The Market Outlook for the Week Ahead, or The Downside of Doge and The Last Glass of Kool-Aid

Let’s engage in a thought experiment here.

Let’s assume that the new government is successful in all its goals and government spending is cut by $2 trillion. That is 7.2% of the $27.2 trillion US GDP. A loss of that magnitude of economic activity is known as a recession on the order of the one triggered by the pandemic.

What if that loss continues for three years? That amounts to a loss of $21.6% of the economy. The name for this? The Great Depression, when we lost 29% of GDP from 1929 to 1933.

What happens if the 25% tariffs on our major trading partners take place, and they bump up the inflation rate from 3% to 5%. Then the Federal Reserve will have to raise interest rates in the face of a weakening economy. That is exactly what caused the last great depression.

Believe it or not, this is not the worst-case scenario.

It is illegal to fire government employees, except for cause, like fraud, theft, or sexual harassment. So unless the government instantly comes up with cases for cause against 10,000 dismissed employees at USAID, it is facing a massive liability in the form of a gigantic class action suit. If they settle for $1 million each that works out to $10 billion. If the court awards $10 million per wrongfully dismissed employee, which is typical, the bill comes to $100 billion.

Multiply that figure across the many government agencies where wrongful dismissals are taking place, and you could easily get to $1 trillion. This is known as a contingent liability, which any corporation would have to disclose.

Here's another problem.

Let’s go back to USAID since that is where we have the clearest set of numbers. About $1 billion of their budget was for salaries. The other $39 billion went to US farmers for the purchase of food, like wheat, corn, and soybeans, to ship abroad to starving foreigners. USAID didn’t send any money to poor countries, just American goods and expertise.

If you take that amount of buying out of the economy, it will have a huge impact. USAID bought some $550 million worth of the $16 billion US wheat market, or 3.5%. This is happening in an already weak wheat market. The three largest wheat-growing states are North Dakota, Kansas, and Montana. They will buy less fuel to operate farm machinery, less demand for bulk shipping, and certainly a lot less hiring of farm workers. I know because I have several farmers as subscribers.

These are all known as “downstream economic effects” and I have a feeling that no one has thought of these. But they are huge, a multiple of the initial cost savings. Trump is discovering the inverse cost multiplier, that a dollar worth of cost cuts creates $3 of service cuts or more.

We will also find out that by firing half the workers in an agency you lose 100% of the functionality. It has an exponential effect. We learned today that the IRS fired 7,000 of its 100,000 workers. When you’re downsizing a company, the last people you get rid of are the bill collectors.

How much this will cut revenues is anyone’s guess, especially when you include the end of audits on high-income earners. But I bet there are more than a few considering that marginal deduction when preparing their 2024 tax returns, due April 15, like claiming that expensive dinner with a wife as an unreimbursed business expense.

That’s great news for me because I have been audited by the IRS every year for the last 12 years. It turns out that the IRS considers an online business with $200,000 a year in travel expenses a high-value target.

Who knew?

These are all known as “downstream economic effects” and I have a feeling that no one has thought of these. But they are huge, a multiple of the initial cost savings.

All of the above is known in the hedge fund industry as “long tail risks,” and is a reference to the far right and left data points in a bell-shaped curve. These are low-probability events that have an astronomical impact on markets when they occur. And you know what? The long tail risks are rising.

You know who is watching the long tail risks? The Federal Reserve, which in the new government has become the sole source of independent, well-researched economic thought.

The Federal Reserve has certainly taken notice of the above risks. One governor opined last week that the trade war would deliver a shock to the economy on the order of the COVID epidemic. Another cited the heightened risks of “pervasive ambiguity”, meaning that no one anywhere knows what the hell is going on. “Pervasive ambiguity” will probably become the “irrational exuberance” of this generation.

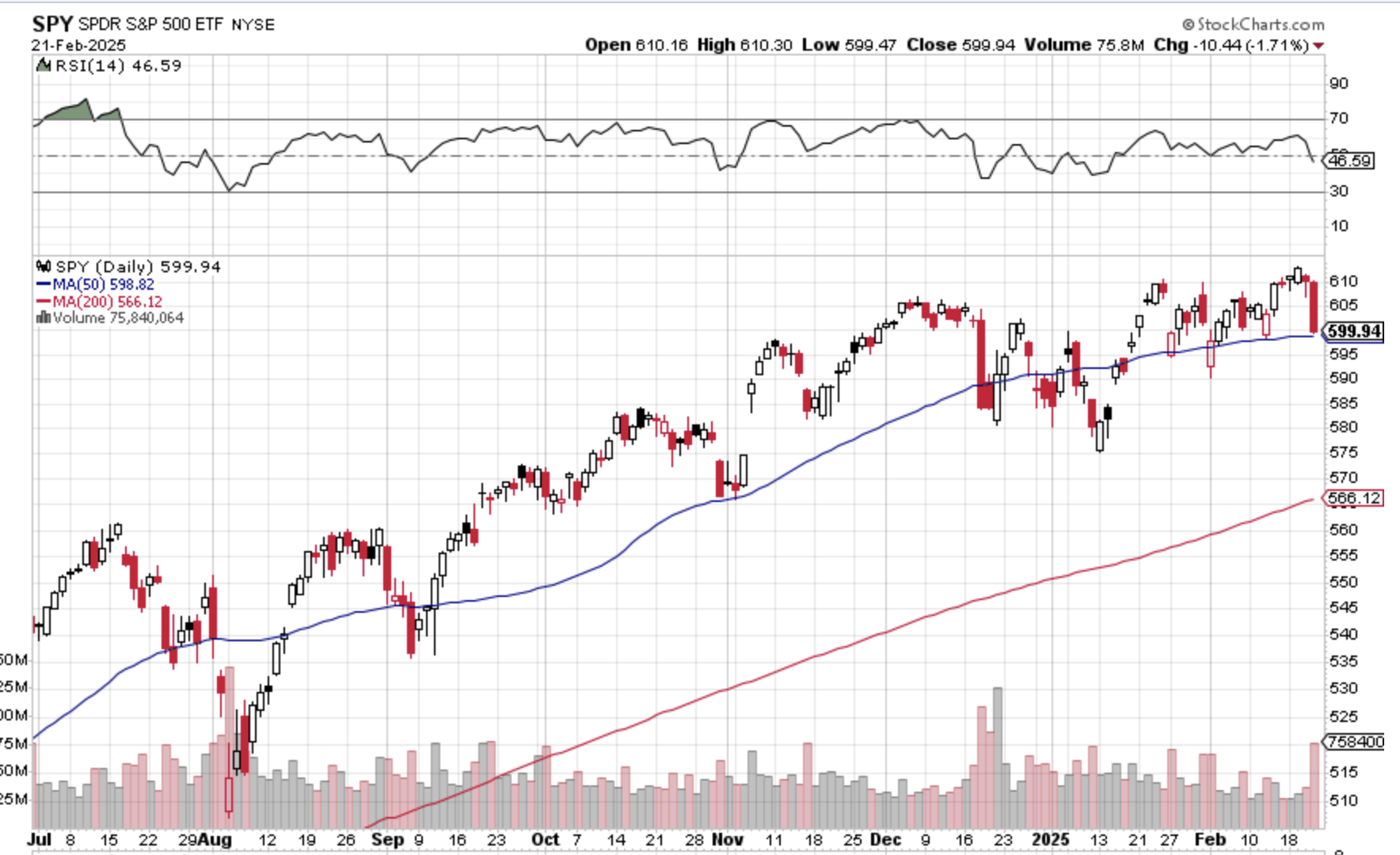

If these long-tail risks come to pass the stock market will notice. We got a free sample on Thursday and Friday when the down plunged intraday by some or 2.6%. The (SPX) is now up just 1.5% YTD, versus +23% for China. What was most important is that many of the highest momentum US stocks saw double-digit losses. Did momentum just die but nobody told us?

Just to prove I am not biased, there is one government move I totally agree with.

They actually asked the Department of Defense if there were any programs they would like to get rid of. I happen to know that our defense spending is greatly diluted by thousands of useless programs that exist for the sole reason that they create jobs in rural states. I know of hundreds of examples but I’ll give you just one.

My Uncle Tim was a Master Sergeant in the US Air Force and was chief mechanic for B-52 bombers stationed at Andersen Air Force Base in Guam. I used to visit him frequently when I lived in Tokyo. He showed me that the big bird was cleverly designed to be built from parts in all 50 states. That made maintenance difficult because it was hard to get replacement parts, forcing him to maintain supplies at much higher levels. Reordering was hard because many of these parts were supplied by companies that only existed on paper and no longer existed. Of the original production run of 744 B-52s from 1952 to 1962, there are only 58 in active duty today. The Air Force plans to continue with these aircraft until 2052 when they will become 100 years old.

If we get a Great Depression, we will get a Great Depression-type stock market. From 1929 we dropped 95%. Personally, I’d settle for the 52% we saw in 2008.

I still think the euphoria trade still has another month or two left. We still have one more cup of Kool-Aid left to drink. After that, we may get some rough sledding and you should seriously consider selling.

Another way of describing this course of events is “The End of American Exceptionalism” The global markets have been shouting as much at us with the massive amounts of investment capital pouring out of the US and into Europe and China, as their stock markets have indicated. The US dollar has been in free fall since mid-January. Who does worst with “The End of American Exceptionalism”? The Magnificent Seven.

Oops! Sorry to piss on your largest position from a great height. But numbers don’t lie.

Every day I go to work I ask myself what I have got wrong, what have I missed”? Do you do the same? If you don’t, maybe you should start. It will have a “long tail” effect on your own investment performance, as it has on mine.

I outlined the out-of-consensus thoughts in today’s letter with an old hedge fund friend last week and after agreeing on every point, he made an interesting observation. Warren Buffet may completely nail this near-century-long bull market in American stocks. He was born in 1930 when most of the stock market damage was done.

The really bad news? Warren Buffet is about to turn 95. In at the bottom, out at the top?

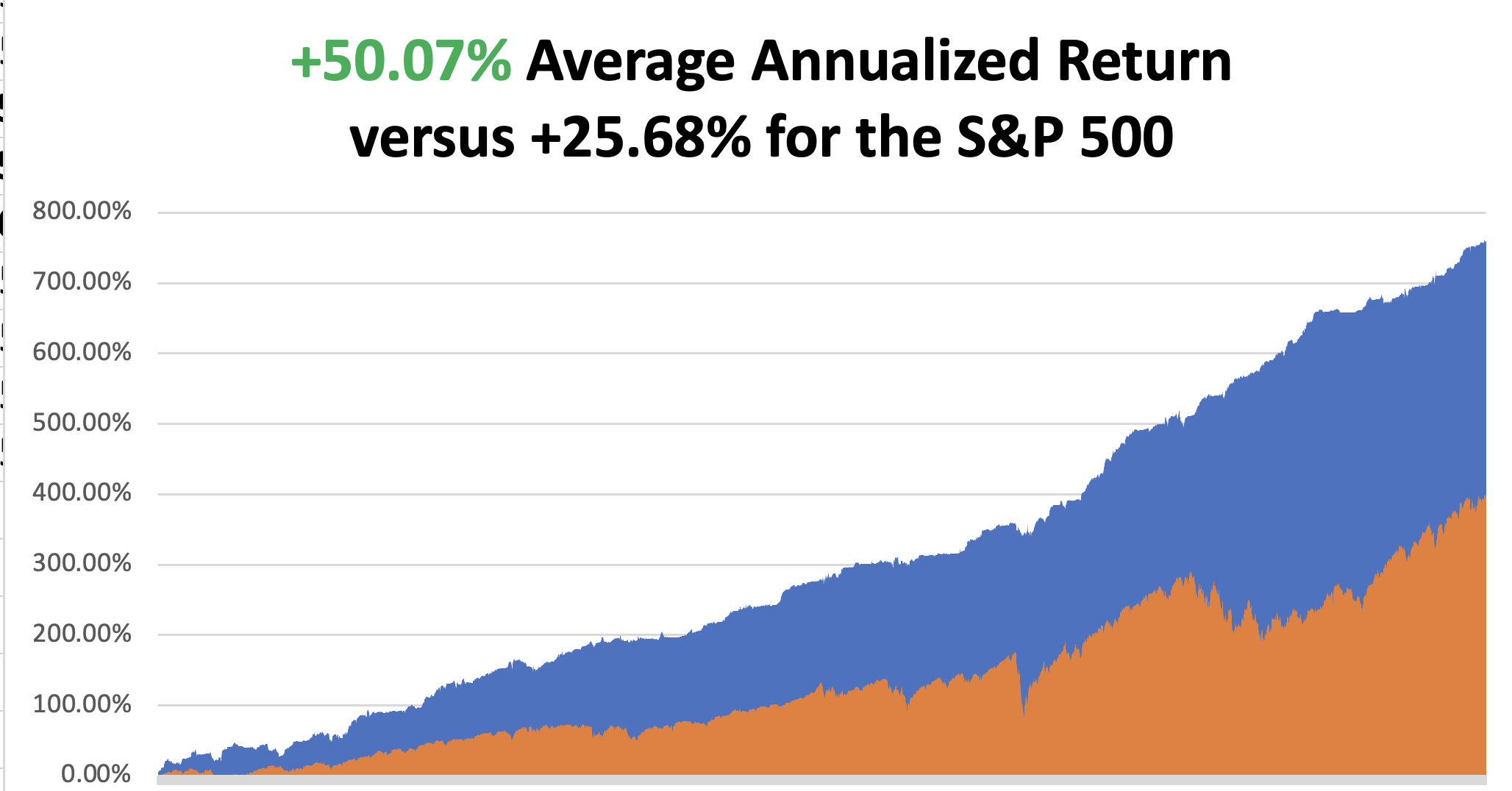

February has started with a respectable +1.76% return so far. That takes us to a year-to-date profit of +6.60% so far in 2025. My trailing one-year return stands at a spectacular +87.93% as a bad trade a year ago fell off the one-year record. That takes my average annualized return to +50.07% and my performance since inception to +759.45%.

I used the February 21 options expiration to take my model portfolio from 60% cash to 90% cash. My long positions in Nvidia (NVDA), Vistra Energy (VST), and my short position in Tesla (TSLA) all expired at their maximum profit points. That leaves me with a sole long position in Goldman Sachs (GS).

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

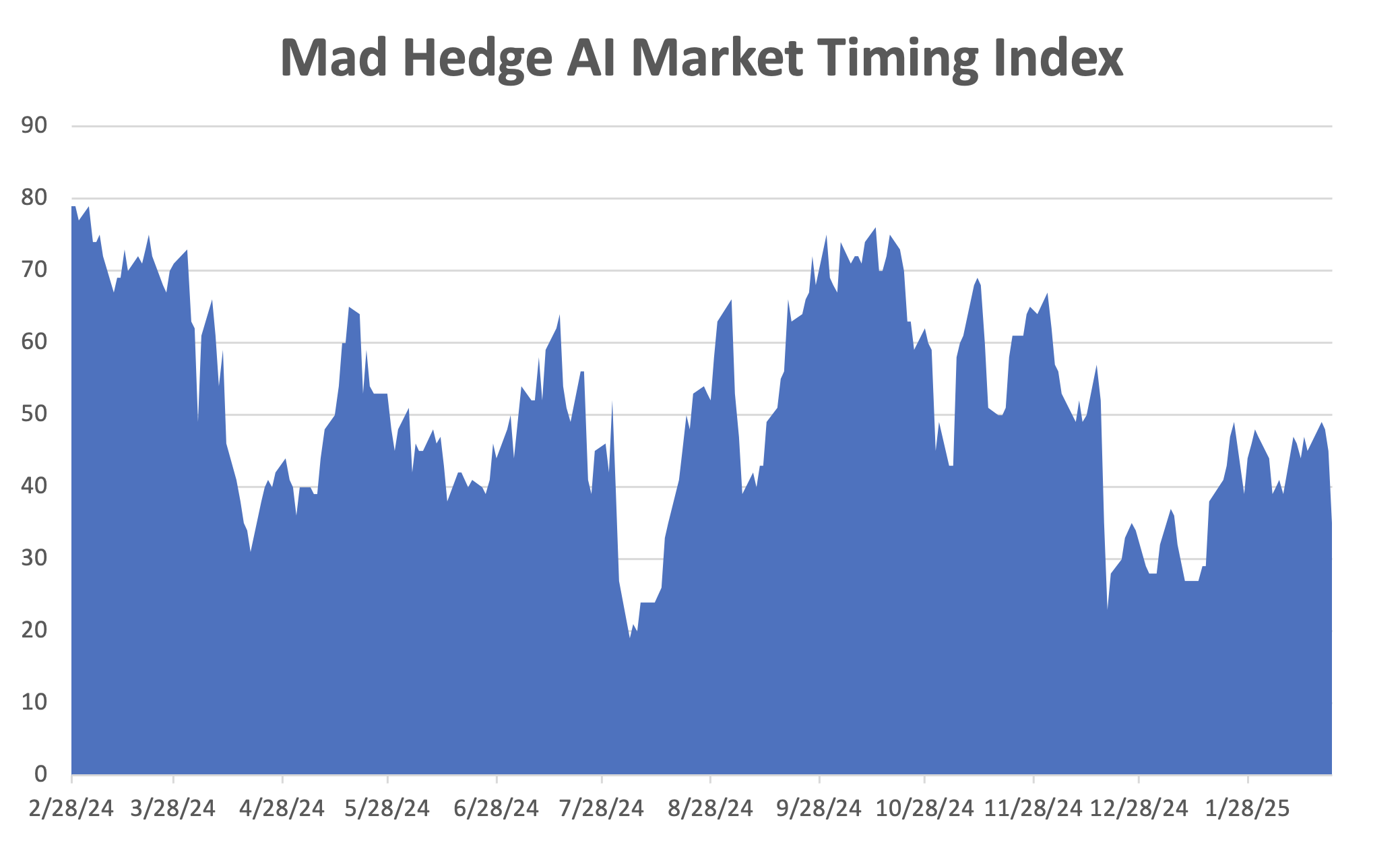

Economic Data Has Flipped from Mixed to Universally Bad, which is why the stock market volatility is increasing. The US now has the worst-performing major stock market in the world. Certain economies have stocks that trade at high multiples. Uncertainty, now at an 85-year high, trades at low multiples.

Goldman Boosts Gold Forecast, to $3,100 per ounce, up from $2,890 previously. Spot gold gained on Tuesday after hitting a record high at $2,942.70 per ounce on February 11. Bullion has hit eight record highs so far this year and is up 11% so far on an annual basis. (Buy (GLD) on dips.

Silver is Catching Up with Gold, which hit a new all-time high weeks ago. Usually, silver outperforms gold by 2:1. But Chinese savers are after the yellow metal, not the white one, as are central banks. Silver depends more on industrial uses and alternative energy, which is seeing all subsidies eliminated. Buy (GLD) over (SLV).

Homebuilders are Panicking Over Tariff Prospects. Sentiment among the nation’s single-family homebuilders dropped to the lowest level in five months in February. The drop was largely due to concern over tariffs, which would raise homebuilder costs significantly. Sales expectations in the next six months took a major hit in the National Association of Home Builders’ Housing Market Index.

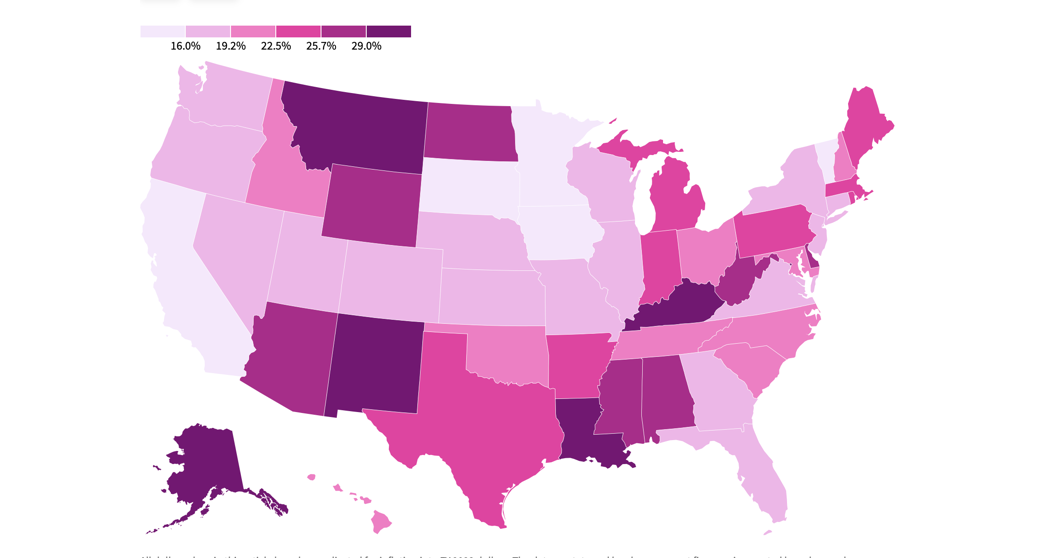

Washington DC Economy is in Recession. Unemployment claims are up 400% YOY, home prices are down 10%, and the commute is noticeably lighter. The condition will get much worse before it gets better. Will it spread to the rest of the country? A lot of rural states are far more dependent on Washington than they realize. Alaska, Montana, Louisiana, Wyoming, and Kentucky are the top six per capita recipients of federal government money. Four out of five voted for Trump in 2024. California and Vermont received the least.

Goldman Sachs Gets Whacked, down $25, or 3.9%, along with the rest of the financial sector. The new administration has decided to continue with Biden’s ultra-tough mergers & acquisitions policy, which is pro-consumer and anti-monopoly. (GS) is still a great company and the deregulation story still applies, but the bloom is off the rose.

Cruise Line Shares Get Sunk, with big losses in (CCL) and (RCL). The New Commerce Secretary indicated that their tax-free status may end. The ships are registered in Bermuda and employ all low-paid foreign crews but almost all of the passengers and revenues come from the US.

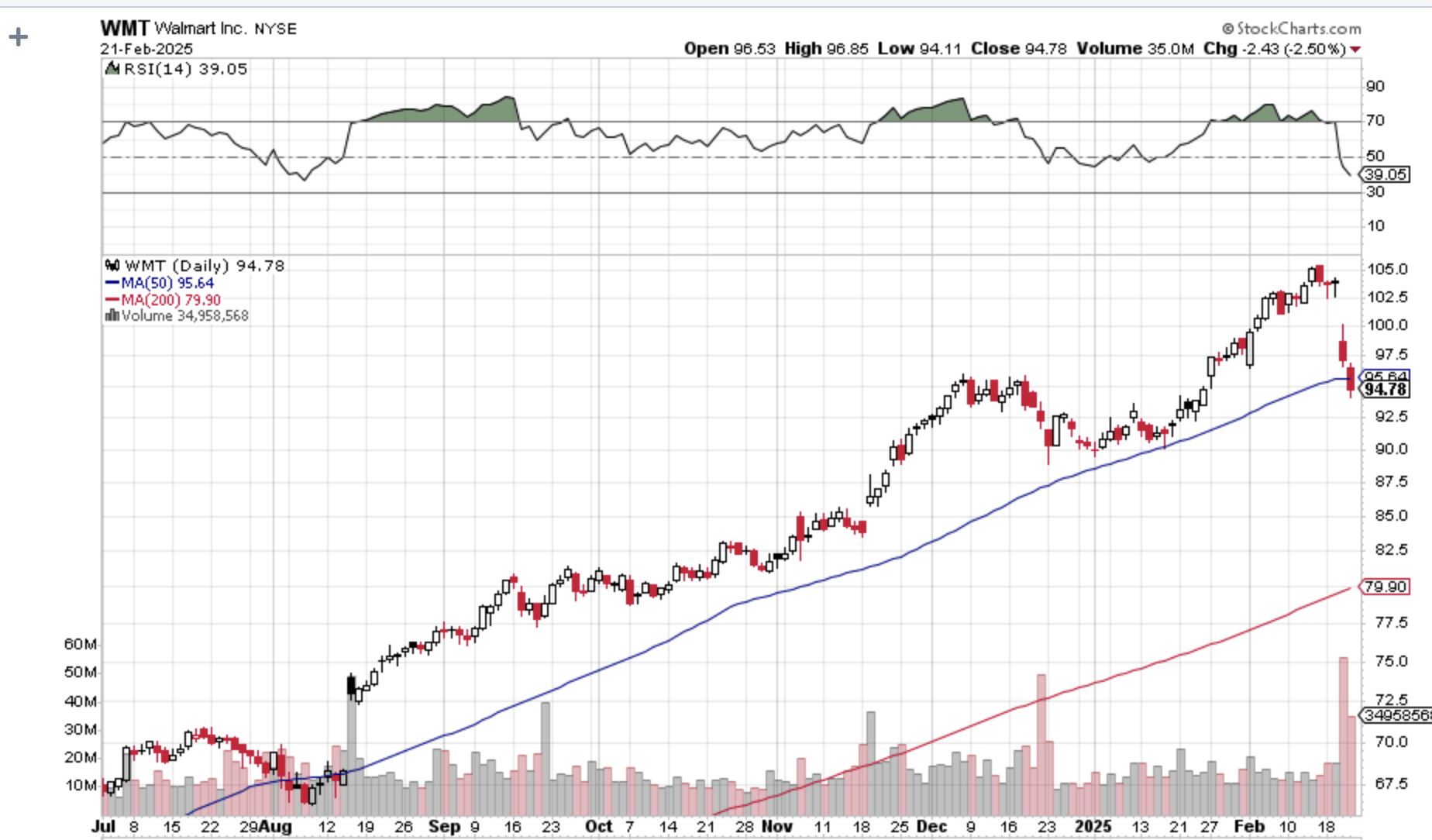

Wal-Mart Gets Crushed, with the shares down 7%. Nobody wants to take the risk that tariffs get implemented when (WMT) would take the biggest hit. The recession risk is on.

Weekly Jobless Claims Jump 5,000, to 219,000. A big surge is coming from newly laid-off government workers.

Consumer Sentiment Nosedives, to a 30-year low according to the University of Michigan. Consumers expect prices will climb at an annual rate of 3.5% over the next five to 10 years, according to the final February reading from the University of Michigan. The news shaved 31 points off the S&P 500.

Early Recession Indicators are Collapsing, like FedEx, down 7% today. A slowing economy ships fewer packages. Warning signals for the economy are flashing red everywhere.

Has Momentum Died? Big momentum stocks like Palantir (PLTR) have been crushed, down 25% in two days. Did we miss the memo that the bear market already started?

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, February 24, at 8:30 AM EST, the Chicago Fed National Activity Index is announced.

On Tuesday, February 25, at 8:30 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, February 26, at 8:30 AM, the New Home Sales are printed.

On Thursday, February 27, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the second estimate for Q4 GDP.

On Friday, February 28, at 8:30 AM, the Core PCE Prices Index is announced. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I usually get a request to fund some charity about once a day. I ignore them because they usually enrich the fundraisers more than the potential beneficiaries. But one request seemed to hit all my soft spots at once.

Would I be interested in financing the refit of the USS Potomac (AG-25), Franklin Delano Roosevelt’s presidential yacht?

I had just sold my oil and gas business for an outrageous profit and had some free time on my hands so I said, “Hell Yes,” but only if I get to drive. The trick was to raise the necessary $5 million without it costing me any money.

To say that the Potomac had fallen on hard times was an understatement.

When Roosevelt entered the White House in 1932, he inherited the presidential yacht of Herbert Hoover, the USS Sequoia. But the Sequoia was entirely made of wood, which Roosevelt had a lifelong fear of. When he was a young child, he nearly perished when a wooden ship caught fire and sank, he was passed to a lifeboat by a devoted nanny.

Roosevelt settled on the 165-foot USS Electra, launched from the Manitowoc Shipyard in Wisconsin, whose lines he greatly admired. The government had ordered 34 of these cutters to fight rum runners across the Great Lakes during Prohibition. Deliveries began just as the ban on alcohol ended.

Some $60,000 was poured into the ship to bring it up to presidential standards and it was made wheelchair accessible with an elevator, which FDR operated himself with ropes. The ship became the “floating White House,” and numerous political deals were hammered out on its decks. Some noted guests included King George VI of England, Queen Elizabeth, and Winston Churchill.

During WWII, Roosevelt hosted his weekly “fireside chats” on the ship’s short-wave radio. The concern was that the Germans would attempt to block transmissions if the broadcast came from the White House.

After Roosevelt’s death, the Potomac was decommissioned and sold off by Harry Truman, who favored the much more substantial 243-foot USS Williamsburg. The Potomac became a Dept of Fisheries enforcement boat in 1960 and then was used as a ferry to Puerto Rico until 1962.

An attempt was made to sail it through the Panama Canal to the 1962 World’s Fair in Seattle, but it broke down on the way in Long Beach, CA. In 1964 Elvis Presley bought the Potomac so it could be auctioned off to raise money for St. Jude Children’s Research Hospital. It sold for $65,000. It then disappeared from maritime registration in 1970. At one point there was an attempt to turn it into a floating disco.

In 1980 a US Coast Guard cutter spotted a suspicious radar return 20 miles off the coast of San Francisco. It turned out to be the Potomac loaded to the gunnels with bales of illicit marijuana from Mexico. The Coast Guard seized the ship and towed it to the Treasure Island naval base under the Bay Bridge. By now the 50-year-old ship was leaking badly. The marijuana bales soaked up the seawater and the ship became so heavy it sank at its moorings.

Then a long rescue effort began. Not wanting to get blamed for the sinking of a presidential yacht on its watch the Navy raised the Potomac at its own expense, about $10 million, putting its heavy life crane to use. It was then sold to the City of Oakland, CA for a paltry $15,000.

The troubled ship was placed on a barge and floated upriver to Stockton, CA, which had a large but underutilized unionized maritime repair business. The government subsidies started raining down from the skies and a down to the rivets restoration began. Two rebuilt WWII tugboat engines replaced the old, exhausted ones. A nationwide search was launched to recover artifacts from FDR’s time on the ship. The Potomac returned to the seas in 1993.

I came on the scene in 2007 when the ship was due for a second refit. The foundation that now owned the ship needed $5 million. So, I did a deal with National Public Radio for free advertising in exchange for a few hundred dinner cruise tickets. NPR then held a contest to auction off tickets and kept the cash (what was the name of FDR’s dog? Fala!).

I also negotiated landing rights at the Pier One San Francisco Ferry Terminal, which involved negotiating with a half dozen unions, unheard of in San Francisco maritime circles. Every cruise sold out over two years, selling 2,500 tickets. To keep everyone well-lubricated I became the largest Bay Area buyer of wine for those years. I still have a free T-shirt from every winery in Napa Valley.

It turned out to be the most successful fundraiser in the history of NPR and the Potomac. We easily got the $5 million and then some. The ship received a new coat of white paint, new rigging, modern navigation gear, and more period artifacts. I obtained my captain’s license and learned how to command a former Coast Guard cutter.

It was a win-win-win.

I was trained by a retired US Navy nuclear submarine commander, who was a real expert at navigating a now thin-hulled 73-year-old ship in San Francisco’s crowded bay waters. We were only licensed to cruise up to the Golden Gate Bridge and not beyond, as the ship was so old.

The inaugural cruise was the social event of the year in San Francisco with everyone wearing period Depression-era dress. It was attended by FDR’s grandson, James Roosevelt III, a Bay area attorney who was a dead ringer for his grandfather. I mercilessly grilled him for unpublished historical anecdotes. A handful of still-living Roosevelt cabinet members also came, as well as many WWII veterans.

As we approached the Golden Gate Bridge, some poor soul jumped off and the Coast Guard asked us to perform search and rescue until they could get a ship on station. Nobody was ever found. It certainly made for an eventful first cruise.

Of the original 34 cutters constructed only four remain. The other three make up the Circle Line tour boats that sail around Manhattan several times a day.

Last summer I boarded the Potomac for the first time in 14 years for a pleasant afternoon cruise with some guests from Australia. Some of the older crew recognized me and saluted. In the cabin, I noticed a brass urn oddly out of place. It contained the ashes of the sub-commander who had trained me all those years ago.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader