The Nightmare That is Uber

As I stare at my trading screen, Uber (UBER) is down over 10% intraday after a better than horrendous earnings report.

I thought share prices go up if companies beat consensus estimates?

In most cases – yes.

But the market is telling us that they do not believe in Uber’s story.

Just because a company loses $1.2 billion which bettered last quarter’s loss of $5.2 billion doesn’t mean investors will handpick the stock and save it from falling through the cracks.

Parsing through the rest of the earnings report, there is not much to really hang your hat on.

First, Lyft (LYFT), its smaller and more targeted competitor, turned up the pressure on Uber claiming they will become profitable on an adjusted earnings basis at the end of 2021, which is a year ahead of its original projection.

This forced Uber CEO Dara Khosrowshahi to hesitantly explain on a call that Uber’s management “hasn’t finalized planning” but is targeting being profitable for financial year 2021.

The claim is farfetched bordering on disingenuous and forcibly made because growth companies are effectively dead if they say it will take three years or more to become profitable.

The investing climate has changed that quickly thanks to Adam Neumann and the fallout at The We Company.

I would be more inclined to say that if Uber has a string of miraculous years with no adverse regulation against them, then there is a fractional chance they might become profitable by 2021.

Honestly, there was nothing that Uber showed me to make me think that I should consider investing in the company.

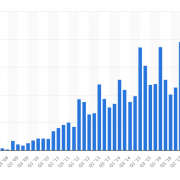

Momentum keeps slipping as we head into the day when 1.7 billion shares will become eligible for sale, roughly 90% of the total, and my guess is that investors will cut their losses.

Uber will have to gut many parts of the model to get to profitability and they have started the process by slashing employee costs cutting over 1,000 employees over the last quarter, or 2% of its entire workforce.

They will have to slash another 30% to get numbers on their side.

They might have to kill the parts of the business that aren’t delivering enough like Uber Freight and the autonomous driving unit.

The company still hasn’t found a solution for competing with taxi drivers without subsidizing each ride at a loss.

No matter how you dress it up, if the company can’t create solutions for this fundamental barrier to profits, investors will stay away.

It’s also a good reason for you and your money to stay away no matter how cheap Uber becomes.

It’s easy to envision if the state of California rebuffs the online food delivery firms' desire to put a cap on driver costs, that the stock could drop into the high teens.

Dara Khosrowshahi’s thesis of the scale and brand power working in Uber’s favor is flat out false.

Scale can be technology companies’ friend and savior, but when your company is literally a loss-making chauffeur service with zero competitive advantage, what is great about scaling that?

Sure, Uber is great for consumers especially in cities which have horrid public transport which is most of America.

I get that.

But Uber will either be forced to raise prices because they will pay the drivers more due to California law or because they lose too much money.

Who wants to hold a stock with these two crappy options on the near-term horizon?

If a gunman put a pistol to my head and asked me to invest in one, Lyft is the better option, it’s the lesser of two evils.

Yes, sadly we are at this point with these types of companies.