The Market Outlook for the Week Ahead, or Welcome to the Great Depression

The neighborhood is alive with power tools.

These are the implements that were given as Christmas presents to dads years ago. But to afford life in the San Francisco Bay Area said dads have to work 12 hours a day and weekends. Now, suddenly they have all the free time in the world and those ancient gifts are coming out of decade-old original packaging.

I’ve noticed something else about my neighborhood. People have suddenly started to turn gray. Beauty salon appointments have been banned for weeks, not designated essential businesses.

The GDP forecasts released by Goldman Sachs (MS) last week have been turning a lot of other people gray as well. Q1 is thought to show a -6% annualized shrinkage and Q2 is expected to come in at -24%. The unemployment rate will peak at 9%. Not to be outdone, Morgan Stanley (MS) cut their Q2 forecast to -30%.

That means America’s GDP will shrink to the 2016 level of $18.62 trillion, down enormously from today’s $21.5 trillion. Yes, three years of economic growth will be gone in a puff of smoke. These are far worse than the last Great Recession when the worst two quarters came in at -2% and -8%. That’s double the worst figures of the Great Recession.

In the meantime, vast swaths of the American economy are moving online, never to return.

The good news is that growth will return at a historic 12% rate in Q3. That sets up an exaggerated “V” for the stock market. How soon should you start buying stocks if this economic scenario plays out? Probably a month, if not weeks, but only if you have the courage to do so.

The numbers from China (FXI) this week are very encouraging, showing no increase in new cases. In February, they enacted the kind of severe lockdown which California enacted a week ago.

Hopefully, that means we will get the Chinese results in a month or two. But the problem is that these are Chinese numbers that may be intended more to please the government than shed light on the truth.

The first real look we get at the effectiveness of lockdown may be in Italy in a few weeks, which has been quarantined since February.

In the US, the states have abandoned all hope of help from Washington and are leading the charge with the most aggressive measures. In California, it is now illegal for 40 million people to go outside unless it is a trip to the grocery store, the pharmacy, or the doctor.

The Golden State is now on a WWII footing. Tesla (TSLA) is switching production to ventilators. The state national guard is setting up field hospitals in parks. I am growing my own victory garden in the back yard.

The state is seeking to double the number of hospital beds to 20,000 within weeks. It just bought an entire hospital in Oakland, Seton Hospital. It went bankrupt last year and the administrators couldn’t give it away. The state i taking control of abandoned college dormitories and leasing empty hotels and cruise ships.

I expect food rationing to hit in a month. The distribution system is strained but working now. It may start to fail in April or May when large numbers of workers get sick.

The good news is that shelter in place should work, possibly by May. Kids are out of school until August.

With Trump refusing to put the entire country on lockdown that raises the specter of those in red states dying, while those in blue ones live. The big blue states of New York, California, New Jersey, Connecticut, and Illinois were the first to order shelter-in-place and will certainly see lower and sooner peaks in disease and fatalities.

And guess who has a one-month supply of Chloroquine, along with antibiotics widely believed to be a cure for the Coronavirus? That would be me, who bought them to fight off malaria for my trip to Guadalcanal six weeks ago. I was planning on going back in June to collect more dog tags for the Marine Corps, so I have an extra supply. As long as you can read, I’ll still be writing.

There is one more unexpected aspect of the pandemic and the shelter-in-place orders. I expect a baby boom to ensue in about nine months, thanks to all this enforced togetherness. The US birth rate has been falling for decades and is now well below the replacement rate. It’s about time we found a way to turn it around. Just don’t count me in on this one. I already have five kids.

So, you’re still asking for a market bottom.

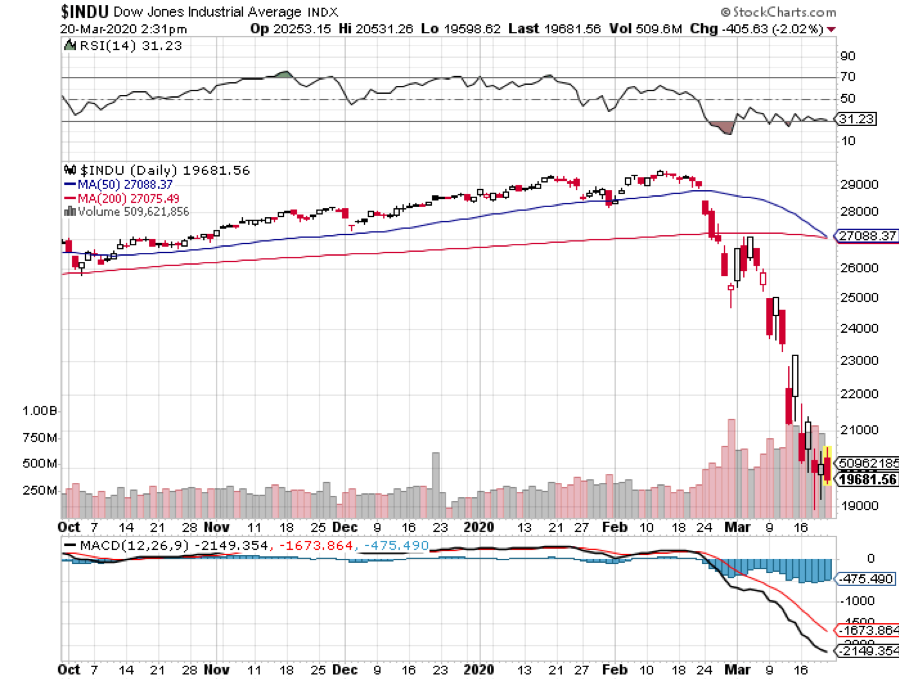

The futures in Asia are limit down as I write this, just above the Dow Average 17,000 handle (INDU), thanks to the Senate failure to pass a virus rescue bill. Near 15,000 seems within range, down 49% from the February high. Modern history is no longer relevant here. We have to go back to 1929 to see numbers this extreme. I’ll be doing the research on that in the coming days.

The 1987 crash was already revisited a week ago, with a 3,000-point plunge in the Dow Average, or 12%. Some 33 years ago, we saw a 20% single day haircut, which I remember too well. This is with the Federal Reserve throwing everything at the stock market but the kitchen sink. I never thought I’d live long enough to see another one of these.

The Fed took interest rates to zero to stave off a depression, but the stock market crashes in overnight trading anyway. That brings the total to 150 basis points in cuts in five days. The Treasury is to buy an eye-popping $700 billion in mortgage securities to clear out the refi market for the first time in a decade. The Fed has just fired its last bullets to save stocks.

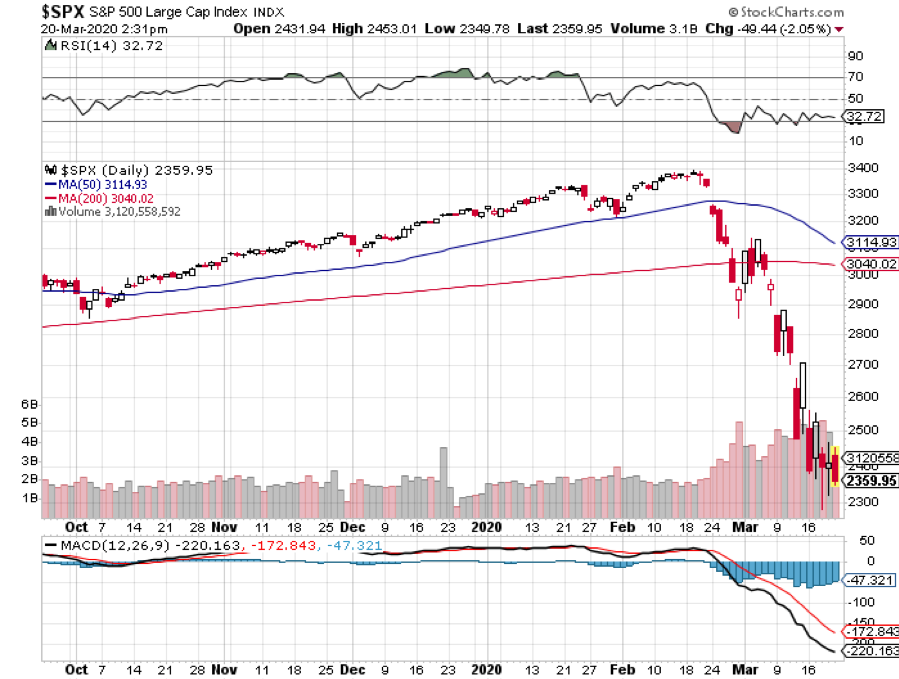

Goldman Sachs is targeting 2,000 in the (SPX), down 10% from here and 41% from the top. That is a 14X multiple on a 2020 S&P 500 earnings decline from $165 to $143. Yes, it’s just a guess. Investors could care less now about fundamentals or technicals. Cash is king.

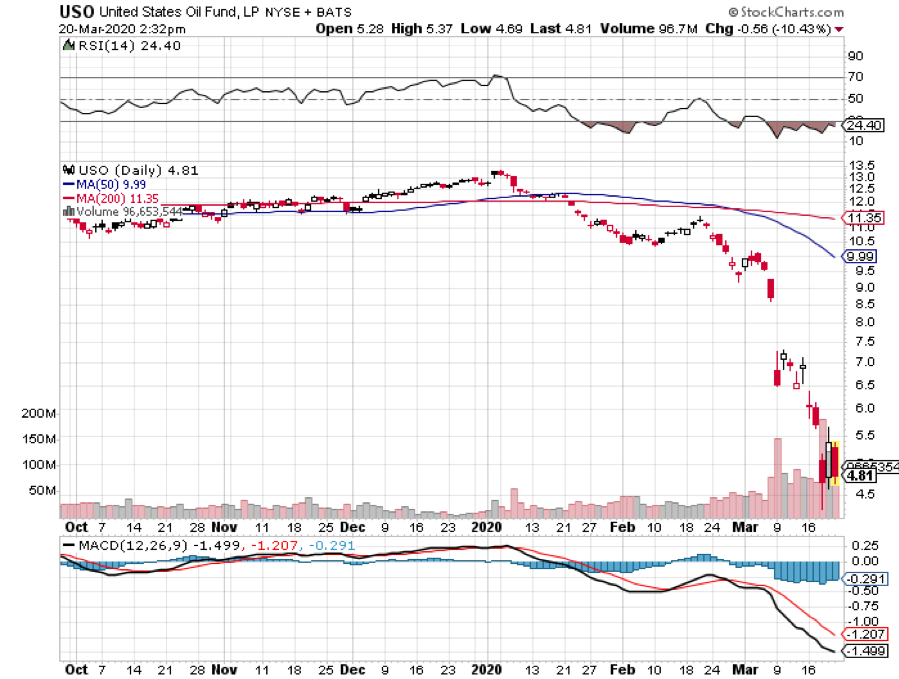

Oil (USO) is headed for the teens. Saudi Arabia is ramping up production to a record 13 million barrels a day. The recession is collapsing US demand from 20 to 15 million b/d, half of which is consumed by transportation.

Russian national income has just collapsed by 75%. Will there by a second Russian Revolution? The 3% of the US market capitalization accounted for by energy stocks will drop below 1%. Fill her up! Avoid energy, even though some are going for pennies on the dollar.

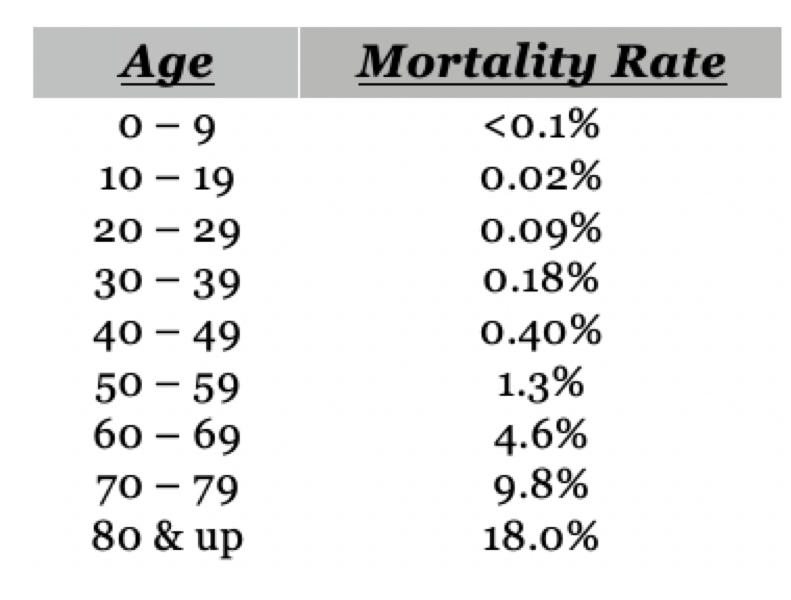

The only data point that counts now is the daily real-time Corona tally of cases and deaths from Johns Hopkins, (click here). All other economic data is now irrelevant. Right now we are at 335,997 cases worldwide and 14,641 deaths. The US is at a frightening 33,276 cases as of writing.

Insider buying is exploding, with CEOs picking up their own stocks at 50%-70% discounts. Charles Scarf, president of Wells Fargo, just bought $5 million worth of (WFC) down 52% from the recent top. This is a legendary indicator that we may be within weeks of a market bottom.

The New York Stock Exchange closes its floor trading operations last week after several members tested positive for the Corona virus. Online trading will continue, where 95% of the business migrated years ago. It’s really just a TV stage now.

It’s all about hedge funds, triggering the massive volatility of the past month. They have been unwinding massive positions with up to 13X leverage in illiquid markets that can’t handle the massive volume.

When the last hedge fund is liquidated, the market will go up and the (VIX) will collapse. They may have started and the (VIX) plunged an incredible 25 points in hours.

Trump asked states to keep unemployment data secret to minimize market impact. Just what we need, less information, not more. The Weekly Jobless Claims were a bombshell, adding 70,000 to 271,000, the sharpest increase in a decade. Look for far worse to come in coming weeks as whole industries are shut down, and state unemployment computers explode from the weight of applications. Jobless Claims over 2 million are imminent!

Existing Home Sales soared by a stunning 6.5% in February, a 13-year high. The West saw an amazing 17% increase. The median home price jumped by 8% YOY. While the data is great, it’s all pre-Corona. It is illegal for people to go out to look at homes in many states, and no one wants to sell to keep strangers out of the house.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $20 a barrel, and many stocks down by three quarters, there will be no reason not to.

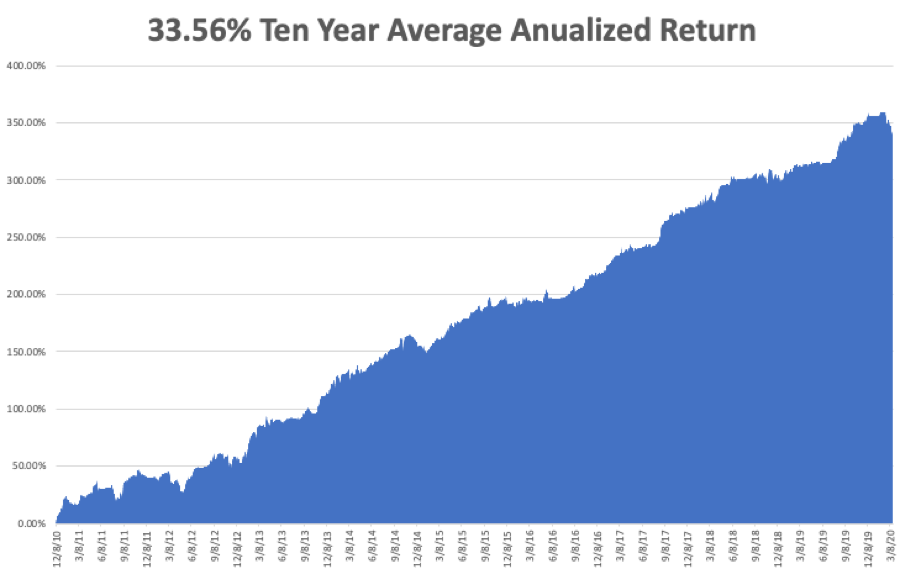

My Global Trading Dispatch performance has had a great week, thanks to the collapse in market volatility, pulling back by -8.22% in March, taking my 2020 YTD return down to -11.14%. That compares to an incredible loss for the Dow Average of -37% at the Friday low. My trailing one-year return was pared back to 31.68%. My ten-year average annualized profit shrank to +33.56%.

I have been fighting a battle for the ages on a daily basis to limit my losses. My goal here is to make it back big time when the market comes roaring back in the second half.

My short volatility positions have largely recovered. I shorted the (VXX) when the Volatility Index (VIX) was at $35. It then went to an unbelievable $80 before falling back to $55. I was saved by only trading in very long maturity, very deep out-of-the-money (VXX) put options where time value will maintain a lot of their value. Now, we have time decay working in our favor. These will all come good well before their one-year expiration.

At the slightest sign of a break in the pandemic, the economy and shares should come roaring back. Right now, I have a 70% cash position.

On Monday, March 23 at 7:30 AM, the Chicago Fed National Activity Index is out.

On Tuesday, March 24 at 9:00 AM, the New Home Sales for February are released.

On Wednesday, March 25, at 7:30 AM, US Durable Goods for February are published.

On Thursday, March 26 at 7:30 AM, Weekly Jobless Claims are announced. The number could top 1,000,000. The final read on Q4 GDP is announced, although it is ancient history.

On Friday, March 27 at 9:00 AM, the US Personal Income for February is printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I will be in training doing daily ten-mile hikes with a 50-pound backpack. I will be leading the Boy Scouts on a 50-mile hike at Philmont in New Mexico. I expect the epidemic to peak well before then and normalcy to return.

Shelter in place will work. Please stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader