The ?Safe? Trade Beats All

I certainly hope you took my advice to load your portfolio with corn and gold and to dump your equities five years ago. What? You didn?t? Then you have almost certainly suffered on the performance front.

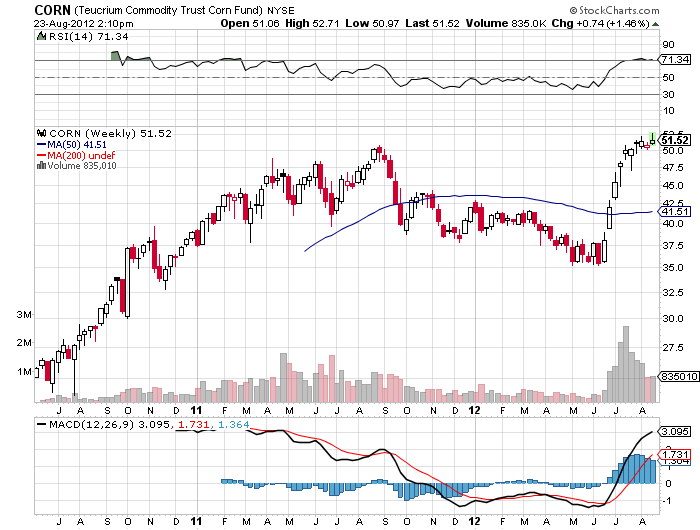

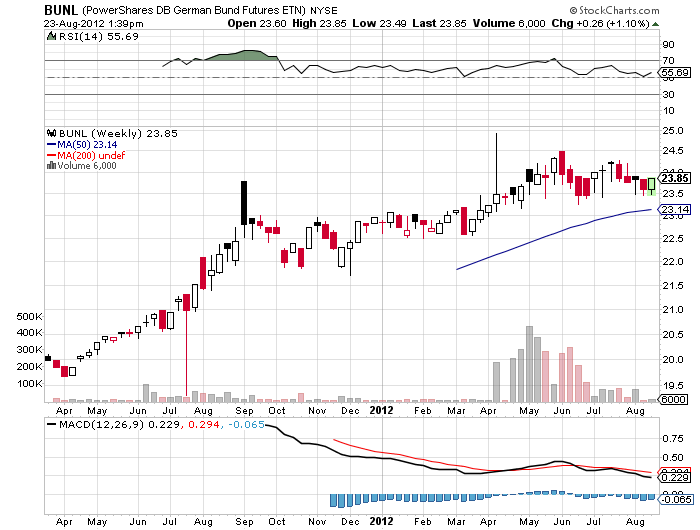

According to data compiled by my former employer, the Financial Times, corn was the top performing asset class since 2007, bringing in a stunning 146% return. Who knew that global warming would be such a winning investment strategy? It was followed by gold (GLD) (144%), US corporate debt (LQD) (44%), US Treasuries (TLT) (38%), and German bunds (BUNL) (26%). This explains why my long gold/short Morgan Stanley (MS) has been going absolutely gangbusters today.

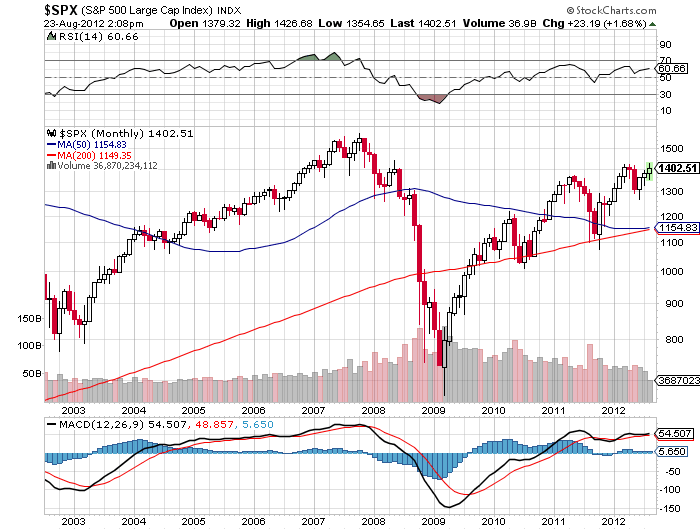

If you ignored my advice and instead loaded the boat with equities, chances are that you are now pursuing a career at McDonalds (MCD), hoping to upgrade to Taco Bell someday. The worst performing asset classes of the past half-decade have been Greek equities (-87%), European banks (-70%), Chinese stocks (-41%), other European equities (-21%), and UK stocks (-11%). If you were in US equities, you are just about breaking even (1%).

Corn is, no doubt, getting an assist from what many are now describing as the worst draught since the dust bowl days of the Great Depression. But there is more to the story than the weather. Empowered with long term forecasts from the CIA and the Defense Department, I have been pounding the table for years that food would become the new distressed asset. These agencies have been predicting that food shortages will become a cause of future wars.

For a start, the world population is expected to increase from 7 billion to 9 billion over the next 40 years. Half of that increase will occur in countries that are net importers of food, largely in the Middle East and Africa. You can also count on the rising emerging nation middle class to increase demand for both the quantity and quality of food. Obesity among children is already starting to become a problem in China.

Managers who have been wrong footed through being overweight equities and underweight bonds will get some respite in coming years. It will be mathematically impossible for government bonds to match their recent performance unless they start charging negative interest rates. My best case scenario has them going sideways to down in the years ahead.

Not so for gold, which will continue to see steady demand from emerging market central banks and their new middle class. Five years ago, gold trading carried a death penalty in China. Today, there are shops on every street corner flogging the latest issue of one ounce Chinese Panda coins.

As for corn, the sky is the limit. If you don?t believe me, try eating a one ounce Chinese Panda.

Is Corn the New Gold?