The Market Outlook for the Week Ahead, or When is Breakout Time?

This will be my last week of writing from the balcony of my chalet in Zermatt. I’ll try to bag a few more peaks over the weekend, then it is a long train ride with transfers in Visp, through the 12-mile stretch of the 125-year old Simplon Tunnel, then on to Milan and my Venice Strategy Luncheon.

Swiss trains run right on time, Italian ones not so much.

Stock markets have been trapped in a tedious range for three months now, from (SPX) 3,600 to 4,200, and are dead in the middle of that range. Earnings widely forecast to be awful came in moderate. With 20% of the S&P 500 reporting, revenues were up 10.5% and profit up 5%. These are not the torrid numbers seen in years past but are positive nonetheless.

This is not what recessions are made of.

Are we about to break out to the upside, downside, or do nothing?

I know the answer but it will take some ‘splanin to get you to understand how and why. I think this has all been one long bottoming process and what follows will be exciting, if not enthralling.

Everyone is hoping for one more capitulation selloff to buy into. The problem is that if too many people wish for something, it never happens.

The primary destroyer of markets this year has been energy-driven inflation. But oil prices peaked at $132 and have been falling ever since and are now off 35%. Oil is now the same price as when the Ukraine War started.

Gasoline has fallen too, some 15% since mid-June, lagging on the downside, as it always does.

Some long-sighted investors, like me, have already read the memo and have been buying. As a result, modest earnings shortfalls have allowed multiple expansion for six weeks now. ALL of the gains since then have come from multiple expansion, meaning the outlook for companies is now improving.

The only question now is whether we get one more selloff in August giving us another chance to load the boat. We could get a short-term peak this week when big tech reports, especially if they come up short. Terms like “hiring freeze”, “slowing revenues”, and “disappointing” might become commonplace.

Another peak could come at 8:30 AM on August 10 when the July CPI Report comes out. Even a modest gain will prompt a round of profit-taking. A decline and it could be a big one, and it’s off to the races.

The end result will be a massive yearend rally that could take the S&P 500 up 20% to 4,800. Individual high-growth stocks, like Tesla (TSLA) could rise by 50% or more.

Happy days will be back again.

The biggest threat to the markets right now may be coming from Europe, where things are clearly falling apart. There is a continuing war in Ukraine that could last for years. A Russian cutoff of natural gas threatens to trigger a deep recession.

Inflation in the UK hit 9.4%, a 40-year high. Heat-induced shutdowns are becoming common. Governments are falling like ten pins, such as in the UK and Italy. Currencies everywhere are in free fall.

Not our problem you may say. But some 30% of S&P 500 earnings come from Europe, especially for technology companies, which with a greenback at a 20-year high are shrinking by the day. Disaster in Europe could cut your retirement portfolio off at the knees, so you better help throw them a rope…. again.

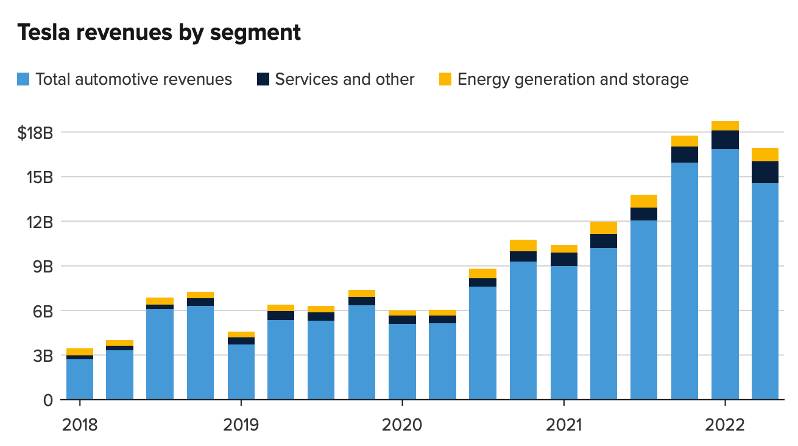

Tesla Earnings Were a Mixed Bag, with revenues up to $16.93 billion for the quarter, a gain of 42% YOY, making it the fastest growing large car maker in the world. Solar energy and services also grew nicely. But margin is down from 33% to 27% QOQ due to high startup costs of the Berlin and Austin factories. That’s still 2.2 times better than the 12% margins seen at Big Three automakers and why it is still a long term “BUY.” The shares popped $100, clearly taking a “glass half full” view. Elon sold 75% of his Bitcoin, taking an implied $350 million paper loss from the top. Buy (TSLA) on dips.

Bonds Hit Two-Week High, boosted by Europe’s 50 basis point rate rise, the first in 11 years. Bonds and the US Dollar are starting to lose some of their yield advantage over the Euro. Recession fears continue to light a fire under bonds, as they have done since early June, taking yields down to 2.73 today.

Weekly Jobless Claims Hit 251,000, giving another recessionary hint, the highest since November. The trend remains up.

Nordstream One is Back Online, delivering 40% of its maximum capacity of natural gas to Germany, the prewar level. It had been down ten days for maintenance. But for how long? The German and the European economies are on a knife edge, and it’s the Russians who decide which way things go. Natgas prices sold off by 4.2%, thankfully.

The Euro Could Hit 90 Cents, a 20-year low, as the Russian gas cutoff hits hard before American supplies arrive on the scene in time. Talk of a 100-basis point Fed rate hike next week is pouring flames on the fire. It will certainly make US vacationers happy, who are seeing prices drop by the day.

Ukraine Sells $12 Billion in Gold, to finance the war with Russia. No wonder the barbarous relic has been trading so poorly.

Russia is Losing the War. I just spoke with the chairman of the British Chiefs of Staff Committee, their Joint Chiefs of Staff, and the one organization with the best read on Russian losses in the Ukraine War so far.

Russia has lost an incredible 2,000 tanks out of their initial 2,800 initial operational ones, and a further 4,000 armored vehicles. Russia has lost one-third of its army since February through deaths or injury, some 50,000 men.

Russia is now unable to defend itself from an attack from the West. Putin is assuming that we are nicer people than we actually are, always a fatal mistake. I can’t tell you why I know this, only that I do. All I can say is that the Internet, advanced hardware, encryption, and artificial intelligence are amazing things.

US Gasoline Prices Hit Two-Month Low, at $4.44 a gallon, suggesting that inflation is in retreat. But notice that they are falling faster than they rose, which is always the case in a rigged market. Prices have fallen for a record 35 consecutive days in a row. Credit recession fears and the administration release of one million barrels a day from the Strategic Petroleum Reserve.

Housing Starts Come in Weak, down 2% in June at 1.55 million seasonally adjusted. Housing Permits were weak at 0.6%, the lowest in ten months. Homebuilder Sentiment saw the biggest decline since the data started where firms are dropping prices. We are starting to see single-digit price drops in almost all markets. Phoenix is seeing the sharpest falls, followed by Austin, which saw the most speculative “flipping” activity.

Existing Home Sales Dive 5.4% in May, and down 14.2% YOY, reflecting the rising tide of woes affecting the housing market. Median prices are still rising, to $416,000, up 13.4% YOY. Some 5.12 million used homes were sold in May. Inventories rose for the first time in three years to a three-month supply.

Real Estate Prices Peaked Simultaneously all Over the World, for the first time ever. The frothiest markets in New Zealand and Australia have already seen a 13% fall. Of course, global interest rates moving up in synch is the cause. Matters were made worse in the land of the kiwis by a flood of Chinese money that abruptly ended with the pandemic. New Zealand has only 5 million residents, smaller than greater San Francisco.

China US Treasury Holdings Drop to a 12-Year Low of under $1 trillion. Few know that China is the world’s largest owner of US government debt, followed by Japan. Is this a political move, or have they simply turned bearish on bonds? My experience is that the Middle Kingdom is pretty good at making calls like this. They have a lot of friends in the market.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility in market history, my July month-to-date performance maintained a healthy +2.01%.

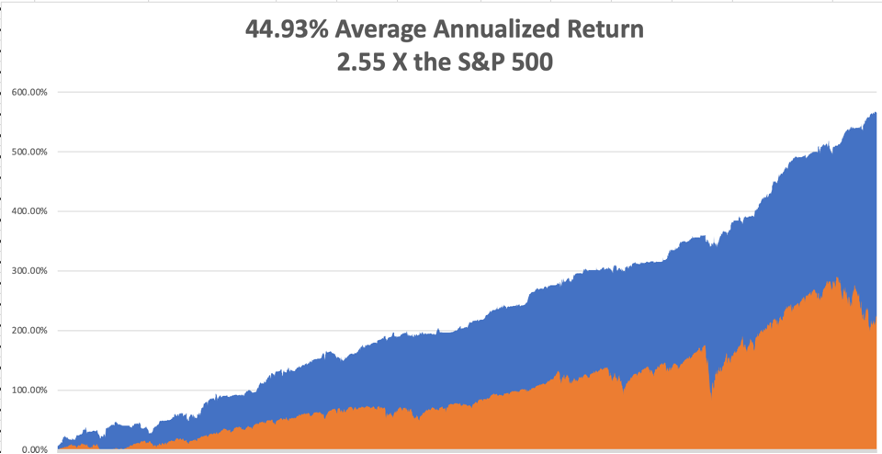

My 2022 year-to-date performance maintained 52.86%. The Dow Average is down -13.5% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 73.07%.

That brings my 14-year total return to 565.42%, some 2.55 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 44.93%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 90.4 million, up 300,000 in a week and deaths topping 1,027,000 and have increased by 9,000 in the past week. You can find the data here.

On Monday, July 25 at 8:30 AM, the Chicago Fed National Activity Index for June is released.

On Tuesday, July 26 at 6:00 AM, the S&P Case Shiller National Home Price Index for May is out. New Home Sales for June are also released. Microsoft (MSFT) reports earnings.

On Wednesday, July 27 at 11:00 AM, the Federal Reserve is expected to raise interest rates by 75 basis points. A closely watched press conference follows. Meta (META) reports earnings.

On Thursday, July 28 at 8:30 AM, Weekly Jobless Claims are announced. We also get the initial read of Q2 GDP growth. Apple (AAPL) and Amazon (AMZN) report earnings.

On Friday, July 29 at 8:30 AM, the Personal Income & Spending are disclosed. At 2:00 the Baker Hughes Oil Rig Count are out.

As for me, it has been a lifetime desire of mine to fly a Supermarine Spitfire, the Royal Air Force fighter that won the 1940 Battle of Britain.

When I lived in London 40 years ago, there were only 15 flying examples in the world owned by the RAF and a handful of British billionaires who only flew them themselves. They were just too valuable to lend out.

By comparison, there were over 200 American P51 Mustangs, which you could buy from the government for scrap for $500 after the war ended.

Now in 2022, there are 70 flying Spitfires. A global network of warbird enthusiasts has rescued them from bogs, jungles, and scrap yards around the world and restored them to flying condition. It helped that the market value of these planes has shot up from $1 million to $5 million since 1982.

So when a Mad Hedge Concierge member Peter offered me his Spitfire for a day, I couldn’t wait to return to England.

There are very few people in the world who can fly prewar tailwheel configured airplanes. I have flown over a dozen different types. They are prone to ground loops, nose overs, scraping wing tips, and crashes. The airframes are usually made of Norwegian spruce and Irish linen and the wings can fall off at any time.

No wonder the fatality rate was so high in the old days. It helped that I went armed with my old British Aerobatics license along with a phalanx of American civilian and military licenses.

It was a cool and blustery afternoon when I showed up at Biggin Hill south of London, one of the top RAF fighter stations during WWII, and told Peter “Major John Thomas reporting for duty, sir.” He laughed and set about giving me my preflight briefing. Flying 80-year-old airplanes can be deadly. 70-year-old pilots are even more dangerous.

I was cautioned to move the stick gently as the controls are famously sensitive, thanks to the plane’s unique elliptical wing tips. No rudder was needed at all.

If the engine failed, I had the choice of parachuting out or risking a hard landing. I chose the latter, as Southern England is basically one big grass landing strip. Plus, I’ve had plenty of practice with this kind of maneuver.

For good measure, I brought along a safety pilot. They’ve moved the London control zone around a bit over the years, and I wanted to make sure you keep receiving Mad Hedge newsletter for the indefinite future. We took off, banked right, and headed for the English Channel.

While the plaque on the control panel read “DO NOT FLY OVER 350 MPH”, I dared not go faster than 250 MPH given the age considerations of both the plane and the pilot. Another plaque reading “EMERGENCY BOOST PUMP” was wired shut. The Merlin V-12 1,250 horsepower engine purred. Later versions of the plane with the 2,000 horsepower Griffin engine flew over 450 MPH.

The Spitfire could outmaneuver any plane the German Luftwaffe threw up against it. When Hitler asked my late acquaintance Luftwaffe General Adolph Galland what he needed to win the Battle of Britain, he replied, “A squadron of Spitfires.” German losses in the battle topped 2,000 planes versus 900 for the British.

But German crew losses were ten times that of the British. That meant an RAF pilot could get shot down and be in another plane in hours. That is what decided the Battle of Britain. The pilots were worth more than the planes. In the end, the British shot down two-thirds of the German Air Force, a loss from which they never recovered.

We found a clear piece of sky over the White Cliffs of Dover between two big fluffy cumulus clouds and commenced a full-on aerobatic flight test. Pilots always want to see what I can do in these old planes and this time was no different.

I executed multiple loops, barrel rolls, chandelles, lazy eights, Immelmann turns, and wingovers, careful never to exceed 1G lest, yes, the wings fall off. Spitfires can dive like crazy. We dropped from 8,000 feet to 2,000 feet in seconds.

While I was limited to one-inch moves of the stick, wartimes diaries speak of full right, full left, and steep dives to escape marauding Messerschmitt 109's and Focke Wulf 190's where pilots suffered 10G’s of force or more. The punishment those kids took was amazing.

The plane carried only two hours of fuel so after I passed my test with flying colors, it was back to Biggin Hill. Spitfires lacked IFR instruments because in 1938 they hadn’t been invented yet, so we were careful to avoid clouds. I made a perfect three-point landing on runway 27, as usual, and taxied up to the hanger where Peter greeted me.

Back at the hanger it took two men to haul me out of the plane, stinking, drenched with sweat, and elated. I felt like I had just done 15 rounds with Mike Tyson, but it was worth it.

Then it was off to the nearest pub for a well-earned pint of Guinness, as has long been the tradition of the RAF. The walls were adorned with the pictures of wartime Spitfire pilots who never made it back, some looking no older than teenagers, which they were.

That’s another bucket list item off the list. The time to get them all is running out, and I keep adding new ones, so I better get a move on.

I’ll be back next summer, for sure, because the commanding general of the RAF has invited me back to fly their sole surviving WWII Avro Lancaster four-engine bomber. It’s part of the Battle of Britain Memorial Flight, the fruit of contacts made during my NATO military duties. It is a national treasure.

It seems they’re short of pilots.

To watch a two-minute video of my epic flight, please click here.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

A 1943 Supermarine Spitfire Mark IX

Flying Upside Down Over the White Cliffs of Dover

Mission Accomplished

Back at the Pub for a Pint

Avro Lancaster Bomber