The Market Outlook for the Week Ahead, or The Delta Correction is Here

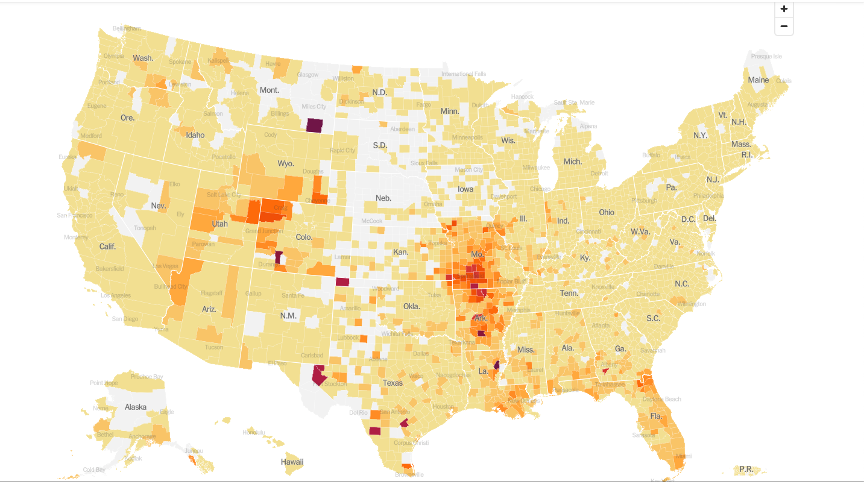

Right now, the fate of your investment portfolio, and indeed your life, is in the hands of a minority of anti vaxers in the Midwest.

If the surge in the delta variant burns out in weeks or a month, the current market correction won’t extend any more than 5% and you should be loading the boat with big tech stocks like (AMZN), (AAPL), (FB), and (MSFT).

The delta variant is becoming a big deal, with unvaccinated states like Arkansas (35% vaccination rate) and Missouri (40% rate) driving the resurgence. It is essentially an epidemic of the unvaccinated.

Unless checked, it could lead to a broader stock market selloff in August. Los Angeles brought back the indoor mask mandate on Saturday, although compliance is near zero. San Francisco may be close behind.

Everyone in my company worldwide is now vaccinated, with Australia last to get one. I’ll be first in line for the Pfizer booster out in the fall. Delta is twice as contagious, more fatal, with more permanent side effects than earlier variants. And it’s killing more kids.

But it’s not the delta you have to worry about. If a future epsilon or zeta variant emerges, that can overcome our current vaccines, bred in the Midwest, the economy would shut down again and you can kiss your bull market goodbye. That would lead to a 1918 style finish to this pandemic, the fatality rate would go up to 50%, and millions more would die.

I’ll stick to the optimistic case….for now.

Even if we get a new variant, we now have the infrastructure in place to sequence the DNA of a new strain in a day and have 100 million doses in the freezer in two months. But it could be a close-run thing.

If you want to stick with your long portfolio in the face of millions dying here is the argument.

The Fed is unable to stimulate the economy any further through interest rate cuts or more QE. It is like pushing on a string. Companies can’t hire the labor they need to increase production or obtain the parts to make things.

This ends in August when workers get their free childcare back in the form of the public school system. The ending of Covid benefits will also light a fire under them. This will lead to a collapse in the unemployment rate and a further rise in GDP from the current ballistic 7.0% rate. This will allow the Fed to raise rates, but not enough to hurt stocks, especially techs.

This is your Goldilocks scenario for H2.

Driving down from Lake Tahoe to Long Beach to pick up my kids from Scout Camp, I passed two huge wildfires. Half the vehicles on the road (US 395) were fire trucks and crews moving in from other states. It’s like being at war.

So, you might ask the question of when will Climate Change affect the stock market? The answer is that Climate Change is actually great for stocks. Money gets spent to put fires out, then trillions of dollars get spent to rebuild with insurance claims.

The biggest impact of climate change is the decarbonization of our energy infrastructure, out of fossil fuels and into alternatives. Solar will soar from 20% to 70% of total electric power output in a decade while nuclear stays at 20% and hydroelectric at 10%. Coal and oil completely disappear. This will enable a large cut in our total energy bill.

Yes, I know oil has rallied lately. I’m sure American Leather had rallied on the way to zero, the only Dow stock to ever completely disappear. It was wiped out by the transition from horses to cars, eliminating 97% of the demand for leather. (The horse population went from 120 million to only 3.8 million today).

There are ways to play this today. Solar growth will be massive, so you have to look at the Invesco Solar ETF (TAN) and First Solar (FSLR).

Here is the next market top, at least for the short term. That’s because, for the last year, stocks have a nasty habit of selling off after quarterly earnings reports, which are just around the corner. Announcement dates for the FANGS are below. For the short term, you want to sell days before the reports. For the long term, you want to keep them, as I expect all to double or more in the next three years.

Facebook (FB) is July 28, 2021

Alphabet (GOOGL) - Jul 25, 2021

Apple (AAPL) Jul 27, 2021

Amazon (AMZN) Jul 26, 2021

Netflix (NFLX) Jul 20, 2021

Microsoft (MSFT) - Jul 28, 2021

China’s economy is slowing, with the post-Covid bounce over. It just provided $154 billion in stimulus for its economy and cut bank reserve requirements by 50 basis points. If they slow there, we could slow here, especially for big exporters to China in the ags.

Core CPI jumps to 5.4%, the biggest gain in 13 years. Excluding food and energy, it’s the biggest print since 1991. The Fed is holding its breath that these large numbers are temporary. Used car and truck prices accounted for a third of the gain for the second month in a row. That is certainly not sustainable, or I’m going into the used car business. Tech took off like a rocket on the news.

Producer prices show biggest gain since 2008, the is index up a hot 1.0% in June against 0.8% in May. PPI is up 7.3% YOY. Higher commodity and labor costs against shrinking inventories were the big issues. Inflationary pressures are here, but for how long?

Senate agrees to $3.5 trillion spending plan, providing great news for stocks and terrible news for bonds. No Republican support is required. This is in addition to the $579 billion infrastructure deal reach with opposition support. It’s enough dosh to keep this stock market percolating for years. Buy FANGS on dips.

Any tightening is a ways off, says Fed governor Jerome Powell in his congressional testimony, sending bonds soaring. The comment was in response to the superheated 5.4% CPI print on Tuesday. The $120 billion a month in Fed bond buying continues. Big tech loved it and continued with its non-stop rally. The rocket fuel for share prices continues unabated.

The four biggest US banks deliver spectacular earnings, posting a combined $33 billion in profits, triggering the predictable selloff. That is $9 billion above analyst forecasts, which seem to be a permanent lagging indicator. Consumer spending is exceeding pre-pandemic levels, credit quality is soaring, and credit card spending is through the roof. Buy (JPM), (BAC), and (V) on dips.

US retail sales come rocketing back, with customers spending those stimulus checks hand over fist. The 0.6% gain in June came on the heels of a 1.7% drop in May. Vaccinations are driving buyers back into the stores. Electronics stores, clothing, and restaurants saw the biggest increases.

Bank of America lowers US GDP from 7.0% to 6.5%, still the whitest hot numbers in history. 2022 is looking like 5.5%, still double the pre-pandemic rate. Personally, I think these numbers are low, and the stock market thinks so too. Keep buying dips in the good names.

Investors pouring out of bonds and into stocks, according to a survey of mutual fund flows last week. I couldn’t agree more. The Fed can’t keep holding on to zero rates forever, and when their turn comes, its will be brutal.

My Ten Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached a 1.84% gain so far in July. My 2021 year-to-date performance appreciated to 70.44%. The Dow Average is up 13.35% so far in 2021.

I spent the week running my two last positions, a long in (JPM) and a short in the (TLT) into the July 16 options expiration. Both expired at max profit. I then immediately strapped on a new short in the (SPY), my first since the pandemic began. That leaves me 90% in cash. I’m keeping positions small as long as we are at extreme overbought conditions.

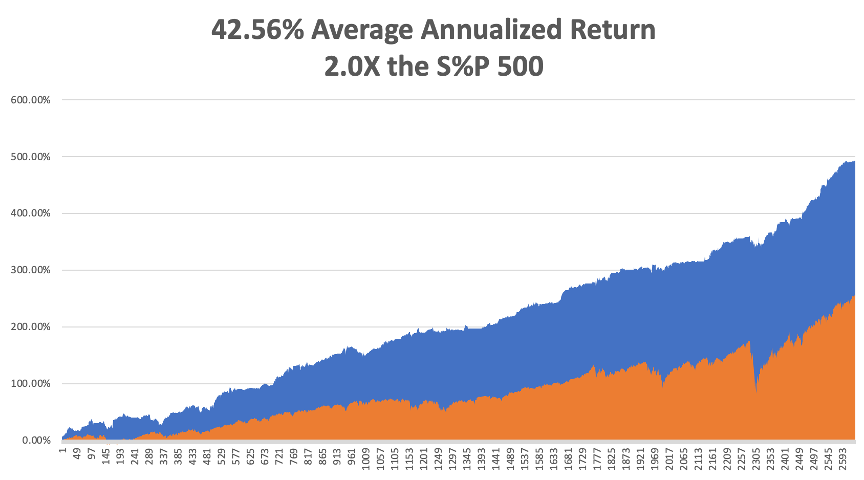

That brings my 11-year total return to 492.99%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.56%, easily the highest in the industry.

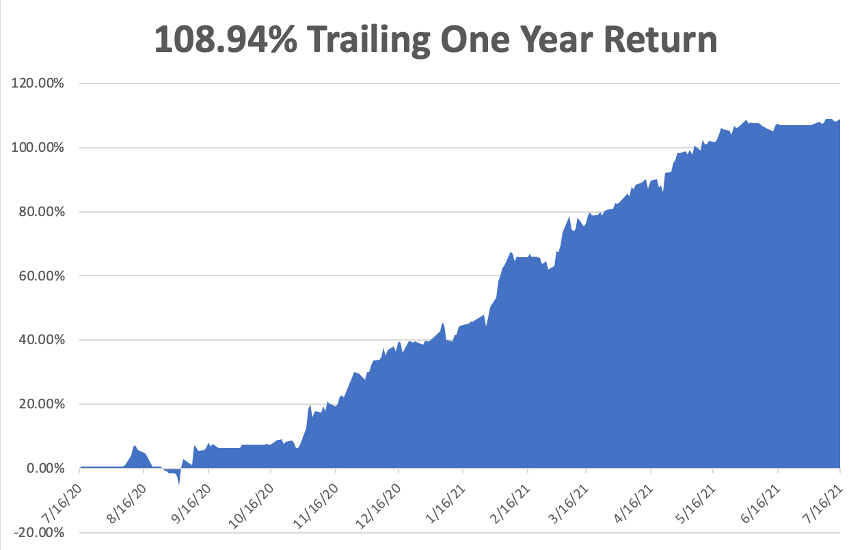

My trailing one-year return exploded to positively eye-popping 108.94%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 34.1 million and deaths topping 609,000, which you can find here.

The coming week will be a weak one on the data front.

On Monday, July 19 at 11:00 AM, the NAHB Housing Market Index for July is out. Johnson & Johnson (JNJ) and Verizon (VZ) report.

On Tuesday, July 20, at 8:30 AM, Housing Starts for June are printed. Haliburton (HAL) and United Airlines (UAL) report.

On Wednesday, July 21 at 11:30 AM, EIA Crude Oil Stocks are announced. Netgear (NTGR) reports.

On Thursday, July 22 at 8:30 AM, we learn the latest Weekly Jobless Claims. At 11:00 AM, we get Existing Home Sales for June. American Airlines (AAL) and Biogen (BIIB) report.

On Friday, July 23 at 2:00 PM, we learn the Baker-Hughes Rig Count. American Express (AXP) reports.

As for me, we all had to rearrange our budgets in the last year, dumping old spending habits and adopting new ones.

As for me, my electric scooter bill with Lime (click here for the site) has gone through the roof. They neatly fill the gap between walking and Uber in major tourist areas like Long Beach.

It’s a lot of fun, provided you don’t kill yourself on your first ride. The scooters go fast, some 20 miles an hour. Each one has a 13-mile range. When you’re done, you just drop it, take its picture, and then Lime picks it up and recharges it overnight.

I think I broke all seven of their mandatory rules (no driving on sidewalks, driving without a helmet, drinking while driving….). Hey, the great thing about being my age is that there are no long-term consequences to anything.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Check Out My New Wheels

Here is the Problem