The Next Trade of the Century is Here!

We are getting to the point where great equity trades with potential huge returns are becoming few and far between. At the very least, they are only a fraction of the opportunities we saw a year ago, which was a once-in-a-century event.

So, when your trade of the century runs out, what do you do?

You find another trade of the century!

It just so happens I have such an animal.

You are all well aware of the short-selling opportunities available in the US Treasury bond market (TLT), where I have been running triple short positions since the beginning of the year. That has allowed us to rake in 6% a month in profits like clockwork.

How would you like to make more than that, a lot more, like three times more?

I have been dealing in the front-month options so far and managed to catch a $25 crash in the United States Treasury Bond Fund (TLT). If you believe that there is another $25 in the works, there are much bigger fish to fry. Simply extend your maturities and lower your strike prices through LEAPS, or Long-Term Equity Anticipation Securities.

I’ll show you how to do that, first with a conservative position, and then a much more aggressive one. Better yet, an excellent entry point for both positions is close.

The case for lower bond prices and higher interest rates is overwhelming.

With 2021 expected to be one of the strongest years for economic growth in history, there is no chance you’ll see a major rally in the US Treasury bond market from here. The only question is how fast it will fall.

This trade is basically betting that interest rates will rise in front of the biggest borrowing since civilization began.

The national debt rose from a record $23 trillion to an eye-popping $28 trillion in 2020. In 2021, it is expected to explode to $32 trillion, and possibly as high as $37 trillion by the end of 2022. The US Treasury demands on the bond market are going to be incredible.

As much as you may admire or despise Biden’s “guns and butter” policy (the guns being aimed at Covid-19), a flood over government bond selling is on our doorstep.

It is almost mathematically impossible in this environment for bond prices to rise and interest rates to fall substantially from here. They can only go sideways at best, or down big in the worst case.

Sounds like a great short to me.

Currently, LEAPS are listed for the (TLT) all the way out until January 2023.

However, the further expiration dates will have far less liquidity than near-month options, so they are not a great short-term trading vehicle. That is why entering limit orders in LEAPS only, as opposed to market orders, is crucial.

These are really for your buy-and-forget investment portfolio, defined benefit plan, 401k, or IRA.

Because of the long maturities, premiums can be enormous. However, there is more than one way to skin a cat, and the profit opportunities here can be astronomical.

Like all options contracts, LEAPS gives its owner the right to "exercise" the option to buy or sell 100 shares of stock at a set price for a given time.

LEAPS have been around since 1990 and traded on the Chicago Board Options Exchange (CBOE).

To participate, you need an options account with a brokerage house, an easy process that mainly involves acknowledging the risk disclosures that no one ever reads.

If LEAPS expires "out-of-the-money" by the expiration date, you can lose all the money you spent on the premium to buy it. There's no toughing it out waiting for a recovery, as with actual shares of stock. Poof, and your money is gone.

Note that a LEAPS owner does not vote proxies or receive dividends because the underlying stock is owned by the seller, or "writer," of the LEAPS contract until the LEAPS owner exercises.

Despite the Wild West image of options, LEAPS are actually ideal for the right type of conservative investor.

They offer vastly more margin and more efficient use of capital than traditional broker margin accounts. And you don’t have to pay the usurious interest rates that margin accounts usually charge.

And for a moderate increase in risk, they present hugely outsized profit opportunities.

For the right investor, they are the ideal instrument.

So, let’s get on with my specific examples for the (TLT) to discover their inner beauty.

By now, you should all know what vertical bear spreads are. If you don’t, then please click this link for my quickie video tutorial (you must be logged in to your account).

Warning: I have aged since I made this video.

Today, the (TLT) is trading at $139.75

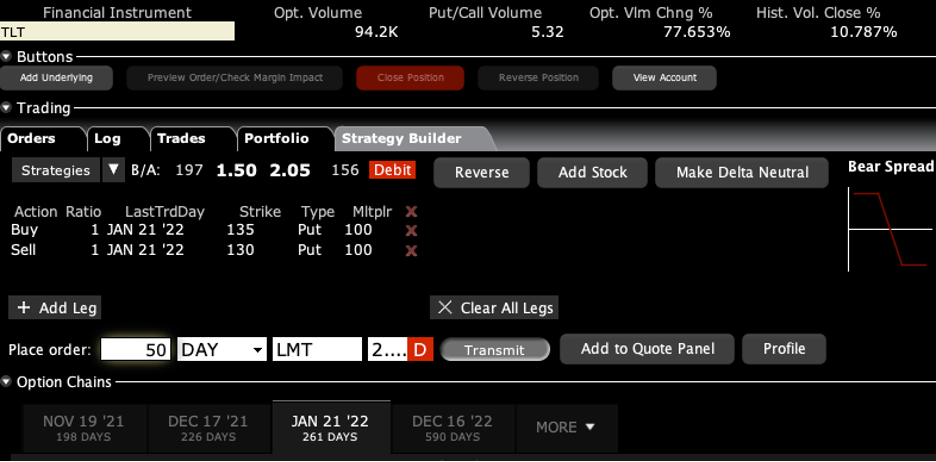

The cautious investor should buy the (TLT) January 2022 $130-$135 vertical bear put debit spread for $2.00. Some 50 contracts get you a $10,000 exposure. This is a bet that ten-year US Treasury yields will rise above 1.75% in eight months. Sounds like a total no-brainer, doesn't it?

expiration date: January 21, 2022

Portfolio weighting: 10%

Number of Contracts = 50 contracts

Here are the specific trades you need to execute this position:

Buy 50 January 2022 (TLT) $135 puts at………….………$6.00

Sell short 50 January 2022 (TLT) $130 puts at…………$4.00

Net Cost:………………………….………..………….........….....$2.00

Potential Profit: $5.00 - $2.00 = $3.00

(50 X 100 X $3.00) = $15,000 or 150.00% in eight months. In other words, your $10,000 investment turned into $15,000 with an almost sure thing bet.

This is a bet that the (TLT) will stay below $130.00 by the January 21, 2022 options expiration in eight months. To lose money on this position, ten-year US Treasury yields would have to stay below 1.75% from the current 1.57%, which they won’t.

Pigs would have to fly first.

Let’s say that you’re so convinced that exploding US debt will cause the (TLT) to crash again that you’re willing to take on more risk and place a bigger bet.

Here is your dream trade:

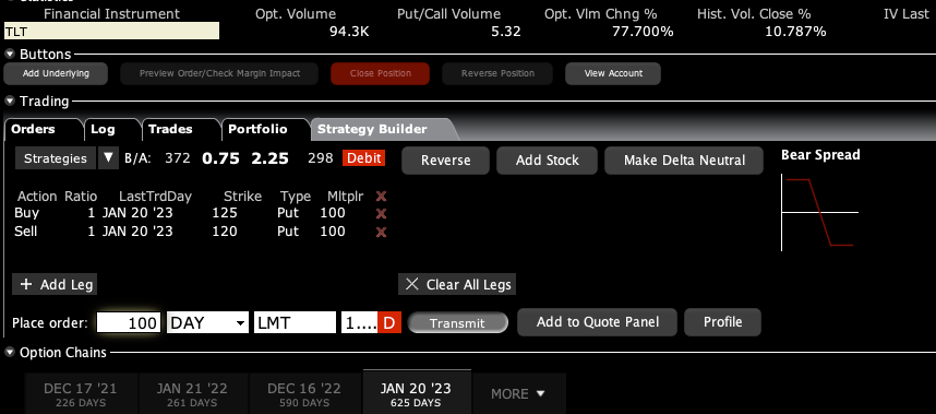

Buy the (TLT) January 2023 $120-$125 vertical bear put debit spread for $1.00. Some 100 contracts get you a $10,000 exposure. This is a bet that ten-year US Treasury yields will rise above 2.25% in 20 months.

That’s what you would expect to see during a normal economic recovery. This is the greatest economic recovery of all time.

expiration date: January 20, 2023

Portfolio weighting: 10%

Number of Contracts = 100 contracts

Here are the specific trades you need to execute this position:

Buy 100 January 2023 (TLT) $125 puts at………….………$7.75

Sell short 100 January 2023 (TLT) $120 puts at…………$6.75

Net Cost:………………………….………..………….….....$1.00

Potential Profit: $5.00 - $1.00 = $4.00

(100 X 100 X $4.00) = $40,000 or 50.00% in 20 months. In other words, your $10,000 investment turned into $40,000 with an almost sure thing bet.

This is a bet that the (TLT) will stay below $120.00 by the January 20, 2023 options expiration in 20 months.

Why do a put spread instead of just buying the $130 puts outright?

You need a much bigger downside move to make money on this trade. By paying only $2.00 instead of $6.00 for a position, you can triple your size, from 16 to 50 contracts for a $10,000 commitment. That triples your downside leverage on the most probable move in the (TLT), the one from $135 to $130.

That’s what real hedge funds do all day long, find the most likely profit and leverage up on it like crazy.

Let’s do the math on the two positions. If you buy the (TLT) January 2022 $130-$135 vertical bear put debit spread for $2.00, you reach a maximum value of $5.00 on expiration day at $130.

If you buy the (TLT) January 2022 $130 puts outright, at $130 on expiration day, your position is worth zero, nada, bupkiss. It gets worse. To make the same amount of profit as the spread the (TLT), or $15,000, it has to fall all the way to $122.50 to break even. Below that, you make more money than the spread, but at half the rate.

How could this trade go wrong?

There is only one thing. We get a new variant on Covid-19 that overcomes the existing vaccines and brings a fourth wave in the pandemic.

In this case, the (TLT) doesn’t crash to $120 but soars to $160 or more. We go back into recession. Both of the above positions go to zero. But if we get a fourth wave, you are going to have much bigger problems than your options positions.

So there it is. You pay your money and take your chances. That's why the potential returns on these simple trades are so incredibly high.

Enjoy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Fat Lady is Singing for the Bond Market