The Nonfarm Payroll Shocker

Economists were left speechless with Friday?s report of the January nonfarm payroll, which came in at an amazing 243,000, more than double the consensus expectations. It was the sharpest improvement in the data since April. Analysts have become inured to bad data that a mediocre report sounds like The Second Coming.

The headline unemployment rate plunged from 8.5% to 8.3%, and is now down an eye popping 0.5% in two short months. Unemployment is now at a three year low. More importantly, it was the second month in a row where the report delivered a major upside surprise.

The private sector led the charge, with new hiring accelerating from 220,000 to 257,000. Average hourly earnings increased by 0.2%. While most nonfarm payroll reports are a confusing jumble of contradictory statistics, this one was almost universally good. Is this the beginning of an important new trend? Are the good times here to stay?

I am no so quick to leap to that conclusion. Past economic recoveries have seen 400,000 jobs added monthly at this stage. The economy needs to add 150,000 jobs per month just to keep up with natural population growth. Never mind that a far larger portion of these new jobs are earning only minimum wage than in the past, far lower than the incomes that went into this recession. Union assembly jobs are out and burger flipping ones are in. The overall net drag on the economy is large.

In fact, this rate of job growth is contestant with an economy that is growing at a 2.0%-2.5%, nicely matching my own prediction and that of the congressional Budget Office. On the other hand, the stock market is reacting as if the GDP was growing at a 4.0% rate, far higher than reality. When it wakes up to reality, the reaction could be harsh.

Let me tell you what I am taking great pains not to do here. I am not trying to cherry pick the data in order to support my own fundamentally cautious view. I am not looking for the clouds within the silver lining. I see perma bulls and perma bears do this all day long, usually with grievous results. Your net worth suffers as a result. The challenge here is to look at the data alone, and ignore the spin, hype, and emotion.

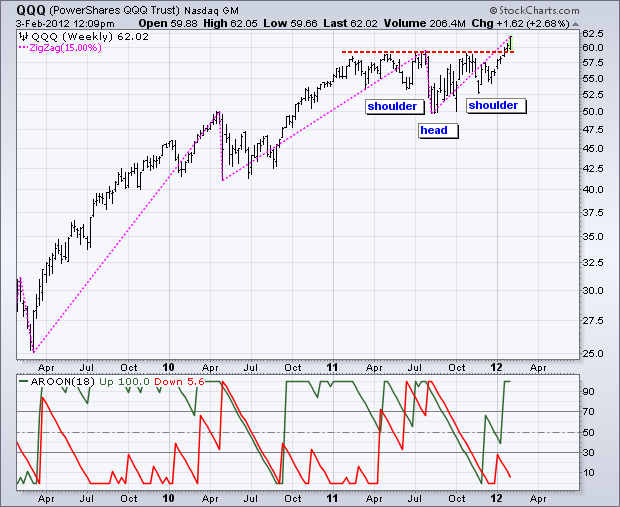

I see the nonfarm report as far more likely to set up a ?sell? of risk assets than a ?buy?. Look at the charts below and tell me that I am wrong. Are those double tops on the S&P 500 and the Russell 2000? Only the NASDAQ disagrees.