The New Carry Trade

Long the domain of hedge funds and large banks, the carry trade has gone mainstream. Individual investors are increasingly resorting to the techniques employed by the masters of the universe to boost trading and investment returns.

But they lack the risk control infrastructure and discipline employed by the big boys. As with other innovations of yore, the net result has been to build up more risk in the system than many realize. This always ends in tears, not just for the players, but for everyone.

The ?carry trade? is just another way of buying low and selling high and doing both at the same time. In its newest incarnation, retail investors borrow cheap overnight money from their discount brokers and invest in high dividend paying stocks. Favorite targets have included REIT?s, tobacco, and utilities. They then use broker margin facilities to double up the bet. Large individual players can obtain private credit lines that increase leverage even further.

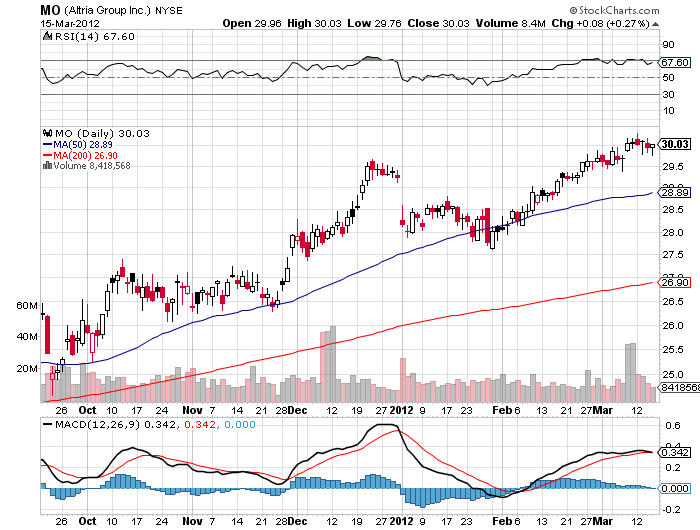

Let me give you an example with one of the favorite target stocks, Altria (MO), the old Phillip Morris. The dividend yield today is 5.40%. Take out the 2% cost of funds provided by online broker TD Ameritrade, and that brings the net down to 3.40%. Double is up with margin and it rises to 6.80%. In a zero return world that is quite a pick up. This is no doubt why the stock has risen 20% since October, bringing the total return up to 26.80%.

There is only one problem with this picture. What happens when the stock goes down? Leveraged positions are subject to margin calls, whether the customer is willing or not. While there is abundant margin in rising markets, it has the habit of disappearing of disappearing in falling ones. Read the fine print in your margin agreement and you will find that your friendly broker has the right to call in their loans at any time without notice.

They have a long history of doing this after sharp selloffs, right when distress is the greatest. Many traders only find this out when they get an email telling them their entire position has been liquidated at market. I can tell you from hard earned experience that there is no person in the world more blind to reason that a margin clerk.

Bunch up a lot of liquidations of these carry trades and you could throw gasoline on any fires that ignite during a market correction. Who might provide the matches? The government, which is expected to substantially raise taxes on dividends after the next election. High dividend stocks that were last year?s stars could become this year?s goats. Be careful that your carry trade doesn?t carry you out.

Will High Dividend Stocks Become This Year?s Goats?