The Market Outlook for the Week Ahead, or The Melt Up is On!

I have a new roommate.

Her name is Goldilocks. The neighbors have been sneaking peeks at her through the curtains at night and raising their eyebrows because she is slightly older than my kids, or about 50 years younger than me.

I have no complaints. Suddenly, the world looks a brighter place, I’m getting up earlier in the morning, and there is a definite spring in my step. My doctor asks me what I’ve been taking lately.

It helps a lot too that the value of my stock portfolio is going up every day.

I don’t know how long Goldilocks will stay. The longer the better as far as I am concerned. After all, I’m a widower twice over, so anyone and anything is fair game. But two or three months is reasonable and possibly until the end of 2021.

That’s the way it is with these May-December relationships, or so my billionaire friends tell me, who all sport trophy wives 30 years younger.

At my age, there are no long-term consequences to anything because there is no long-term. I don’t even buy green bananas.

I have been expecting exactly this month’s melt-up for months and have been positioning both you and me to take maximum advantage. I am making all my pension fund and 401k contributions early this year to get the money into the stock market as fast as possible.

So far so good.

More money piled into stocks over the past five months than over the previous 12 years. And this pace is set to continue. Those who sold a year ago are buying back. $2 trillion in savings enforced by the pandemic are also going into stocks. And after all, there is nothing else to buy.

If all this sounds great, it’s about to get a lot better. Europe and Asia are still missing in action, thanks to a slower vaccine rollout. When they rejoin the global economy in the fall, it will further throw gasoline on the fire. Exports will boom.

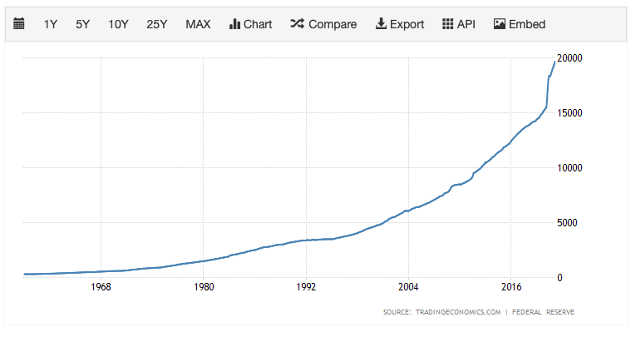

The money supply is growing at an astonishing 26% annual rate, thanks to QE forever and massive government spending. That’s the fastest rate on record. In ten years, a PhD will write a paper on how much of this ended up in the stock market. Today, I can tell you it is quite a lot.

In the meantime, make hay while the sun shines. What am I supposed to talk to about with Goldilocks at night anyway?

Do you suppose she trades stocks?

50 Years of Money Supply Growth is Going Vertical

A face-ripping rally is on for April, or so says Strategas founder Lee. A Volatility Index with a $17 handle is sending a very strong signal that you should be loading up on energy, industrials, consumer discretionary, and travel-related stocks. Avoid “stay at home” stocks like Covid-19, which are extremely overcrowded. I’m using dips to go 100% long.

It’s all about infrastructure, 24/7 for the next three months, or until the $2.3 trillion spending package is passed. It might have to take a haircut first. Biden has set a July 4 target to close thousands of deals and horse-trading. With the S&P 500 breaking out above $4,000 and the financial markets drowning in cash, the plan could be worth another 10% of market upside. Would your district like a new bridge? Maybe a freeway upgrade? The possibilities boggle the mind.

US Manufacturing hits a 37-year high in March, driven by massive new orders front-running the global economic recovery. The Institute for Supply Management publishes a closely followed index that leaped from 60.8 to 64.7. Buy before the $10 trillion hits the market.

US Services Industry hits record high, with the Institute of Supply Management Index soaring from 55.3 to 63.7 in March. The ending of Covid-19 restrictions was the major factor. Roaring Twenties here we come!

US Job Openings are red-hot, coming in at 7.4 million compared to an expected 7 million, according to the JOLTS report. It’s the best report in 15 months. It's a confirmation of the ballistic March Nonfarm Payroll report out on Friday.

US Auto Sales surge in Q1, shaking off the 2020 Great Recession. It’s a solid data point for the recovery, despite a global chip shortage. General Motors (GM) was up 4%, thanks to recovering Escalade sales, and strong demand is expected for the rest of 2021. Toyota (TM) was up 22% and Fiat Chrysler 5%. “Pent-up demand” is a term you’re going to hear a lot this year.

The Economic boom will run through 2023, says JP Morgan chairman Jamie Diamond, one of the best managers in the country. In his letter to shareholders, he says 10% of his workforce will work permanently from home. Zoom (ZM) is here to stay. Fintech is a serious threat to legacy banks, which is why we love Square (SQ) and PayPal (PYPL). Keep buying (JPM) on dips. Interest rates will rise for years, but not fast enough to kill the bull market.

IMF predicts 6.0% Global Growth for 2021, the highest in 40 years. China will grow at 8.4%. It’s a big improvement since their January prediction. The $1.9 trillion US Rescue is stimulating not just America’s economy, but that of the entire world. Expect a downgrade to the 3% handle in 2022, which is still the best in a decade.

Fed Minutes say Ultra Dove Policy to Continue, so say the minutes from the March meeting. Rates won’t be raised on forecasts, predictions, or crystal balls, but hard historic data. That’s another way of saying no rate hikes until you see the whites of inflation’s eyes. $120 billion of monthly bond buys will continue indefinitely. Bonds dropped $1.25 on the news. Sell all (TLT) rallies in serious size. It’s still THE trade of 2021.

Disneyland in LA to open April 30 after a one-year hiatus. It’s time to dust off those mouse ears. The last time the Mouse House was closed this long, antiwar protesters took to Tom Sawyer’s Island and raised the Vietcong flag (I was there). Some 10,000 cast members have been recalled. Only 15% capacity will be allowed to California residents only. The new Avengers Campus will open on June 4. The company is about to make back the 25% of revenues it lost last year, but with a much lower cost base. Buy (DIS) on dips.

Was that inflation? The Producer Price Index jumped by 1.0% in March compared to an expected 0.40%. It’s the second hot month in a row. Basically, the price of everything went up. The YOY rate is an astonishing 4.04% a near-decade high. If it looks like a duck and quacks like a duck….Stocks didn’t like it….for about 15 minutes.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 5.80% gain during the first nine days of April on the heels of a spectacular 20.60% profit in March.

It was a very busy week for trade alerts, with five new positions. Sensing an uncontrolled market melt-up for the entire month piled on aggressive long in Visa (V), JP Morgan (JPM), and Microsoft (MSFT). I also poured on a large short position in bonds (TLT) with a distant May expiration.

My now large Tesla (TSLA) long expires in 4 trading days. Half of my even larger short in the bond market (TLT) also expires then.

That leaves me 100% invested for the sixth time since last summer. Make hay while the sun shines.

My 2021 year-to-date performance soared to 49.89%. The Dow Average is up 11.60% so far in 2021.

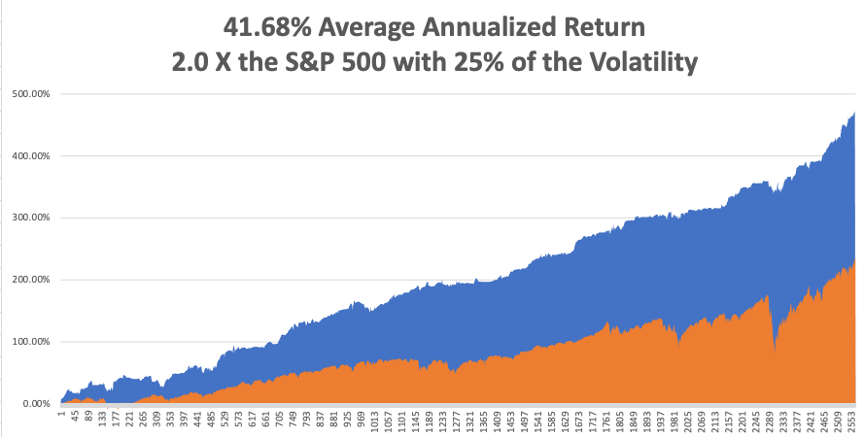

That brings my 11-year total return to 472.44%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 41.68%, the highest in the industry.

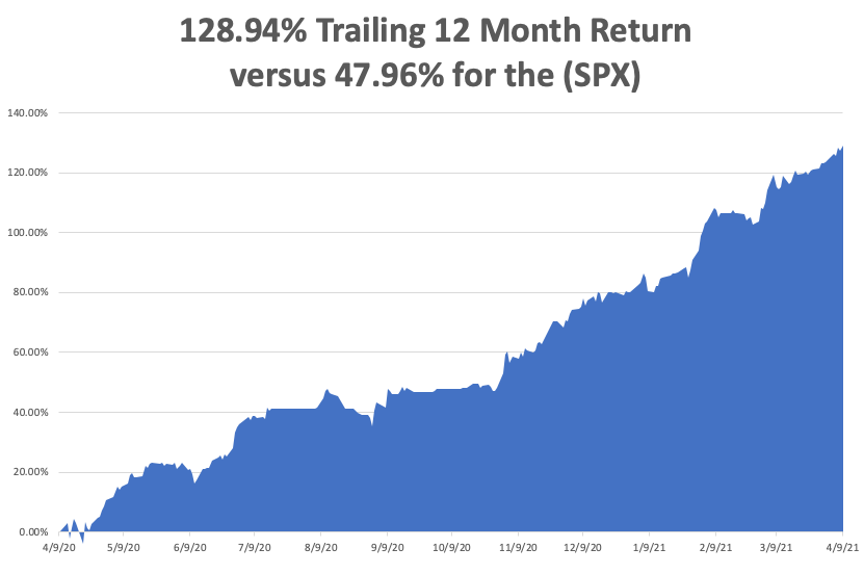

My trailing one-year return exploded to positively eye-popping 128.94%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives. Every time I think these numbers can’t be topped, that increases by another 10% during the following two weeks.

We need to keep an eye on the number of US Coronavirus cases at 30.6 million and deaths topping 563,000, which you can find here.

The coming week will be dull on the data front.

On Monday, April 12, at 11:00 AM, the US Consumer Inflation Expectations for March is released.

On Tuesday, April 13, at 8:30 AM, US Core Inflation for March is published.

On Wednesday, April 14 at 2:00 PM, the Federal Reserve Beige Book is out.

On Thursday, April 15 at 8:30 AM, the Weekly Jobless Claims are printed. We also learn US Retail Sales for March.

On Friday, April 16 at 8:30 AM, we get the Housing Starts for March. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, the whole Archegos blow-up reminds me that there are always a lot of con men out there willing to take your money. As PT Barnum once said, “There is a sucker born every minute.”

I’ll tell you about the closest call I have ever had with one of these guys.

In the early 2000s, I was heavily involved in developing a new, untried, untested, and even dubious natural gas extraction method called “fracking.” Only a tiny handful of wildcatters were even trying it.

Fracking involved sending dynamite down old, depleted wells, fracturing the rock 3,000 feet down, and then capturing the newly freed up natural gas. If successful, it meant that every depleted well in the country could be reopened to produce the same, or more gas than it ever had before. America’s gas reserves would have doubled overnight.

A Swiss banker friend introduced me to “Arnold” of Amarillo, Texas who claimed fracking success and was looking for new investors to expand his operations. I flew out to the Lone Star state to inspect his wells, which were flaring copious amount of natural gas.

Told him I would invest when the prospectus was available. But just to be sure, I hired a private detective, a retired FBI man, to check him out. After all, Texas is notorious for fleecing wannabe energy investors, especially those from California.

After six weeks, I heard nothing, so late on a Friday afternoon, I ordered $3 million sent to Arnold’s Amarillo bank from my offshore fund in Bermuda. Then I went out for a hike. Later that day, I checked my voice mail and there was an urgent message from my FBI friend:

“Don’t send the money!”

It turns out that Arnold had been convicted of check fraud back in the sixties and had been involved in a long series of scams ever since. But I had already sent the money!

I knew my fund administrator belonged to a certain golf club in Bermuda. So, I got up at 3:00 AM, called the club Starting Desk and managed to get him on the line. He said I had missed the 3:00 PM Fed wire deadline on Friday and the money would go out first thing Monday morning. I told him to be at the bank at 9:00 AM when the doors opened and stop the wire at all costs.

He succeeded, and that cost me a bottle of Dom Perignon Champaign, which fortunately in Bermuda is tax-free.

It turned out that Arnold’s operating well was actually a second-hand drilling rig he rented with a propane tank buried underneath that was flaring the gas. He refilled the tank every night to keep sucking in victims. My Swiss banker friend went bust because he put all his clients into the same project.

I ended up making a fortune in fracking anyway with much more reliable partners. No one had heard of it, so I bought old wells for pennies on the dollar and returned them to full production. Then gas prices soared from $2/MM BTU to $17. America’s gas reserves didn’t double, they went up ten times.

I sold my fracking business in 2007 for a huge profit to start the Diary of a Mad Hedge Fund Trader.

It is all a reminder that if it is too good to be true, it usually is.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader