The Market Outlook for the Week Ahead, or the Melt-Up Continues

I can tell you that the way to NOT start writing a newsletter is to first swing a 20-pound sledgehammer for three hours. That's what I did this morning helping the Boy Scouts mount 700 trees on rebar stands as part of the annual Christmas tree fundraiser.

Nor is it advisable to start writing a newsletter by hauling 50-pound trees on to car rooftops and tying them down.

However, I am a man of my commitments, so here I am with the aid of a long hot bath and some Epsom salts.

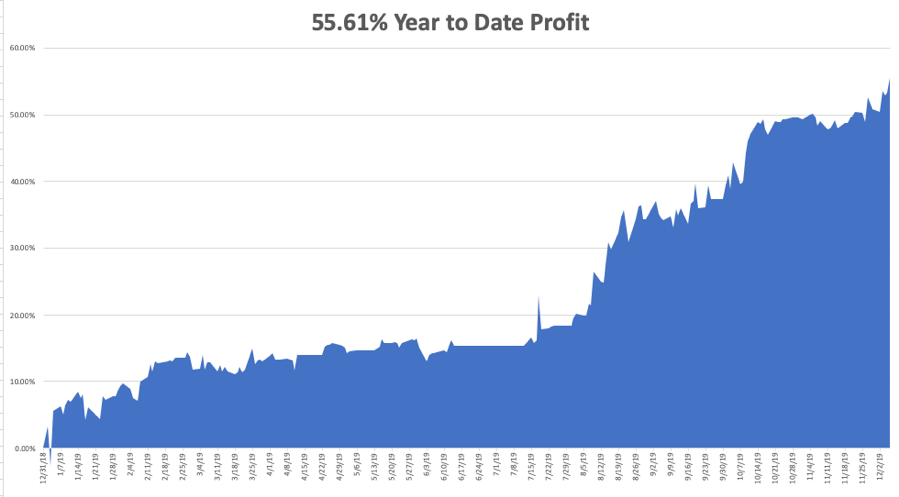

With that said, I have only one number to announce: 55.61%. That is the profit that followers of the Mad Hedge Fund Trader have earned so far in 2019, and I know many of you are up a lot more than that.

All it took for me to achieve a new all-time high was to turn aggressive at the bottom of last week’s 900 selloff in the Dow Average.

With super liquidity flooding the financial system and ultra-low interest rates fanning the flames, I didn’t believe my Mad Hedge Market Timing Index would not fall below 60, where it held.

I also thought that, with so many buyers clamoring to get into the market, no pullbacks would go beyond 3%, which also turned out to be true.

This prompted me to increase my “RISK ON” positions from 20% to 50%, the timing of which turned out to be perfect. That enabled me to coin a breathtaking +4.81% in performance last week, quite a big bite for this normally sedentary time of the year.

A sledgehammer of a different sort was taking to the shorts last week as a robust November Nonfarm Payroll Report sent share flying, up 266,000, a ten-month high. The Headline Unemployment rate dropped to 3.5%.

It was not entirely a rosy report, with 50% of the gains by those 55 and overtaking second jobs at paltry minimum $8-$12 an hour minimum wages to put food on the table during the Christmas season. On the other hand, only 25% of the gains were accounted for my Millennials who now make up 50% of the population.

The other sobering fact is that 100% of America’s economic growth is currently debt-driven. If the government were running a balanced budget as it should at this point in the economic cycle, the country’s GDP growth rate would be zero, and stocks would be in free fall.

As a result, risk in the market is at century highs. The second the government starts to reduce its gargantuan deficit, the stock market will crash.

Trump said the China (FXI) Trade Deal may have to wait until the 2020 election. I told you so. The Volatility Index (VIX) jumped 40% providing a great entry point for one more bite of the apple (AAPL).

Bonds (TLT) soared, opening up one of the best short-selling opportunities of 2019, which I took. The Chinese aren’t going to lift a finger to help Trump get reelected. Farmers are going to have to endure a third year of depression.

The November Nonfarm Payroll blew it away with a 266,000 report, a ten-month high. I’m hiring, that’s for sure. Maybe trade doesn’t matter after all.

China banned US warship visits in response to the US human rights stand on Hong Kong. It’s not exactly a step towards a trade deal, which is why the Dow is diving. The very long overdue correction in the US stock market is starting. Is the marketing finally starting to notice the still weak economic data?

Cyber Monday sales soared by 19% to an all-time record of $9.4 billion. Some 49% of sales were on smartphones, which to me who can bare read one is amazing. The internet was barely functioning on Monday, slowed to a snail’s pace by a glut of business. Now, if I can only get the Victoria’s Secret website to open….

A bigger oil glut looms as OPEC+ went into the Vienna meeting last week. If they don’t cut production substantially, oil prices will crash….again. High prices now are artificially high in front of the Saudi ARAMCO IPO. Avoid all energy plays on pain of death. The end of carbon-based energy forms has begun.

This was a week for the Mad Hedge Trader Alert Service to catapult to new all-time highs.

My long positions have shrunk to my core (MSFT) and (GOOGL).

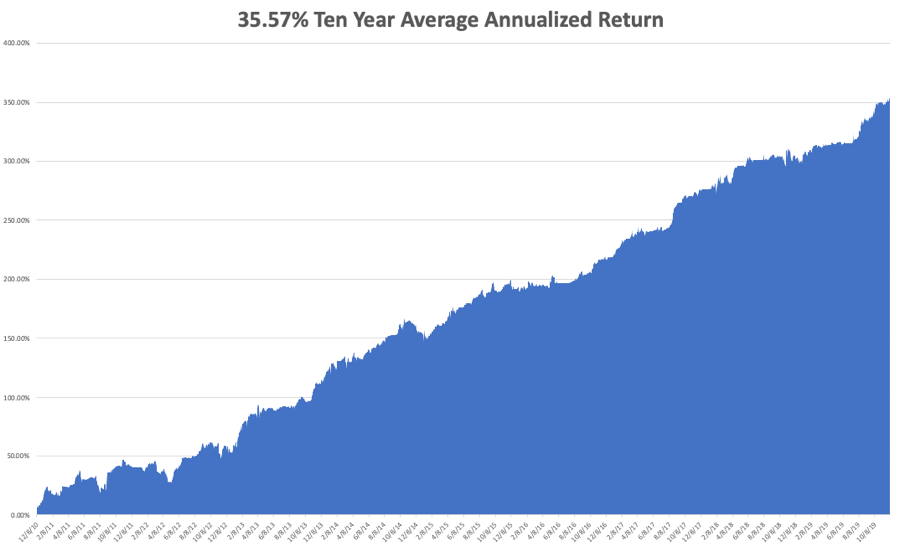

My Global Trading Dispatch performance held steady at +352.76% for the past ten years, pennies short of an all-time high. My 2019 year-to-date catapulted back up to +52.62%. We closed out November with a respectable +3.07% profit. My ten-year average annualized profit ground back up to +35.28%.

The coming week will be a noneventful one on the data front.

On Monday, December 9 at 9:00 AM, Consumer Inflation Expectations for November are out.

On Tuesday, December 10 at 2:30 PM, the NFIB Business Optimism Index is released.

On Wednesday, December 11, at 6:15 AM, US Core Inflation is announced.

On Thursday, December 12 at 8:30 AM, Weekly Jobless Claims come out.

On Friday, December 13 at 9:30 AM, November US Retails Sales are printed.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be wrapping presents and doing some last-minute Christmas shopping. Only 200 Christmas trees left to sell.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader