The Market Outlook for the Week Ahead, or The Recession Has Begun

I hate to be the one to fart in church here, but the long-feared recession has already started.

It’s not a conventional recession defined by two back to back quarters of negative GDP growth, although you have a tough time convincing anyone in the besieged auto, real estate, or agricultural sectors of that.

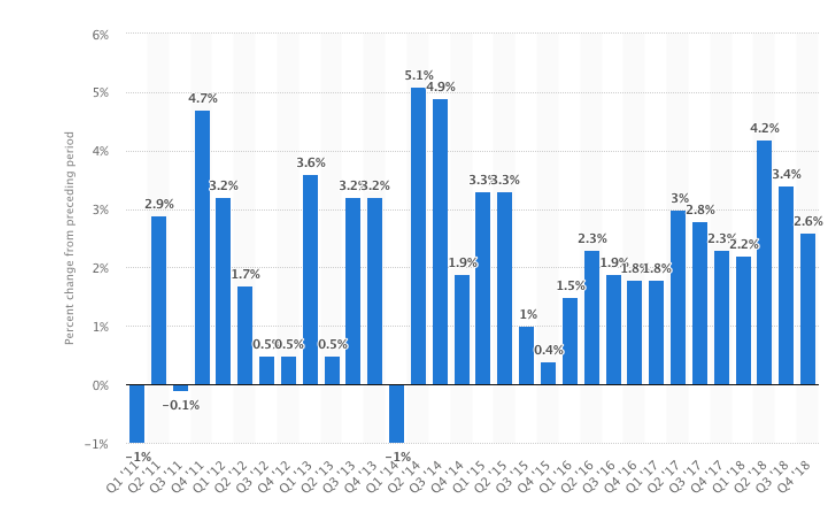

No, this is more of a growth recession. US GDP growth peaked at a 4.4% annualized rate during the second quarter of 2018. The third quarter came in at 3.4% and the four quarter at only 2.6%. Consensus forecasts for Q1 2019 are well below 1%, thanks to the government shutdown.

That means the growth rate has fallen by an eye-popping 76% in nine months! By the way, the government has told us that economic growth has been rising this entire time. But want the stimulus from the 2017 tax bill were spent, there were no more bullets left.

If it were just the GDP data that was falling off a cliff, I wouldn’t be so worried. However, the weakness is confirmed by a raft of other data. The ten year US Treasury bond (TLT) remains stuck around 2.75%, an incredibly low figure given that we are ten years into an economic recovery.

Corporate earnings growth forecasts going forward are now at zero. To see a market multiple of 18X for stocks with no growth and prices that are just short of all-time highs defies belief. This will all lead us to a REAL recession sometime in the near future.

What we are left with is a market of very low return, high-risk trades, not the kind you want to pursue, let alone bet the ranch on.

I believe that when the BIG ONE finally arrives, it won’t be all that bad. I’m looking for a short, sharp recession of maybe six months in duration. There really isn’t that much leverage in the system that can blow up. It might even not be worth selling out all your stocks to avoid it, especially if it results in a giant tax bill.

You would also be selling in front of my coming Golden Age for the United States when a huge demographic tailwind brings a new era of prosperity. If you are smart enough to get out at the top now, will you also be clever enough to get back in at the bottom? Or will you sell more instead, like you did in December?

Merger fever hit the gold industry with Barrick Gold (GOLD) taking a run at Newmont Mining (NEM), the world’s first and second largest producers. It’s all about efficiencies of scale. Take this as a long-term bottom in gold prices.

The China tariff hike was postponed indefinitely, and Chinese stocks love it. Import duties will stay at 10%, instead of rising by 25% starting last Friday. We knew it was never going to happen.

Some 95% of the China trade deal is now already priced into the market. If a deal DOESN’T get done and goes the way of the North Korean negotiations, the market will very quickly back out that 95%.

Poor economic data was to be found everywhere you looked. Wholesale Inventories rose sharply, up 1.1% in another recession indicator. US Factory Orders came in incredibly weak at 0.1% in December when 0.6% was expected. Recession indicator number one million. Limit your risk.

Our friend Jay stayed dovish again, but markets yawned this time. How much mileage can you get from the same vague assertion? Shorts are about to swarm the market. Take profits on all longs.

The US Dollar hit a three-week low. The Fed’s dovish leanings are hammering the buck. Keep loading the boat with weak dollar plays, like emerging markets (EEM).

Bonds got crushed delivering their worst week in five months, down three points as the great “crowding out” begins. Massive corporate borrowing can’t compete with government borrowing, so rates are rising sharply. This is the beginning of the end. Sell short the (TLT).

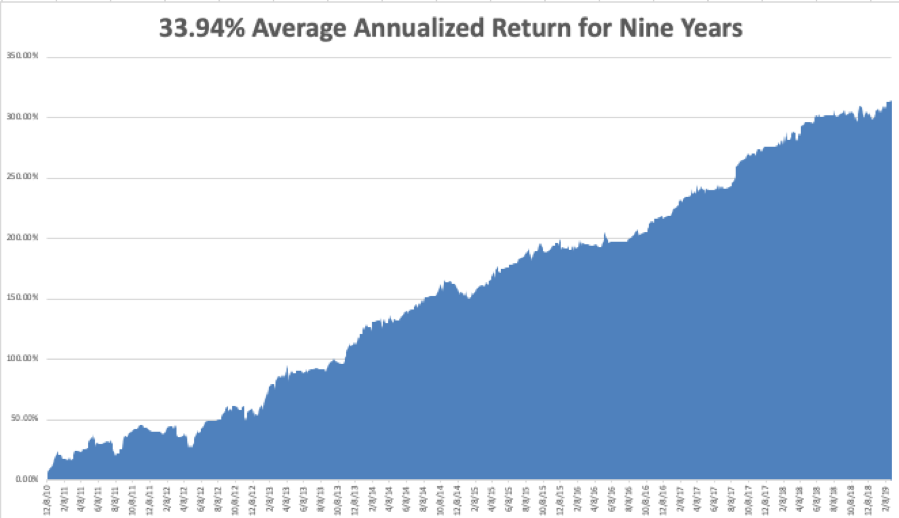

February came in at a hot +4.16% for the Mad Hedge Fund Trader. My 2019 year-to-date return ratcheted up to +13.64%, a new all-time high and boosting my trailing one-year return back up to +31.90%.

My nine-year return clawed its way up to +313.78%, another new high. The average annualized return appreciated to +33.94%.

I am now 80% in cash, 10% long gold (GLD), and 10% short bonds (TLT). We have managed to catch every major market trend this year, loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

As for the Mad Hedge Technology Letter, it is short Apple (AAPL).

Q4 earnings reports are pretty much done, so the coming week will be all about jobs, jobs, jobs.

On Monday, March 4, at 10:00 AM EST, December Construction Spending is published.

On Tuesday, March 5, 10:00 AM EST, December New Home Sales are out.

On Wednesday, March 6 at 10:00 AM EST, the February ADP Employment Report is out, a measure of private sector hiring.

Thursday, March 7 at 8:30 AM EST, we get Weekly Jobless Claims.

On Friday, March 8 at 8:30 AM EST, we get the February Nonfarm Payroll Report is released. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’m taking the kids to see Hello Dolly in San Francisco. This was one of my parents’ favorite Broadway musicals, and they used to sing the songs around the house all day long. However, it won’t be the same without the late Carol Channing.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader