The Market Outlook for the Week Ahead, or The Market that Time Forgot

This has become the Rip Van Winkle market. Go to sleep for 20 years and nothing has changed. Well, at least it seems like 20 years.

Last Monday saw the lowest trading volume of 2023. Trading ranges are the narrowest since the 1990s. The Volatility Index ($VIX) hit a two-year low at $15.78.

Themes come and go with no net change in the indexes. One week, it's artificial intelligence, the next it’s the regional banking crisis. Gold bubble (GLD) anyone? How about an auto price war? It’s like the market keeps throwing spaghetti on the way to see what sticks, but nothing ever does.

In fact, 80% of the gains this year have taken place in just seven stocks, and you know which ones, the AI leaders. You wouldn’t be surprised to learn that AI has added $1.4 trillion in market value this year. It has also eliminated 600,000 jobs. Most of the 200,000 tech jobs lost this year have been felled by AI.

If you are befuddled by this, you are not alone. Hedge funds lost $18 billion in Q1 on their technology shorts. That last bastion of volatility, Tesla (TSLA), saw its option implied volatility crushed from 100% to only 48.4% as both call and put prices were crushed.

I was in Las Vegas last week to visit Concierge clients where they are already boasting about the move there by the Oakland A’s baseball team. The Las Vegas A’s? It doesn’t sound quite right.

I also had the chance to drop in on an online market conference. When the question was asked how many financial newsletters were now written by ChatGPT, three-quarters of the hands went up. I sat there dumbfounded. At least ChatGPT might do better than market advice written by professional copywriters and marketers. It is a very low bar to reach.

I know you don’t want to hear this, but markets are set to remain in the same tedious ranges at least until the summer. Bonds, on the other hand, seem to be begging for an upside breakout, driven by recession fears. Keep buying (TLT) calls, call spreads, and one-year LEAPS. We are headed to a 2.50% ten-year yield by yearend.

Of course, if you know that nothing is going to happen you can make a fortune, as I have amply proven this year.

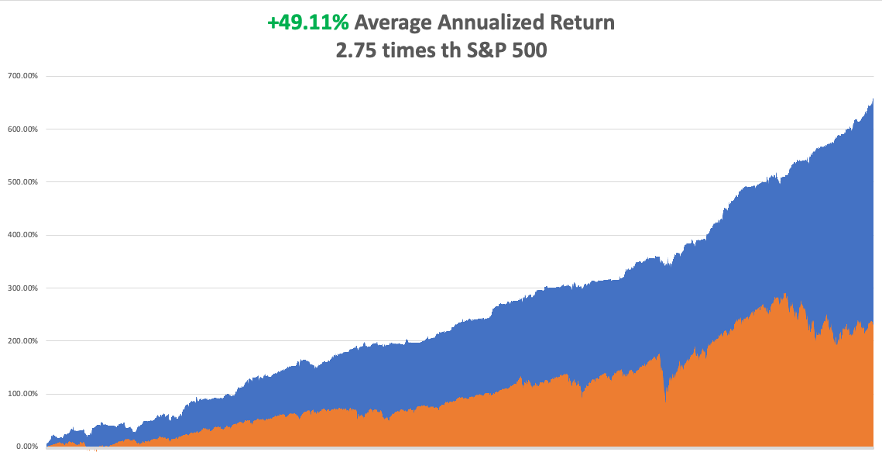

My big bet that Tesla shares would stay within a $100 range for three weeks paid off hugely. April closed out at an incredible +15.13% profit. My 2023 year-to-date performance is now at an eye-popping +61.75%. The S&P 500 (SPY) is up only a miniscule +9.47% so far in 2023. My trailing one-year return maintains a sky-high +116.20% versus +3.06% for the S&P 500.

That brings my 15-year total return to +658.94%. My average annualized return has blasted up to +49.11%, another new high, some 2.75 times the S&P 500 over the same period.

Some 43 of my 46 trades this year have been profitable. After 30 trade alerts in April, I have to admit I am getting a little tired.

I initiated no new trades last week, content to run off existing profitable ones. With the Volatility Index at a two-year low at 15.78%, opportunities are few and far between. Those include longs in Boeing (BA) and shorts in the (QQQ) and the (SPY).

That leaves me with longs and shorts in Tesla (TSLA) and a double long in the bond market (TLT). That leaves me 40% long, 20% short, for a net long of 20%.

Whenever I enjoy a terrific run like this, I become extremely cautious. Chaos Theory dictates that a reversion to the mean is coming. I just hope it’s a small one.

Weekly Jobless Claims Rise Another 5,000, to 245,000, a new year high. The tide of poor economic data is rising.

Meta (META) Earnings Explode to the Upside, taking the shares up 12%. The company seems to be the early winner in AI. A comeback in digital advertising was the major factor here. So was aggressive cost-cutting through layoffs, some 12,000 so far. It reinforced my argument that big tech is safe tech.

Boeing (BA) Bumps 737 Max Production to 38 planes a month, up from 31, returning it as the number one airplane manufacturer in the world. The stock popped 5% on the news. Net earnings are now up 28% YOY, improving net earnings by 2%. The company expects $3 -$5 billion in free cash flow this year. Buy (BA) on dips.

Tesla (TSLA) Drops Model Y Price Again, to $46,990. The base Model Y now costs $759 less than the average amount paid for a car or truck in the US. The differential between these figures has changed by more than $20,000 since the middle of last year. This is the price war to end all price wars.

$1 trillion Boosts Asset Prices in Q1. What will happen when it’s not there? Mad Hedge thinks stocks go down, never fans of draining liquidity. Another Fed Rate Rise will pour gasoline on the fire. The inflow cut 50 basis points in yield from investment-grade bonds, delivering the best total returns since 2019.

Bank Insider Buying Hits Record, with over 1,000 officers buying the shares of their own companies. Do you think they know something we don’t?

New Home Sales Pop, to 683,000, 50,000 better than expected in March. That is up 10%, the best MOM in a year on a signed contract basis. Those incentives and mortgage buydowns are coming hot and heavy. New home inventories shrunk from 8 months to 7.6 months.

Pending Home Sales Plunge 5.2%, with the high-interest rate bogeyman back for a return visit. This is the best leading indicator for the residential real estate market. A shortage of homes for sale is also a major factor. In the meantime, prices have resumed rising, although slowly.

S&P Case Shiller Rises 2%, in February, the first time in nine months. At a 2.6% YOY rate, we are seeing the slowest price growth in 11 years. Miami led the pack with a 10.8% YOY gain, followed by Tampa at 7.7% and Atlanta at 6.6%.

US GDP Slows in Q1, to a 1.1% annual rate. That’s a full percent below estimates. Rising inventories are a problem, a key recession indicator. High inflation is another issue.

New Car Loans are in Free Fall, and car sales can’t be far behind. It is collateral damage from the regional bank crisis, hastening a coming recession. High loan interest rates are another dagger through the heart. That sends Detroit into a tailspin and may explain the recent $67, or 31% plunge in Tesla too.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, May 1 at 7:30 AM, the ISM Manufacturing Index is out.

On Tuesday, May 2 at 6:00 AM, the JOLTS Job Openings is announced.

On Wednesday, May 3 at 11:00 AM, the US ADP Private Employment Report is printed.

On Thursday, May 4 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Balance of Trade.

On Friday, May 5 at 8:30 the Nonfarm Payroll Report for April is released.

As for me, as you may imagine, the most interesting man in the world is impossible to shop for when it comes to Christmas and birthdays.

So, it was no surprise when I opened a box and found a DNA testing kit from 23 and Me. So, I spat into a small test tube to humor the kids, mailed it off, and forgot about it.

I have long been a keeper of the Thomas family history and legends, so it would be interesting to learn which were true and which were myths.

A month later, what I discovered was amazing.

For a start, I am related to Louis the 16th, the last Bourbon king of France, who was beheaded after the 1789 revolution.

I am a direct descendant of Otzi the Iceman, who is 5,000 years old and was recently discovered frozen in an Alpine glacier. He currently resides in mummified form in an Italian museum. So my love of the mountains and hiking is in my genes.

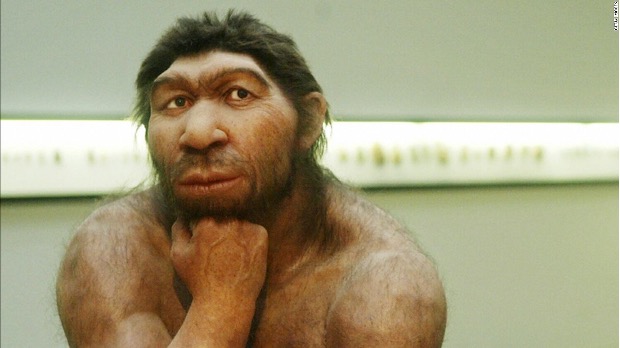

Oh, one more thing. The reason I don’t have any hair on my back is that I carry 346 gene fragments that I inherited directly from a Neanderthal. Yes, I am part caveman, although past girlfriends suspected as much.

There were other conclusions.

I have a higher-than-average probability of getting prostate cancer, advanced macular degeneration (my mother had it), celiac disease, and melanoma. I immediately booked a physical with my doctor.

The service also offered to introduce me to 1,107 close relatives around the world who I didn’t know, mostly in New York, California, and Florida.

The French connection I already knew about. During the 16th century, my ancestors rebelled against the French kings over the nonpayment of taxes and were exiled to Louisiana.

Fleeing a malaria epidemic, they moved up the Mississippi River to St. Louis and stayed there for 200 years. When gold was discovered in California in 1849, they joined a wagon train headed west. It only got as far as Kansas where it was massacred by Cherokee Indians.

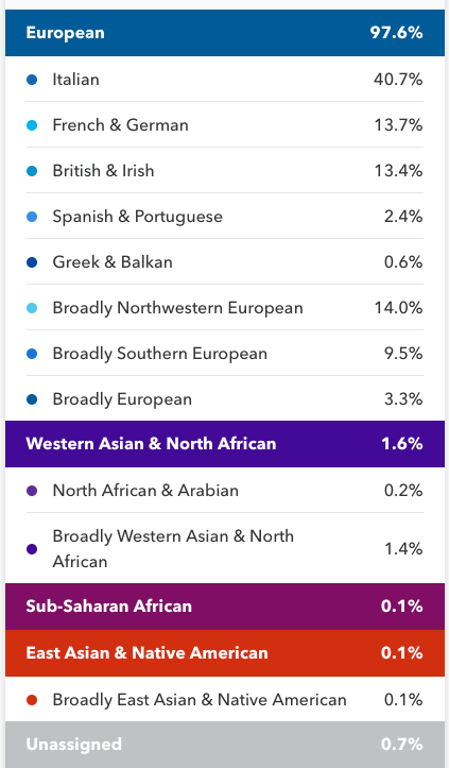

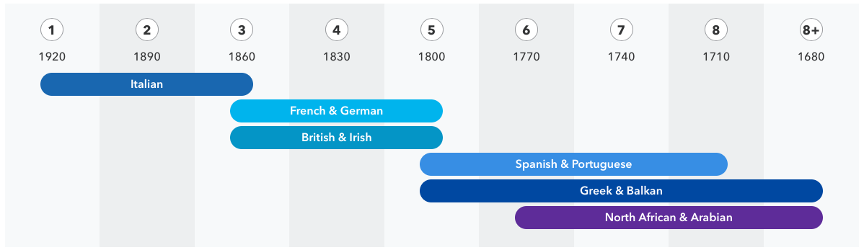

I am half-Italian and have birth certificates going back to 1800 to prove it. But 23 and Me says that I am only 40.7% Italian (see table below). It turns out that your genes show not only where you came from, but also who invaded your home country since the beginning of time.

In Italy’s case, that would include the ancient Greeks, Vikings, Arabs, the Normans, French, Germans, and the Spanish, thus making up my other 9.3%. Your genes also reflect the slaves your ancestors owned, for obvious reasons, as well as many of the servants who may have worked for them.

It gets better.

All modern humans are descended from a single primordial “Eve” who lived in Eastern Africa 180,000 years ago. Of the thousands of homo sapiens who probably lived at that time, the genes of no other human-made it into the modern age. We are also all descended from a single “Adam” who lived 275,000 years ago. Obviously, the two never met, debunking some modern conventions.

Around 53,000 years ago, my intrepid ancestors crossed the Red Sea to a lush jungle in the Sinai Peninsula probably pursuing abundant game. 11,000 years ago they moved onto the vast grasslands of the Central Asian Steppes. As the last Ice Age retreated, they moved into the warmer climes of South Europe. We have been there ever since.

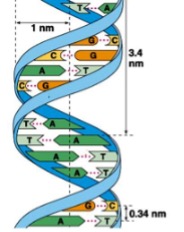

23 and Me was founded in 2006 by Anne Wojcicki, wife of Google founder Sergei Brin. It is owned today by her and a few other partners. Its name is based on the fact that humans' entire DNA code is found on 23 pairs of chromosomes.

23 and Me and other competitors like Ancestry.com, MyHeritage, and Living DNA have sparked a DNA boom that has led to once unimagined economic and social consequences. DNA promises to be for the 21st century what electricity was to the 20th century. The investment consequences are amazing.

Talk about unintended consequences with a turbocharger.

A common ancestor going back to the early 1800s enabled Sacramento police to capture the Golden State killer. Unsolved for 40 years, it took a week for them to find him after a DNA sample was sent to a DNA database.

Thirty and 40-year-old cold cases are now being solved on a weekly basis. Long ago kidnapped children are being reunited with their parents after decades of separation.

California just froze all executions. That’s because DNA evidence showed that approximately 30% of all capital case convictions were of innocent men. That was enough for me to change my own view on the death penalty. The error rate was just too high. Dozens of men around the country have been freed after new DNA evidence surfaced, some after serving 30 years or more in prison.

23 and Me had some medical advice for me as well. They strongly recommended that I get tested for diabetes and high blood pressure, as these maladies are rife among my ancestors. They even name the specific guilty gene and haploid group.

This explains why major technology companies, like Amazon (AMZN) and Apple (AAPL) are pouring billions of dollars into genetic research.

I have long had a personal connection with DNA research. I worked on the team that sequenced the first-ever string of DNA at UCLA in 1974. It was groundbreaking work. We obtained our raw DNA from Dr. James Watson of Harvard, who along with Francis Crick, were the first to discover its three-dimensional structure. As for my UCLA professor, Dr. Winston Salser, he went on to found Amgen (AMGN) in 1980 and became a billionaire.

The developments that are taking place today then seemed to us like science fiction that was hundreds of years into the future. To see the paper created by this work please click here.

As research into DNA advances it is about to pervade every aspect of our lives. Do you have a high probability of getting a disease that costs a million dollars to cure and are counting on getting health insurance? Think again. That may well bring forward single-payer national health care for the US, as only the government could absorb that kind of liability.

And if you can only hang on a few years, you might live forever. That’s when DNA-based monoclonal antibodies and gene editing are about to cure all major human diseases. DNA is about to become central to your physical health and your financial health as well.

To learn more about 23 and Me please visit their website here.

Maybe the next time I visit the Versailles Palace outside of Paris, I should ask for a set of keys, now that I’m a relative? Unfortunately, it’s much more likely that I’ll get the keys to my Neanderthal ancestor’s cave.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader