The Market Outlook for the Week Ahead, or Time for a Break

I know you’re not going to want to hear this. I might as well be trying to pull your teeth, lead you down a garden path, or sell you a high-priced annuity.

But there is nothing to do in the market right now. Nada, diddly squat, bupkis, and for all you Limey’s out there, bugger all.

For during the first six weeks of 2021, we have pretty much squeezed all there is out of the market.

Not only did we nail the timing and the direction, we also got the lead sectors, financials, brokers, chips, and short bonds (MS), (GS), (BLK), (AMD). We also chased the Volatility Index (VIX) down from $38 to a lowly $20, baying and protesting all the way.

That enabled us to extract a 28.29% profit so far in 2021, the best return in the 13-year history of the Mad Hedge Fund Trader. The only other time you see numbers this high is when Ponzi schemes get busted. And not a dollar of this was earned from the really marginal plays like Bitcoin, SPAC’s, GameStop (GME), or pot stocks.

If I feel like I did a year’s worth of work during the first seven weeks of 2021, it’s because I have, issuing 60 trade alerts since January 1.

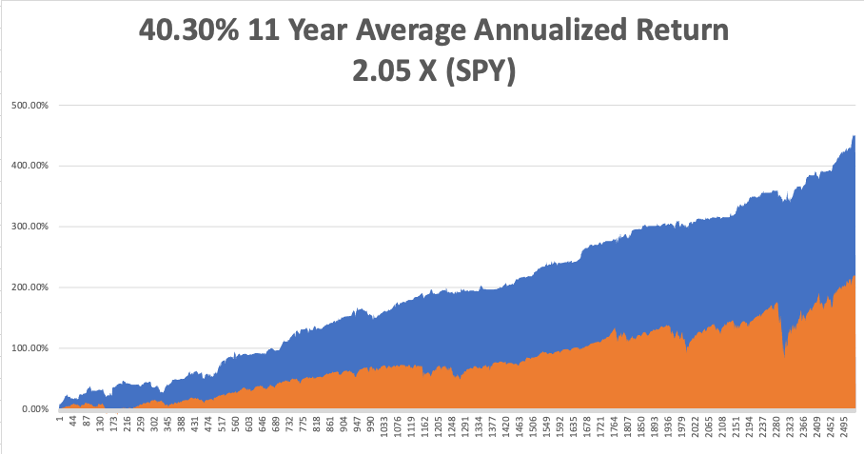

However, bonds (TLT) are reaching the end of their current leg down. The 1.34% yield we saw on Friday is suspiciously close to the 1.36% yields we saw during the 2012 and 2017 market double bottom.

So, there may be some wood to chop around these, levels, possibly for weeks or months.

This is important because a collapsing bond market has been the principal driver of the winning trades of 2021, such as in banks, brokers, money managers, and other domestic recovery plays.

And when one side of the barbell goes dead, what do you do? You buy the other side. FANGs are just completing a six-month “time” correction where they have gone absolutely nowhere. So, Facebook (FB), Amazon (AMZN), and Apple (AAPL) may be getting ready for a roll.

One other sector that might keep running is the SPDR Mining & Metals ETF (XME), and Freeport McMoRan (FCX). That’s because it's not just us buying metals to front-run a recovery, it’s the entire world. What do you think a $2 trillion infrastructure budget will do to this area?

New lows for bonds, as the ten-year US Treasury yield hits 1.26%, up 38 basis points since January 1 and a one-year high. 1.50% here we come! Ever hear the expression “Don’t fight the Fed”? All financials are off to the races, where we were 60% long. Biden’s $1.9 trillion rescue package will be 100% borrowed and take total US borrowing to a back-breaking 55% of GDP. I hate to sound like a broken record but keep selling rallies in the (TLT), buy (JPM), (BAC), (GS), (MS), and (BRK/B) on dips.

Volatility index hit a one-year Low, which is what you’d expect at the dawn of a decade-long bull market in stocks. The (VIX) may flat line here for a while before the next out-of-the-blue spike.

The Nikkei Stock Average topped 30,000, for the first time in 31 years, Yes, it’s been a long haul. I was heavily short in the initial 1990 meltdown from 39,000 to 20,000 and many fortunes were made. The top marked the end of the Japanese company’s ability to copy their way into leadership. After that, rapidly advancing technology made copying too slow to compete in a global economy.

A midwest storm upended energy markets, with oil popping $8 to $67 and gas deliveries spiking from $4 to $999. It would have gone higher, but the software only provided for three digits. Electricity prices are all over the map. Some 4 million Texas customers are without power. Fracking has ground to a halt. Windfarms are frozen solid. If you are a net producer (as I am), you are in heaven. The turmoil is expected to be gone by the weekend. It’s another high price paid for ignoring global warming.

Weekly Jobless Claims soared, to 861,000, casting a dark cloud over the economic recovery. The news took a 300-point bite out of the Dow. Illinois and California saw the biggest gains. We are not out of the woods yet.

SpaceX was valued at $74 Billion, according to an $850 billion venture capital fundraising round this week. However, Elon Musk’s rocket company won’t go public until men are landed on Mars. The company is also the launching pad for its Starlink global WIFI project, which will cost at least $10 billion to build out. Blowing up rockets is not a good backdrop for an IPO.

Cash is still pouring off the sidelines, with equity mutual funds attracting some $7.8 billion last week. As long as this is the case, which could be for years, any market corrections will be limited. Strangely, bond funds are still pulling in money too, some $5.7 billion. It’s called a liquidity-driven market, silly!

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch earned an amazing 17.27% so far in February after a blockbuster 10.21% in January. The Dow Average is up a trifling 2.92% so far in 2021.

This is my fourth double-digit month in a row. My 2021 year-to-date performance soared to 27.28%. After the February 19 option expiration, I am now 80% in cash, with a single long in Tesla (TSLA) left.

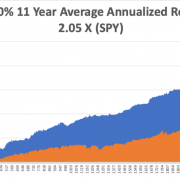

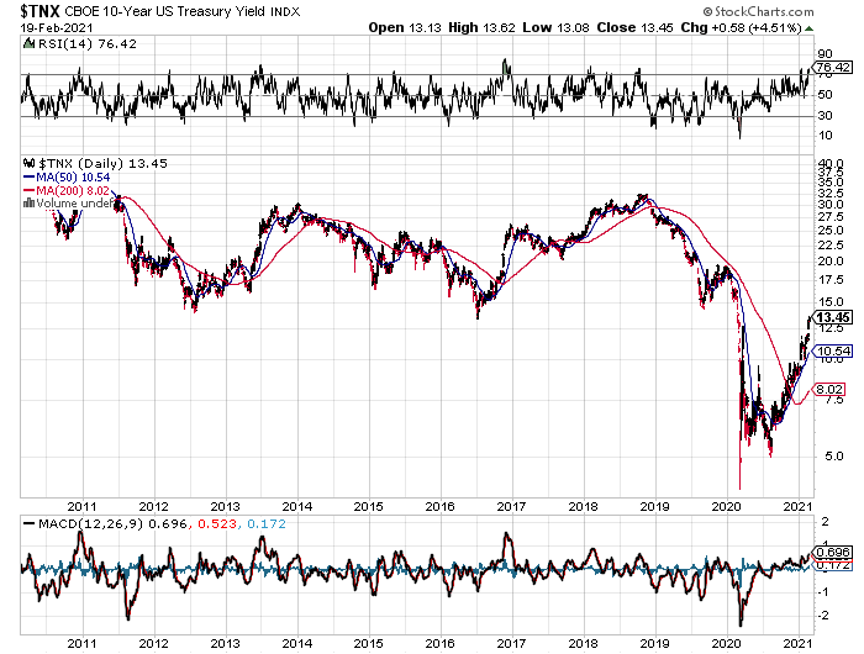

That brings my 11-year total return to 450.03%, some 2.05 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an Everest-like new high of 40.30%.

My trailing one-year return exploded to 94.09%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 109.00% since the March 20, 2020 low.

We need to keep an eye on the number of US Coronavirus cases at 28 million and deaths approaching 500,000, which you can find here. We are now running at a heart breaking 3,000 deaths a day. But that is down 35% from the recent high.

The coming week will be a boring one on the data front.

On Monday, February 22, at 8:30 AM EST, the Chicago Fed National Activity Index is out. Zoon (ZM) reports.

On Tuesday, February 23 at 9:00 AM, the S&P Case-Shiller National Home Price Index for December is announced. Square (SQ) and Intuit (INTU) report.

On Wednesday, February 24 at 8:30 AM, New Home Sales for January are printed. NVIDIA (NVDA) reports.

On Thursday, February 25 at 9:30 AM, Weekly Jobless Claims are printed. US Durable Goods for January and Q4 GDP are out. Salesforce (CRM), (Moderna (MRNA), and Airbnb (ABNB) report.

On Friday, February 26 at 8:30 AM, US Personal Income and Spending are published. DraftKings (DKNG) reports. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, if you want to see what it is like to work at Amazon, watch the movie Nomadland. It’s an artsy Francis McDormand film made with a $4 million budget about the end of life, which I caught over the weekend on Hulu.

It covers a contemporary trend in US society where retirees with no savings move into RVs and live off the grid, working occasionally to earn gas money. They raved about it in Europe.

If I don’t keep those trade alerts coming, that could be me in a couple of years.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader