The Market Outlook for the Week Ahead, or The Great Look Through

It was a week when traders and investors alike were confused, befuddled, and gob-smacked.

If you believed that the worst Great Depression in a hundred years was worth more than a 12% pullback in the market you were punished, quite severely so if you were short tech stocks.

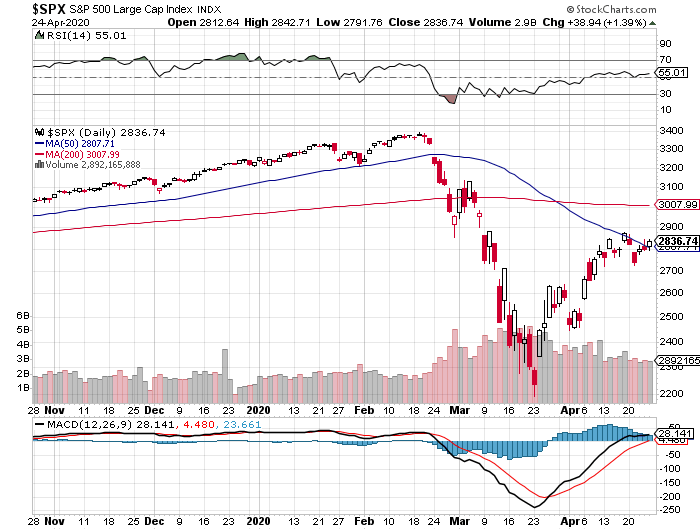

April has turned out to be the best month for the stock market since 2011. Warning: it won’t last.

The largest buyers of the market for the past decade, corporations, are now a thing of the past. Worse yet, companies are about to become massive sellers of their own stock to cover burning cash flows. United Airlines has already tapped the market with a $1 billion share offering and there are many more to follow.

This means that the airline industry used its entire profit of the last ten years to buy their own shares, which are now virtually worthless. They are currently selling shares at a decade low. Buy high, sell low, it sounds like a perfect money destruction machine.

There are more than a dozen industries guilty of this practice. A decade’s worth of management value added is a negative number, just like the price of oil.

The only consolation is that it is worse in Europe, as is everything, except for the coffee.

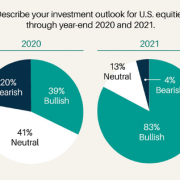

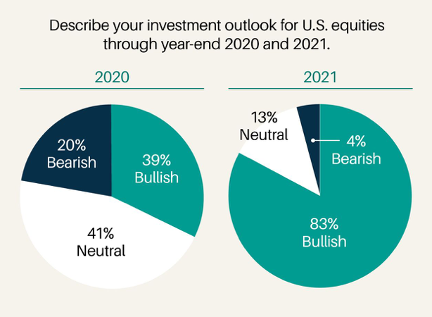

The obvious explanation is that we are witnessing the greatest “Look Through” in history. A Barron’s Big Money poll points the finger this weekend. While only 38% of professional money managers are currently bullish, some 83% are bullish for 2021, and it is just not worth dumping your portfolio to avoid a few months’ worth of carnage.

I believe that we will see substantial new all-time highs in 2021. The pandemic is forcing enormous efficiencies, cost cuts productivity increases on every company just to survive. Look at me. My travel budget has plunged from $100,000 a year to $20,000, ad there will be no travel for the rest of this year. Most big companies have adopted the same policy.

Return to a normal economy and record profits will ensue. Get the uncertainty of the presidential election out of the way and you have another boost, although it is looking less uncertain by the day.

It all perfectly sets up my new “Golden Age” and “Roaring Twenties” scenario for the 2020s, as I have been predicting for years

If the bears have any hope, it is that the big tech stocks, the principal market divers since the bottom, usually peak when they report earnings, which is this week.

None of the long-term trends in the stock market have changed, they have only been accelerated. Growth stocks are beating value by miles, tech is outpacing non-tech, and US shares are vastly overshadowing international, and large companies are outperforming small ones.

The dividend futures market is telling us that a recovery to pre-pandemic conditions will take far longer than anyone expects. It is discounting 10 years to return to 2019 dividend payouts, compared to only three years after the 2008-2009 Great Recession.

The are many structural changes to the economy that are becoming apparent. Many of the people sent home to work are never coming back because they like it, avoiding horrendous commutes in the most crowded cities. That is great for all things digital, where demand is exploding. It is terrible for many REITS, where demand for commercial real estate is in free fall and prices have imploded.

Oil hit negative $37 a barrel in a futures market meltdown with the May contract expiration. This could be the first of several futures expiration meltdowns until the economy recovers. The supply/demand gap is now a staggering 35 million barrels a day. A large swath of the oil industry will go under at these prices. It’s all part of a global three-way oil war which the US lost. Buy (USO) when crude is at negative numbers for a trade.

Don’t expect a rapid recovery. Wuhan China is now free and clear and open for business, but restaurant visits are still down 50%. Same in South Korea, which had the best Corona response where theater attendance is still down 70%. Predictions of a “V” shaped recovery may be optimistic if we get hit with a second wave. Government pressure for a quick reopening guarantees that will happen. The problem is that the stock market doesn’t know this yet.

Leading economic indicators dove 6.7%. No kidding. Expect much worse to come as the economy implodes. The worst data in a century are coming, paling the great depression.

2.9 million homes are now in forbearance and the number is certainly going to rise from here. Laid off renters are defaulted on payments, depriving owners of meeting debt obligations. It’s just a matter of time before this creates a financial crisis. Avoid the banks for now, no matter how cheap they get.

US restaurants to lose $240 billion by yearend. It’s a problem even a government can’t fix. At least one out of four eateries will go under over the next two months. Boy, I’m glad I didn’t open a trophy restaurant as a hobby like so many of my wealthy friends did.

Another $484 billion bailout bill is passed, and the market could care less, plunging 631 points. It includes $310 billion for the troubled Paycheck Protection Plan, $75 billion for hospitals, and $25 billion for Corona testing. Notice how markets are getting less interested in announced rescue plans and more interested in result, so far of which there have been none? The free fall in the economy continues.

Existing Home Sales plunged by 8.5% in March. Realtors expect this figure to drop 40% in the coming months. Open houses are banned, sellers are pulling listings, and buyers low-balling offers. However, price declines in the few deals going through are minimal. When will the zero interest rates come through? Mortgage interest rates are higher now than before the pandemic because 6% of all home loans are now in default.

Weekly Jobless Claims hit a staggering 4.4 million. Total unemployed over the last five weeks has topped 26.4 million, more than seen at the peak of the Great Depression. All job gains since the 2008-09 Great Recession have been lost. Of course, the population back then was only 123 million compared to today’s 335 million. But then employment is still in freefall and we may reach the Fed’s final target of 52 million. Most of the SBA Paycheck Protection Program funding went to large national chains and virtually none to actual small businesses.

US Car Sales dove 50%, and they’re expected to drop 60% in May. Showrooms have gained “essential” exemptions to open, but the newly jobless don’t make great buyers. Why are the shares of traditional carmakers like Ford (F) and General Motors (GM) in free fall, while those of Tesla (TSLA) are soaring?

Gilead Science’s Remdesivir bombed, in a phase 1 trial conducted by the WHO, triggering an immediate 400-point market selloff. It was a small study in China that was leaked. The company says it still might work.

Existing Home Sales collapsed by 15.4%, in March. With open houses closed across the country, it’s no surprise. But with the market closed, no one is selling either. Defaulted mortgages rose by a half million this week. Buy big homebuilders on the next big dip, like (KBH) and (LEN). They will lead the recovery.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $0 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

My Global Trading Dispatch performance had a tough week, with me getting squeezed out of a short position in Facebook (FB) and also losing my weekly longs in Microsoft (MSFT) and Apple (AAPL).

Everyone is expecting the market to roll over, but it’s not just happening. Risk control is the order of the day and that means stopping out of losers fast.

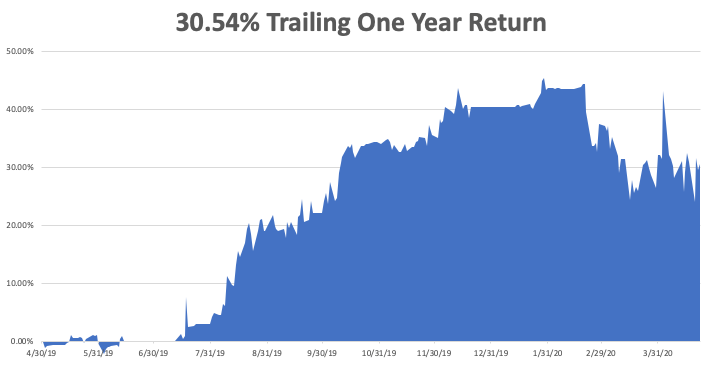

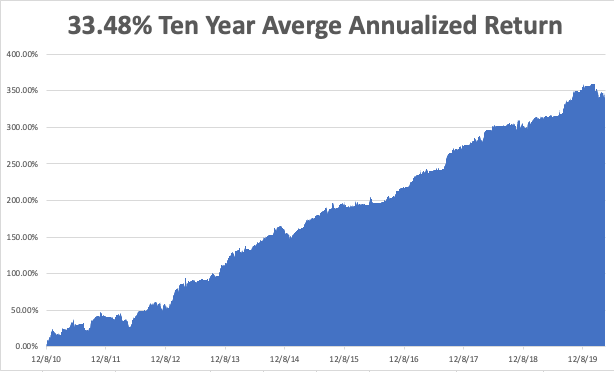

We are now down -2.12% in April, taking my 2020 YTD return down to -10.54%. That compares to a loss for the Dow Average of -12% from the February top. My trailing one-year return returned to 30.54%. My ten-year average annualized profit returned to +33.48%.

This week, Q1 earnings reports continue, and so far, they are coming in much worse than the most dire forecasts. This is the week that big tech reports. The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here at https://coronavirus.jhu.edu

On Monday, April 27 at 9:30 AM, the Dallas Fed Manufacturing Index is released.

On Tuesday, April 28 at 8:00 AM, the S&P Case Shiller National Home Price Index is published. Alphabet (GOOGL) reports.

On Wednesday, April 29, at 8:30 AM, an updated read on Q1 GDP is printed and the Cushing Crude Oil Stocks are announced. That one should be a thriller with zero interest rates. Apple (AAPL), Facebook (FB) and Microsoft (MSFT) report.

On Thursday, April 30 at 8:30 AM, Weekly Jobless Claims will announce another horrific number. Amazon (AMZN), McDonald’s (MCD), and Visa (V) report.

On Friday, May 1, the Baker Hughes Rig Count follows at 2:00 PM. Expect these figures to crash as well. Chevron (CVX) and Exxon (XOM) report.

As for me, tonight I’ll be attending the first-ever Boy Scout virtual camp out. Every member of the girls’ patrol will be setting up tents in their backyards and connecting up in a giant Zoom meeting. I bet they stay up all night.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader