slow by three percentage points in June. It’s all about interest rates.

Mortgage Rates Drop Below 5%, for the 30-year fixed, a four-month low. It’s putting a floor under the housing market. Refi’s are still near zero. The collapse in bond yields is feeding through.

Half of U.S. Homes are Equity Rich, indicating homeowner equity is more than 50% of market value. That makes available trillions of dollars in potential second mortgages to support the economy. Americans are richer than they think.

Tesla Voted to Split Shares. The 3:1 split will make the shares more affordable for lower-end (poorer) investors who want to make the millions we have for the past decade. Watch for a spike in the price as share splits always attract a hoard of short-term meme investors. The last 5:1 split in 2020 brought an eye-popping near doubling of the shares in six months

ISM Non-Manufacturing Gains 2%, in June where tech lives. It shows that our “recessionary” economy may be stronger than you think, especially in the right sectors. No wonder stocks are going up every day.

Carried Interest Lives Again, with Arizona’s Kristin Sinema stopping the abolishment of tax-free treatment of hedge funds and private equity funds as her pound of flesh for backing Biden’s stimulus bill. People have been trying to end carried interest since President Carter pushed it through in 1979 to jump-start venture capital and Silicon Valley. It truly demonstrates the power of lobbying and will lead to more concentration of wealth at the top. Look for a vote next week.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility in market history, my August month-to-date performance reached +0.46%.

My 2022 year-to-date performance expanded to 55.29%, a new high. The Dow Average is down -9.64% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 74.73%.

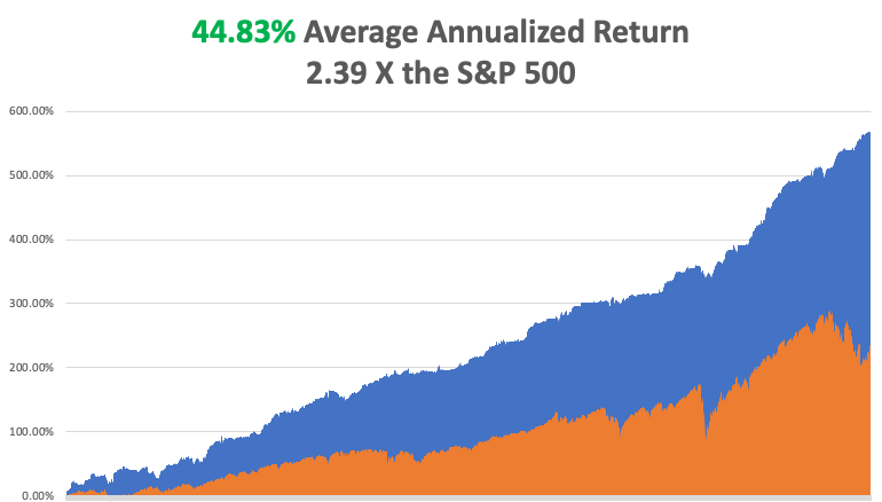

That brings my 14-year total return to 567.85%, some 2.39 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 44.83%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 91 million, up 300,000 in a week, and deaths topping 1,033,000 and have only increased by 2,000 in the past week. You can find the data here at https://coronavirus.jhu.edu.

On Monday, August 8, there is no data of note.

On Tuesday, August 9 at 8:30 AM, the NFIB Business Optimism Index for July is out.

On Wednesday, August 10 at 8:30 AM, the CPI Index for July is published.

On Thursday, August 11 at 8:30 AM, Weekly Jobless Claims are announced. The Producer Price Index for August is printed.

On Friday, August 12 at 7:00 AM, the University of Michigan Consumer Sentiment Index is disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, I had the good fortune to live with a Nazi family in West Berlin during the 1960s. While working at the Sarotti chocolate factory in Templehof, my boss took pity on me and invited me to move in with his family. I jumped at the chance of free rent and all the German food I could eat.

What I learned was amazing.

Even though the Germans had lost WWII 20 years earlier, they still believed in the core Nazi beliefs. However, they loved Americans as we had saved them from the Bolsheviks, especially in Berlin. President Kennedy had delivered his famous “Ich bin ein Berliner” speech only seven years earlier.

There have been thousands of books written about wartime Germany, but almost none about what happened afterwards. I absorbed dozens of stories from my adopted German family, and I’ll tell you one of the most unbelievable ones.

In the weeks after the German surrender on May 7, 1945, Berlin was shattered. The city had been the subject of countless 1,000 bomber raids and the population had shrunk from 5 million to only 1.5 million. Most of the military-aged men were absent. Survivors were living under the rubble.

What’s worse, everyone knew that the allies would soon declare the German currency, the Reichsmark, worthless and replace it with a new one, wiping out everyone’s life savings. So, they had to spend as fast as they could. But with the economy in ruins, there was nothing to buy. In any case, the only thing they really wanted was food, which they could get on a thriving black market.

It turned out that there was only one thing they could buy in unlimited quantities:

Movie tickets.

When Hitler came to power in 1933, one of the first things he did was ban American movies. The industry was taken over by propaganda minister Joseph Goebbels who only permitted propaganda films promoting Nazi values for domestic consumption.

The only American film permitted in Germany during the 1930s was Grapes of Wrath because it highlighted U.S. weaknesses. Movie production was shut down completely in 1943 because of the war’s demands on supplies.

When the war ended, suddenly, the iconic movies of the Great Depression became available, such as the works of the Marx Brothers, Shirley Temple, The Wizard of Oz, Gone with the Wind, and King Kong.

Impromptu movie theaters were thrown up against standing walls of destroyed buildings. Within two weeks of the surrender, half of Berlin’s prewar 550 theaters had reopened. Of a population of 1.5 million, 850,000 movie tickets were sold every weekend. The summer of 1945 became one long film festival. The Germans laughed, cried, and were enthralled.

Every weekend was a sellout. The only movie that bombed that summer was a U.S. Army documentary about the concentration camps. But even that one sold 400,000 tickets.

The movies had a therapeutic effect on the German people. It distracted them from their daily privations, starvation, and suffering. It also allowed them to reconnect with western civilization. Ask any Berliner about what they did after the war and all they will talk about are the movies.

The allies finally did withdraw the Reichsmark in 1948. Individuals were only permitted to convert $40 out of the old currency into the new Deutschmark, which was then worth 25 cents. Only those who had title to land maintained their wealth, and most of those were farmers in the new West Germany.

I hope you enjoyed this little fragment of unwritten history, which I find amazing. But then, I find everything amazing.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Berlin in 1945

Berlin in 1968