The Market Outlook for the Week Ahead, or the Fun Has Only Just Begun!

Here is the game-changer that everyone is missing.

Everyone knows that the pandemic pulled forward demand on a monumental scale. What they don’t know is that adoption has also been pulled forward, of new products and services, apps, technology, business organization by years, if not a decade. And while the pull forward in demand is temporary, the pull forward in adoption is permanent.

All this means is that stocks and markets are wildly undervalued, the bull market will last for not weeks or months but 7-10 years, and a Dow Average of 120,000 is the most conservative 2020s target I can come up with.

It's more likely now that the Dow will reach 240,000 in a decade, and that my 120,000 print could come as soon as 2025 or 2026.

The best is yet to come!

Here is the next market top, at least for the short term.

That’s because for the last year, stocks had a nasty habit of selling off after quarterly earnings reports, which are just around the corner. Announcement dates for the FANGS are below. For the short term, you want to sell days before the reports. For the long term, you want to keep them, as I expect all to double or more in the next three years.

Facebook (FB) is July 28

Alphabet (GOOGL) - Jul 25, 2021

Apple (AAPL) Jul 27

Amazon (AMZN) Jul 26, 2021

Netflix (NFLX) Jul 20, 2021

Microsoft (MSFT) - Jul 28, 2021

If you are a chronic worrywart, and I am, you have to be concerned about the crash in defaults in the junk bond market, from 9.5% a year ago to 2% now and 1% in a year. The leverage of issuers is collapsing, and earnings are soaring, causing fundamentals to improve dramatically. Junk bonds have been dragged up kicking and screaming all the way by the monster rally in the bond market, now yielding only a 3.26% yield. That’s an awful lot of risk for very little return. Is this a giant market-topping signal for bonds? Markets certainly looked so on Friday, when bond markets dove two full points.

Double up your short in the (TLT).

Fed Minutes turn dovish, citing that the “Standard of subnational progress in the economy has not been met.” It’s pretty substantial in my neighborhood where hiring and spending is almost impossible. Ten-year US Treasury Bonds (TLT) soared in anticipation of the news to a 1.30% yield, and the dollar sold off in the aftermath.

The $40 billion a month in mortgage-backed securities buying will clearly be the first taper target. Tech stocks certainly like the news. The most likely taper target is after Jackson Hole in late August-early fall. Expect bonds to crash and interest rates to soar then. Sell rallies in the (TLT) now.

Weekly Jobless Claims rise to 373,000, but the major trend continues down. Slowing gains on vaccinations could keep elevated longer than hoped for.

Tokyo Bans Olympic Spectators on Covid delta variant fears. The news was bad enough to knock 500 points off the Dow Average….temporarily. The US may be nearly out of the pandemic, but the rest of the world isn’t, raising risk for a recovery of the global economy. I skipped the event when I learned that only participants and families could attend the opening event. Still, it would be nice to visit the old neighborhoods. The public baths are gone, but the sushi is still great.

Pentagon Cancels Microsoft Jedi Cloud Deal. The $10 billion Joint Enterprise Defense Infrastructure deal intended to modernize the Defense Department’s antiquated IT will instead now be evenly split between market leader Amazon (AMZN) and second rung (MSFT). The contract had been subject to bitter litigation. Trump steered the contract away from (AMZN) because Jeff Bezos also owned the Washington Post, which was constantly critical of the former president. (AMZN) shares soared, while (MSFT) dumped, even though it’s good news for both companies. Buy (AMZN) and (MSFT) on dips.

100 Million EVs by 2040, 25 million by 2026, compared to only 1 million now, says EVGO (EVGO) CEO Cathy Zoi. Electrification of US transportation will be a seminal investment theme of our generation, just like electrification was during the 1930s. Biden plans to accelerate the process by creating incentives to build 500,000 charging stations, with 100,000 of these fast chargers that can top you up in 15 minutes. Copper per car will jump from 20 to 400 pounds, and aluminum demand will soar as 200,000 miles of long-distance transmission lines are built out. Buy (FCX) and (AA) on dips.

OPEC battle spikes oil, sending prices up to $75 a barrel, a six-year high. A 400,000 b/d increase was agreed to for two years, then reneged on by the UAE, as is the way at OPEC. The micro country was angry because it felt it was carrying an unfair share of the burden. No deal means much higher prices and even an oil shock. It was enough to knock the Dow Average down 400.

Pfizer to launch Covid Booster in August to bring out more firepower against the many variants. It can raise protection tenfold for the original two shots. It will become an annual shot as with the flu. I’ll be the first in line. Buy (PFE) on dips.

US Hotel Occupancy returns to Pre Covid-Levels, at least the ones that are still in business. It’s all leisure and no business, which is unlikely to return until next year. Avoid (HLT), (H), and (MAR) for now as the good news is already in the price the stocks have already recovered.

Fed ends Emergency Commercial Paper Program, turning it back to the private sector. Is this a stealth taper? Is the real taper around the corner? If so, you must be selling the daylights out of the (TLT), which is begging for a 15-point plunge.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached a 1.79% gain so far in July. My 2021 year-to-date performance appreciated to 70.39%. The Dow Average is up 13.21% so far in 2021.

I spent the week sitting in 80% cash, waiting for a better entry point on the long side. That leaves me with a long in JP Morgan (JPM) and a short on the (TLT). Up this much this year, there is no reason to reach for the marginal trade, the maybe instead of the certainty. I’ll leave that for the Millennials.

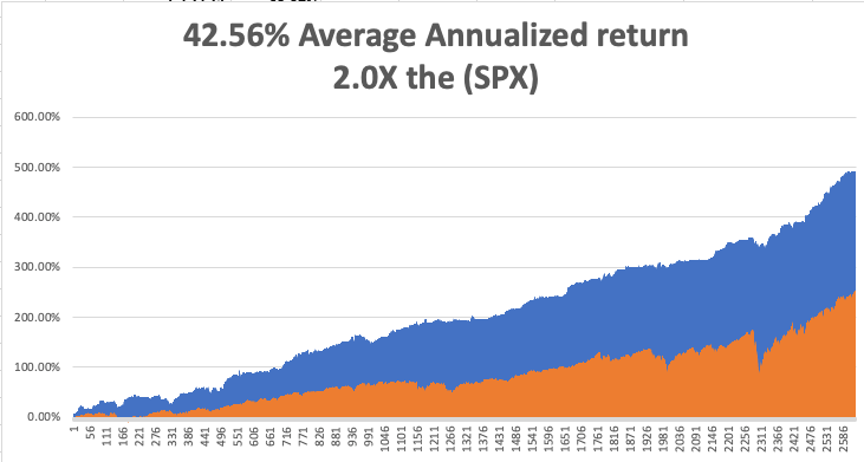

That brings my 11-year total return to 492.84%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.56%, easily the highest in the industry.

My trailing one-year return exploded to positively eye-popping 111.20%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 33.85 million and deaths topping 607,000 which you can find here.

The coming week will be a weak one on the data front.

On Monday, July 12 at 8:00 AM, US Consumer Inflation Expectations for June are published.

On Tuesday, July 13, at 8:30 AM, the US Core Inflation Rate is released.

On Wednesday, July 14 at 8:30 AM, the US Producer Price Index for June is printed.

On Thursday, July 15 at 8:30 AM, Weekly Jobless Claims are disclosed. We also get the Philadelphia Fed Manufacturing Index for June.

On Friday, July 16 at 8:30 AM US Retail Sales for June are released.

At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I have always been applauded for my iron discipline, which is crucial for all traders. I got mine from a decade of learning karate in Japan.

When I landed in Tokyo in 1974, there were very few foreigners in the country. The WWII occupation forces had left, but the international business community had yet to arrive. You met a lot of guys who used to work for Douglas MacArthur.

There was only one way to stay more than 90 days on the standard tourist visa. That was to get another visa studying “Japanese culture.” There were only two choices: flower arranging or karate.

Since this was at the height of Bruce Lee’s career, I went for karate.

It was not an easy choice.

World War II was not that distant, and there were still hundreds of army veterans missing limbs begging for money under railroad overpasses. Some back then were still fighting on remote Pacific islands.

There were many in the karate community who believed that the art was a national secret and should never be taught to foreigners. So those who entered this tight-knit community paid the price and had the daylights beaten out of them. I was one of those.

To this day, I am missing five of my original teeth. There is nothing like taking a kick to the mouth and watching your front teeth fly across the dojo, skittering on the teak floor.

We trained three hours a day, five days a week. It involved punching a bloody hardwood makiwara at least 200 times. The beginners were paired with blackbelts who thoroughly worked us over. Then the entire class met up at a nearby public bath to soak in a piping hot ofuro. You always hurt.

During the dead of winter, we ran five miles around the Imperial Palace in our karate gi’s barefoot in freezing temperatures daily. Then we were hosed down with cold water and trained for three hours.

During this time, I was infused with the spirit of bushido, the thousand-year-old Japanese warrior code. I learned self-discipline, stamina, and concentration. In the end, karate is actually a form of meditation.

Knowing you’re indestructible and unassailable is not such a bad thing, especially when you’re traveling in some of the harsher parts of the world. When muggers in bad neighborhoods see me late at night, they cross the street to avoid me. I am not a guy to mess with. Utter fearlessness is a great asset to possess.

The highlight of the annual training schedule was the All-Japan Karate Championship held in the prestigious Budokan, headquarters of all Japanese martial arts near the ghostly Yasukuni Jinja, Japan’s National Cemetery. By my last year in Japan, I had my black belt, and my instructor, Higaona Sensei, urged me to enter.

Because I had such a long reach, incredibly, I made it to the finals. I was matched with a very tough-looking six-footer who was fighting for Japan’s national prestige, as no foreigner had ever won the contest.

I punched, he kicked, fist met foot, and foot won. My left wrist was broken. My opponent knew what happened and graciously let me fight on one-handed for another minute to save face. Then he knocked me out on points.

The crowds roared.

It’s all part of a full life.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Losing the All-Japan National Karate Championship