The Market Outlook for the Week Ahead, or the “Endless Bid” Market

I am usually hiking at Lake Tahoe this time of year, doing the deep research, hiking ten miles a day, and the stripping down to jump into the lake at the end.

This year, climate change had other ideas.

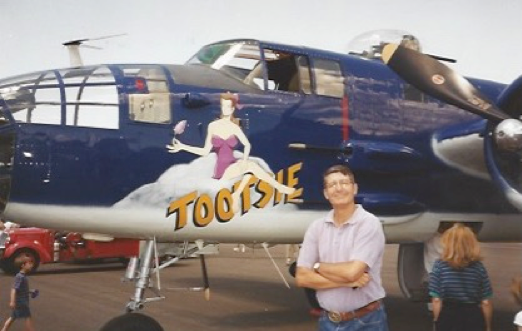

So I am visiting a childhood haunt in Newport Beach, CA, where my late uncle used to live. Remember him? He was the former CFO of Penn Central Railroad in 1970 who made a fortune buying puts just before the company went bankrupt. I guess that was allowed back then.

He lived next door to John Wayne, and we kids used to wave at him, astonished at his bald head. I still miss The Duke.

I am still typing one finger at a time, my left wrist in a brace and elbow in a huge bandage. I told the doctor I couldn’t get to Reno for him to take the stitches out because of the wildfires, so I would do it myself with a pocketknife with Jack Daniels as a sterilizer. He said, “Knock yourself out.”

Traders are so frustrated waiting for the normal summer correction they are starting to call “The Endless Bid Market.” That has left them underweight, trying to catch up, which is why we didn’t get a drop of more than 4% this summer.

Of course, they are also getting rich with what they already have, but they all want to get richer. Greed is trouncing fear big time. Forget about investing.

You can’t buy the dip anymore because there are no dips. You simply use new cash flows to add to your winners, the more they have gone up, the better.

That’s why large-cap tech stocks have been on an absolute tear, hitting new all-time highs. Of course, I am just as guilty as the rest, with a retirement fund loaded with big tech. Google (GOOG) is now my largest position, not through savvy stock selection but purely because of price appreciation.

Of course, it helps that the higher stocks go, the cheaper they get.

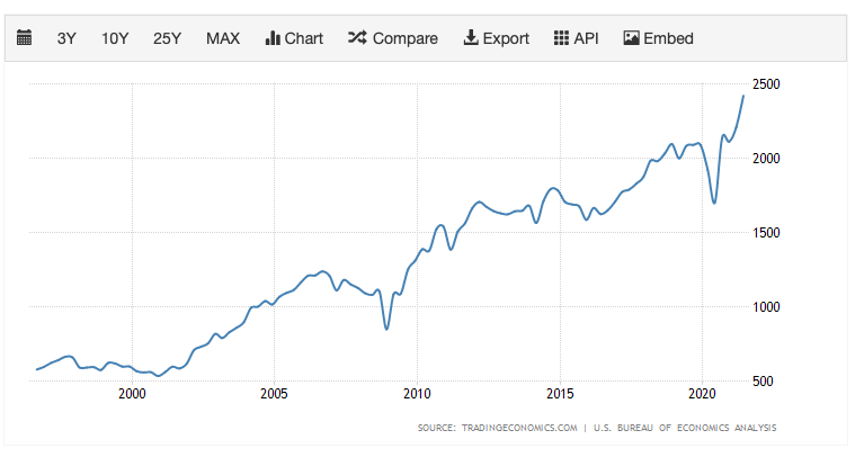

Earnings are melting up maintaining the same price-earnings multiple and stock prices are simply following suit. There is nothing overheated about it.

Company profit margins are soaring to record highs as companies make enormous productivity investments to deal with chronic labor shortages. If you live here in Silicon Valley, you see this happening around you every day.

If you don’t, stock valuations are fantasies coming from a faraway land, therefore the surprise at market strength.

Haven’t you noticed how hard it is to get a human on the phone outside of the Philippines, where workers feel rich when they are making $300 a month?

If anything, the market is still undervaluing stocks rather than overvaluing relative to their upside earnings potential.

An S&P 500 target of $500 is now my easy target for 2022.

Any credit crunch that could trigger a recession is years off, and one Fed governor away. A delta variant that won’t quit, or the upcoming Mu variant is another worry.

Consensus forecasts constantly lagging the market has the effect of leaving institutions and individuals under-invested and trying to get in, hence no real dips for almost a year.

Afghanistan proves the market could care less about any geopolitical surprise.

You heard it from me first. If the market can’t selloff over the next two weeks when poor seasonals start to fade away, the they wont for all of 2021.

Nonfarm Payroll Report bombs, coming in at only 235,000 versus an expected 720,000, a huge miss. The headline Unemployment Rate fell 0.2% to 5.2% a new post-pandemic low. Mysteriously, both stocks and bonds hated it. Manufacturing was up 37,000, while Leisure & Hospitality was zero and Retail at -28,000. Education LOST -25,000 during the back-to-school season. Average Hourly Earnings rose an astonishing 0.6% MOM, or 4.3% YOY. The U6 long term unemployment rate fell to 8.8%. Goodbye taper. A shortage of workers was to blame, but the economic data has been worsening for a while now. Delta is taking a bigger bite than we thought.

Stocks hit new August highs the most in history, surpassing the 1929 record of 11 times. The only negative three-month period seen since 1929 are August, September, and October. Remember what happened in 1929? If that doesn’t scare the living daylights out of you, then nothing will. So, it seems we are in for some kind of correction, even if it’s just the 5% kind. Looks like the month end will be hot.

Bitcoin leads crypto, but Ethereum is catching up. Cardano has doubled in a month making it the number three crypto and Avalanche has tripled. Newly minted online broker Robinhood (HOOD) says 60% of its option trading is now in crypto. MicroStrategy’s (MSTR) Michael J. Saylor sees a 50-fold increase in Bitcoin to a total market value of $100 trillion. That is five times the US M3 money supply of $20 trillion. It’s become a financial system of "get crypto or go home."

Oil jumps on Hurricane IDA, with a sharp 8.9% rally. Some 91% of Gulf Production shut in, or 1.65 million barrels a day. Don’t expect it to continue. Sell into the rally on this future buggy whip industry.

SEC is cracking down on Market Gaming by multiple apps aimed at Millennials. It’s shopping for a new set of market rules aimed at regulating those who foster runaway volatility in single stocks like (AMC).

PayPal to enter stock trading, sending the stock up a ballistic $15 in two days. If they pull it off, it will open a huge new profit stream for them, possibly becoming another Robinhood (HOOD), cashing in on the retail trading boom. Earning: regulation costs a lot. Buy (PYPL) on dips.

S&P Case Shiller soars to new highs in June, the National Home Price Index jumping 18.6% YOY, breaking all records. Prices are now 41% higher than the bubble top in 2006. This is the sharpest gain in the 34-year history of the index. Prices in Phoenix leaped 29.6%, followed by San Diego at 27.1% and Seattle by 25.0%. Supply and demand will be seriously out of whack for years.

Pending Home Sales drop for the second straight month on a signed contract basis, down 1.8% in July. Summer slowdown, delta slowdown, or market top? However, supply and demand are still far out of balance.

Your next Apple purchase may be a satellite phone, bypassing local cell phone networks. A Chinese analyst made this prediction for the iPhone 13 out in 2022. The report says that the iPhone 13 includes a Qualcomm X60 baseband modem chip, which includes LEO satellite comms capabilities. If accurate, this means that the upcoming iPhone will have the hardware capability to act as a satellite phone. It certainly would upend the rush to build private satellite networks, like Viasat and Tesla’s Starlink. Enough investors believed the story to send the stock to a new all-time high. Buy (AAPL) on dips.

Air Travel is falling off, with airport security screening dropping to only 1.35 million, the lowest since May 11. Delta is taking its toll, but back to school is a factor as well.

Bond king Bill Gross says treasuries are trash. He sees ten-year yields hitting 2.00% sometime in 2022. The 77-year-old drove bond prices for a decade and also made a fortune collecting stamps. Sometimes Bill is early, but he is always right.

One billion Asians to join middle class by 2030 on top of the existing 3.75 billion today. That will create a vastly larger market for all online services, which the stock market seems to be telling us today. Indonesia, Pakistan, and Bangladesh are expected to see the largest increases. There is a lot of “hope” in this number, i.e., no more covid, no ward, and no depressions.

The next market correction won’t come until the Fed makes a mistake and that might be years off, says Wharton finance professor and long-term bull Jeremy Siegel. That will be when the Fed finds itself behind the inflation curve. Until then, the slow grind up continues. Stocks are the best defense against inflation.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

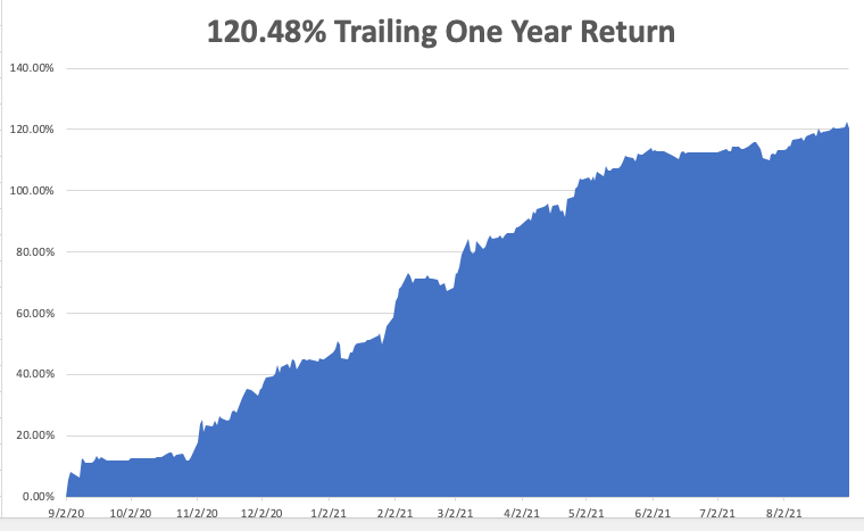

My Mad Hedge Global Trading Dispatch saw a robust +9.31% gain in August. My 2021 year-to-date performance soared to 78.57%. The Dow Average was up 15.82% so far in 2021.

That leaves me 80% in cash at 20% in short (TLT) and long (SPY). Although we have maxed out the profits with these two positions, I’ll keep them as there is nothing else to do. I’m keeping positions small as long as we are at extreme overbought conditions. The “endless bid” market is not giving anyone entry points as long as the Volatility Index (VIX) remains at $16.

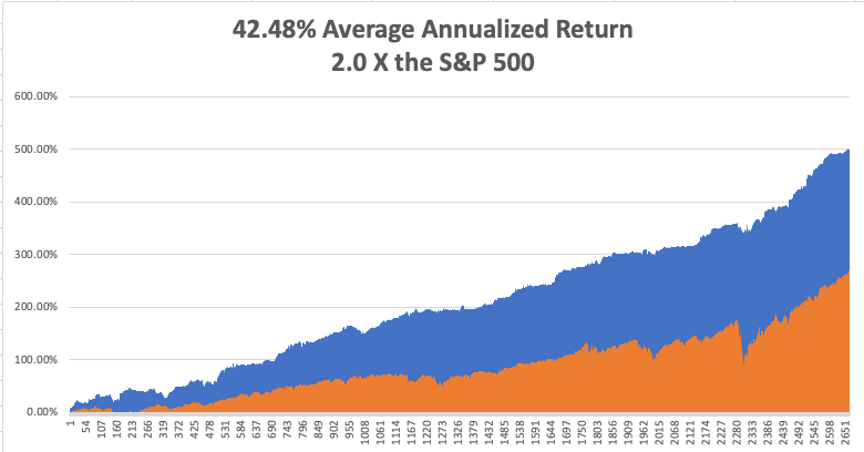

That brings my 12-year total return to 501.12%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.48%, easily the highest in the industry.

My trailing one-year return popped back to positively eye-popping 120.48%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 40 million and rising quickly and deaths topping 645,000, which you can find here.

The coming week will be slow on the data front.

On Monday, September 6 markets are closed for the US Labor Day.

On Tuesday, September 7, there are no special data releases. Everyone will be recovering from hurricanes in the south and east, wildfires in the west, and Covid everywhere.

On Wednesday, September 8 at 9:30 AM, we get API crude oil stocks.

On Thursday, September 9 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, September 10 at 8:30 AM, we learn the Producers Price Index for August. At 2:00 PM, the Baker Hughes Oil Rig Count is disclosed.

As for me, a few years ago, I was visited in London by an old friend who had once served on the British Army staff of General Bernard Law Montgomery, the hero of Alamein, who was known to his friend as “Monty” (he had no friends).

I asked if there was anything I could do for him and he said, “Actually, I haven’t had a dish of moules mariniere (steamed mussels in white wine sauce) on the Grand Square in Brussels for a while. I said, “No problem, let’s go.”

We drove my Mercedes 6.0 to an old Battle of Britain hanger (one-inch-thick bombproof steel doors) on the outskirts of London where I kept a twin-engine Cessna 340 with turbocharged engines with a maximum speed of 225 kts. We landed in Brussels in an hour.

We savored the mussels on the square, as good as ever, the national dish of Belgium. The autumn air was brisk, tourists gawked, we drank, and everyone had a good time.

I left my fried there talking to some Belgian beauty for an early return to England. I wanted to park my plane at the grass airfield in Salisbury in Wiltshire, home of the tallest cathedral in England, which I nearly took out several time. The problem was that the runway had no lights.

Unfortunately, I ran into an Atlantic headwind and was running late, so I skipped a refueling stop at Ostend. When My instruments showed I was right over the airfield, I saw nothing but black.

I did, however, remember the radio frequency of the pub at the end of the field which constantly kept a speaker on. I radioed the pub, “if anyone will roll up some newspapers set them on fire and line the runway, I will buy them a pint of beer.”

The entire pub emptied out and within secondss I had a perfectly lighted runway on both sides. Landing was a piece of cake.

When I taxied up to the pub, the starboard engine ran out of gas. I walked in and made good on my promise, even buying a second round for my rescuers. I then crawled back into my airplane and went to sleep, waking up the next day with the worst hangover ever.

My flying these days is much more sedentary. The FAA requires me to do three take offs and landings every three months to keep my license current, and I usually bring along my kids for this chore. On the last landing, I always shut off my engine and glide in.

I warn the kids and they always say, “No dad, don’t,” but I do it anyway. I tell them it’s the only way to practice engine failures.

As I said before, I crash better than anyone I know.

I think I’ll watch the John Wayne classic “The Searchers” one more time tonight.

US Corporate Profits Through End 2020