The Market Outlook for the Week Ahead, or What a Waste of Time!

“Sell in May and go away” has long suffered from the slings and arrows of non-believers, naysayers, and debunkers.

Not this time.

Looking at the trading since April 30, we have barely seen an up day. Since then, the Dow Average has plunged 1,900 points from a 26,700 high, a loss of 7.1%. We are now sitting right at my initial downside target of the 200-day moving average.

The Dow has now given up virtually all its 2019 gains, picking up only 2.0%. In fact, the market is dead unchanged since the end of 2017. If you have been an index investor for the past 17 months, your return has been about zero. In other words, it has been a complete waste of time.

There are a lot of things I would have preferred to do rather than invest in index funds for the past year and a half. I could have hiked the Pacific Crest Trail….twice. I might have taken six Cunard round-the-world cruises and met several rich widows along the way. I might even have become fluent in Italian and Latin. Such is the value of 20-20 hindsight.

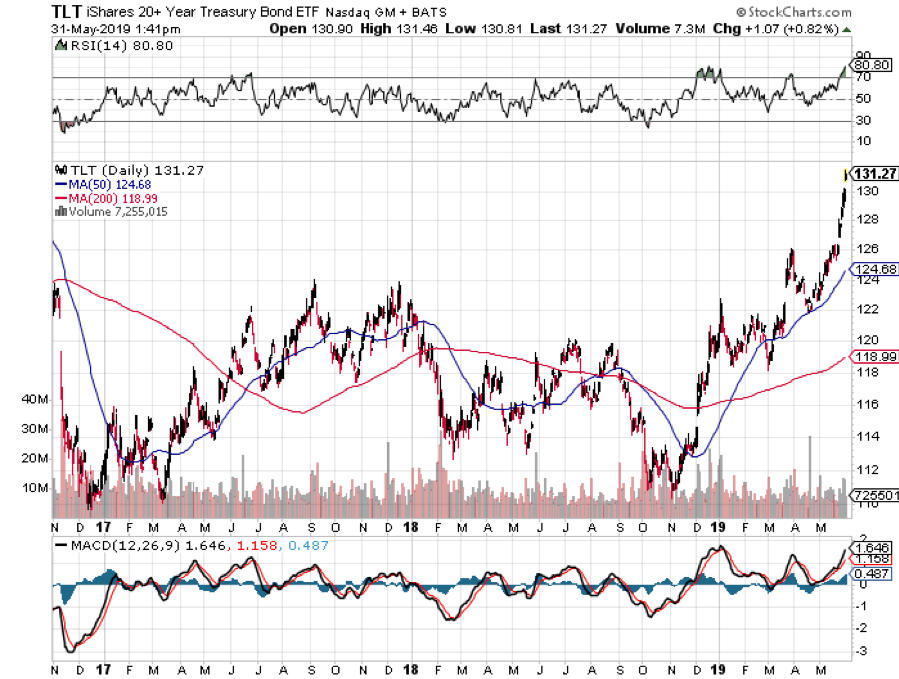

You would have done much better investing in the bond market, which has exploded to a new two-year high, taking the ten-year US Treasury yield down to a once unimaginable 2.16%. During the same period, the (TLT) has gained 11 points, or 9.0% plus another 3.0% worth of interest. You did even better if you invested in lower grade credits.

Which leads us to the big question: Will stocks bottom out here, or are we in for a full-on retrace to the December lows?

Unfortunately, recent events have conspired to point to the latter.

The United States has now declared trade wars against all neighbors and allies around the world: China, Mexico, Europe, and Canada. On Friday, it announced 25% punitive tariffs against Mexico before NAFTA 2.0 was even ratified before Congress, thus rendering it meaningless. Businesses are dropping like flies.

As a result, GDP forecasts have been falling off a cliff, down from 3.2% in Q1 to under 1% for Q2. The administration’s economic policy seems to be a pain now, and more pain later. It is absolutely not what stock investors want to hear.

If you are a business owner now, what do you do with the global supply chain being put through a ringer? Sit as firmly on your hands as possible and do nothing, waiting for either the policy or the administration to change. Stock investors don’t want to hear this either. The fact that stock markets entered this cluster historically expensively is the fat on the fire.

Having hummed the bear national anthem, I would like to point out that stocks could rally from here. We enter a new month on Monday. There will be plenty of opportunities to make amends and the G-20 meeting which starts on June 20. This should provide a backdrop for a rally of at least one-third of the recent losses, or about 600 points.

But quite honestly, if that happens, I’ll be a seller. The economy is doing the best impression of going down the toilet that I can recall, and that includes 2008. Only this time, all the injuries are self-inflicted.

As the trade war ramped up, China moved to ban FedEx (FDX) and restrict rare earth exports (REMX) to the US essential for all electronics manufacture. Most modern weapons systems can’t be built without rare earths. The big question in investors' minds becomes “Is Apple next?”

The OECD cut its global growth forecast from 3.9% to 3.1% for 2019 because of you know what. Stock markets are now down for their sixth week as the 200-day moving average comes within striking distance.

There was more bad news for real estate with April Pending Home Sales down 1.5%. If rates this low can’t help it, nothing will. Where are those SALT deductions?

The bear market in home prices continued in March with the Case Shiller CoreLogic National Home Price Index showing a 3.7% annual price gain, down 0.2%. Home price in San Francisco is posting negative numbers. When will those low-interest rates kick in?

The bond market says the recession is already here with ten-year interest rates at 2.16%, a new 2019 low. German bunds hit negative -0.21%. JP Morgan (JPM) CEO Jamie Diamond says the trade war could cause real damage to the US economy.

US Capital Goods fell out of bed in April, down 0.9%, in another important pre-recession indicator. No company with sentient management wants to expand capacity ahead of an economic slowdown.

Despite all the violence and negativity, the Mad Hedge Fund Trader managed to crawl to new all-time highs last week, thanks to some very conservative positioning on the long side in the right names.

Those would include Microsoft (MSFT), Amazon (AMZN), and Tesla (TSLA). All of these names were down on the week, but the vertical bull call spreads were up. You see, there is a method to my madness!

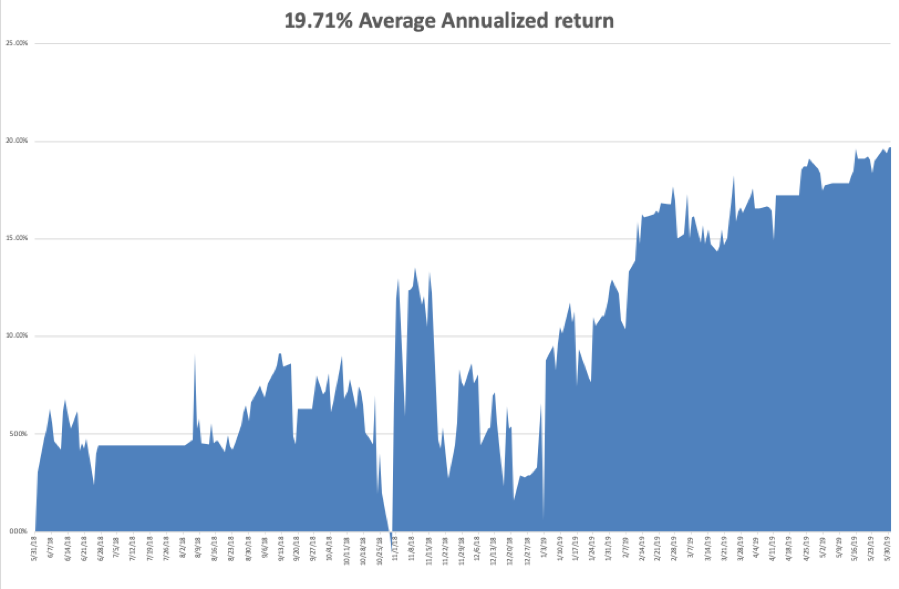

Global Trading Dispatch closed the week up 16.30% year-to-date and is up 0.51% so far in May. My trailing one-year declined to +19.71%.

The Mad Hedge Technology Letter did fine, making money on longs in Microsoft (MSFT) and Amazon (AMZN). Some 10 out of 13 Mad Hedge Technology Letter round trips have been profitable this year.

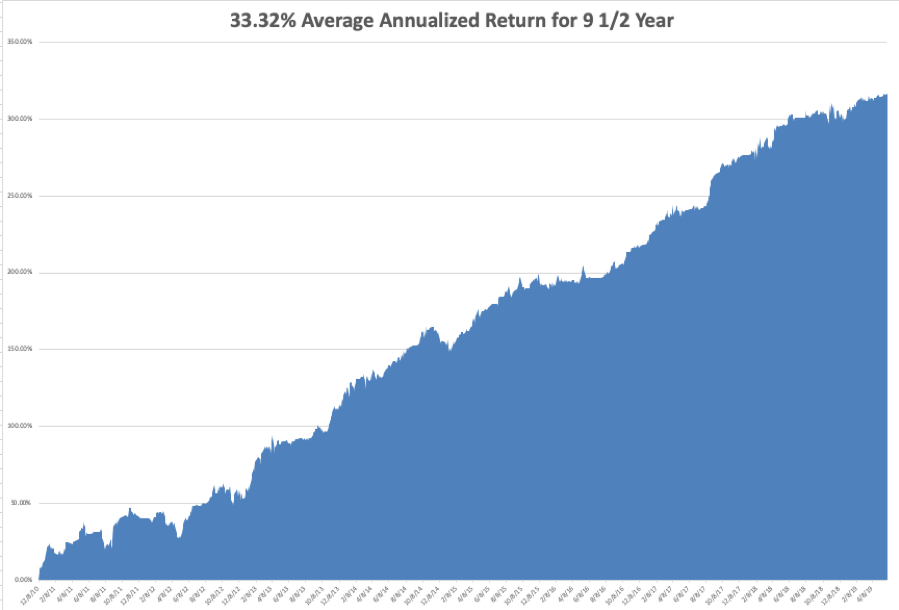

My nine and a half year profit jumped to +316.55%. The average annualized return popped to +33.32%. With the trade war with China raging, I am now 70% in cash with Global Trading Dispatch and 80% cash in the Mad Hedge Tech Letter.

I’ll wait until the markets enjoy a brief short-covering rally before adding any short positions to hedge my longs.

The coming week will be a big one with the trifecta of big jobs reports.

On Monday, June 3 at 7:00 AM, the May US Manufacturing PMI is out.

On Tuesday, June 4, 9:00 AM EST, the April US Factory Orders are published.

On Wednesday, June 5 at 5:15 AM, the May US ADP Employment Report of private hiring trends is released.

On Thursday, June 6 at 5:30 AM, the April US Balance of Trade is printed. At 8:30 Weekly Jobless Claims are published.

On Friday, June 7 at 8:30 AM, we learn the May Nonfarm Payroll Report is announced which lately has been incredibly volatile.

As for me, I am going to be leading the local Boy Scout troop on a 20-mile hike with a 2,500-foot vertical climb in the Oakland Hills. Hey, you never know when Uncle Sam is going to come calling again. I need to stay boot camp-ready at all times.

At least I can still outpace the eleven-year-olds. I’ll be leaving my 60-pound pack in the garage so it should be a piece of cake.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader