The Secret Fed Plan to Buy Gold

With the latest effort to expand quantitative easing through the Fed purchase of individual corporate bonds, we must consider what else our central bank has up its sleeve.

With American interest rates already near zero, the markets will take the rates for all interest-bearing securities well into negative numbers. This has already happened in Japan and Germany.

At that point, our central bank’s primary tool for stimulating US businesses will become utterly useless, ineffective, and impotent.

What else is in the tool bag?

How about large-scale purchases of Gold (GLD)?

You are probably as shocked as I am with this possibility. But there is a rock-solid logic to the plan. As solid as the vault at Fort Knox.

This theory gained credence when my old friend, Judy Shelton, was appointed to the federal reserve, a noted gold bug.

The idea is to create asset price inflation that will spread to the rest of the economy. It already did this with great success from 2009-2014 with quantitative easing, whereby almost every class of debt securities were hoovered up by the government.

“QE on steroids”, to be implemented only after overnight rates go negative, would involve large-scale purchases of not only gold, but stocks, government bonds, and exchange-traded funds as well. Corporate bond purchases are simply a step in that direction.

If you think I’ve been smoking California’s largest cash export (it’s not the raisins) you would be in error. I should point out that the Japanese government is already pursuing QE to this extent, at least in terms of equity-type investments and ETFs, and already owns a substantial part of the Japanese stock market.

And, as the history buff that I am, I can tell you that it has been done in the US as well, with tremendous results.

If you thought that President Obama had it rough when he came into office in 2009 with the Great Recession on, it was nothing compared to what Franklin Delano Roosevelt inherited.

The country was in its fourth year of the Great Depression. US GDP had cratered by 43%, consumer prices crashed by 24%, the unemployment rate was 25%, and stock prices vaporized by 90%. Mass starvation loomed.

Drastic measures were called for.

FDR issued Executive Order 6102 banning private ownership of gold, ordering them to sell their holdings to the US Treasury at a lowly $20.67 an ounce.

He then urged Congress to pass the Gold Reserve Act of 1934, which instantly revalued the government’s holdings at $35.00, an increase of 69.32%. These and other measures caused the value of America’s gold holdings to leap from $4 to $12 billion. That’s a lot of money in 1934 dollars, about $208 billion in today’s money.

Since the US was still on the gold standard back then, this triggered an instant dollar devaluation of more than 50%. The high gold price sucked in massive amounts of the yellow metal from abroad creating, you guessed it, inflation.

The government then borrowed massively against this artificially created wealth to fund the landscape-altering infrastructure projects of the New Deal.

It worked.

During the following three years, the GDP skyrocketed by 48%, inflation eked out a 2% gain, the unemployment rate dropped to 18%, and stocks jumped by 80%. Happy days were here again.

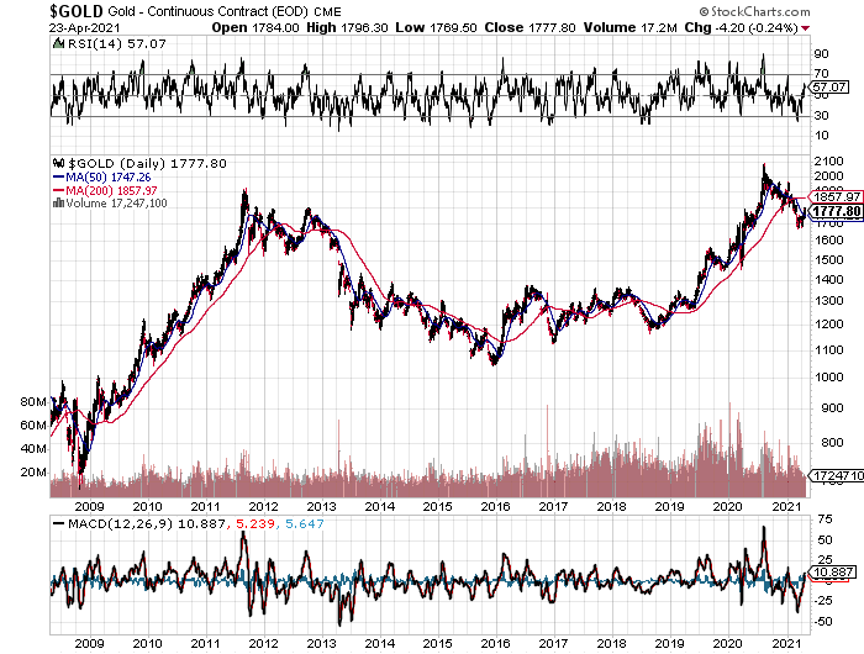

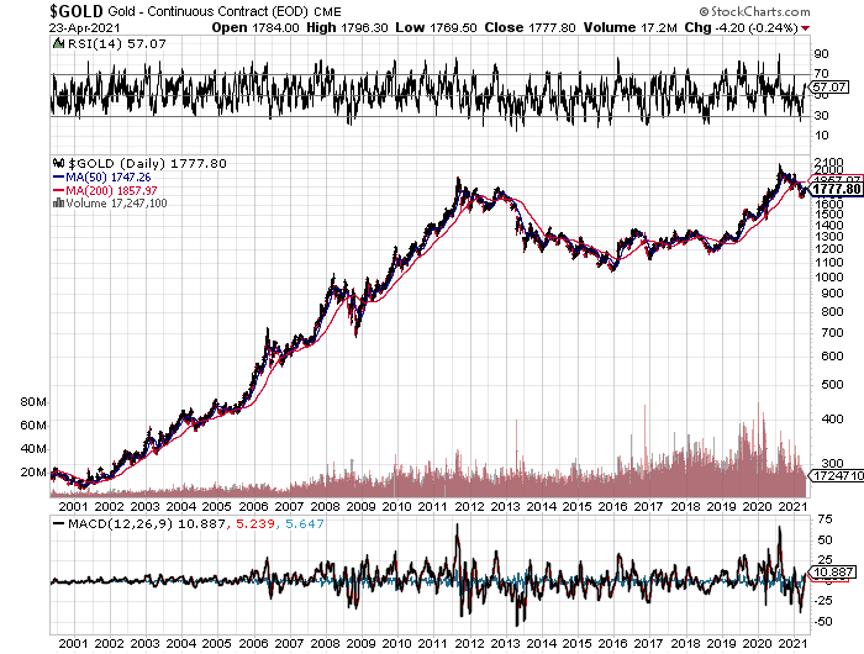

Monetary conditions are remarkably similar today to those that prevailed during the last government gold buying binge.

There has been a de facto currency war underway since 2009. The Fed started when it launched QE, and Japan, Europe, and China have followed. Blue-collar unemployment and underpayment are at a decades high. The need for a national infrastructure program is overwhelming.

However, in the 21st century version of such a gold policy, it is highly unlikely that we would see another gold ownership ban.

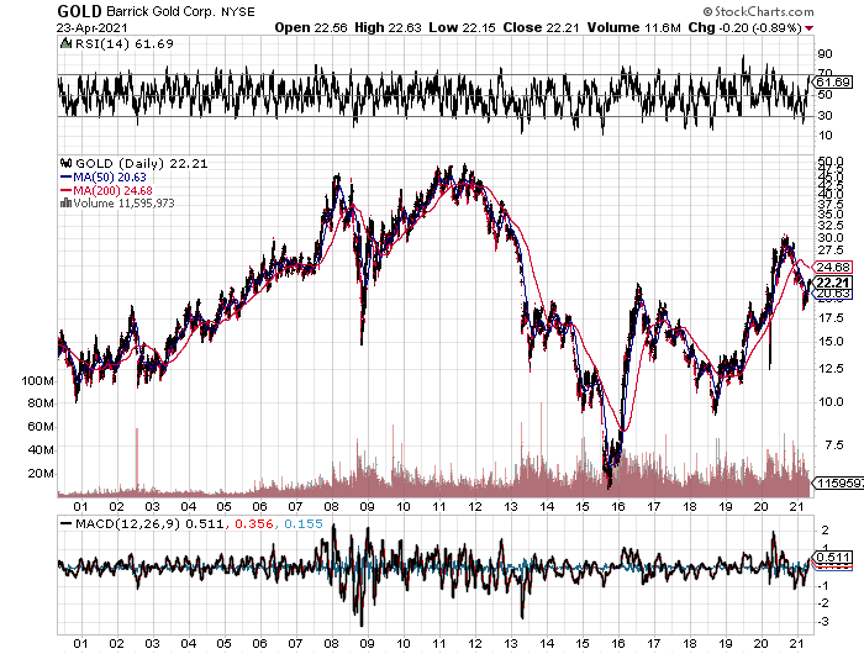

Instead, the Fed would most likely move into the physical gold market, sitting on the bid for years, much like it recently did in the Treasury bond market for five years. Gold prices would increase by a multiple of current levels.

It would then borrow against its new gold holdings, plus the 4,176 metric tonnes worth $200 billion at today’s market prices already sitting in Fort Knox, to fund a multi trillion-dollar infrastructure spending program.

Heaven knows we need it. Millions of blue-collar jobs would be created, and inflation would come back from the dead.

Yes, this all sounds like a fantasy. But negative interest rates were considered an impossibility only years ago.

The Fed’s move on gold would be only one aspect of a multi-faceted package of desperate last-ditch measures to extend economic growth into the future which I outlined in a previous research piece (click here for “What Happens When QE Fails” by clicking here).

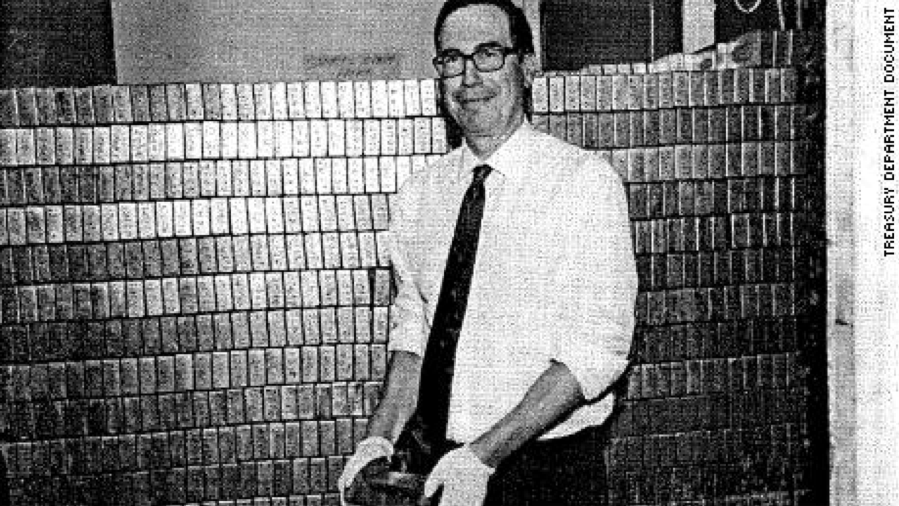

That’s assuming that the gold is still there. Treasury Secretary Stephen Mnuchin says he saw the gold himself during an inspection that took place on the last solar eclipse over Fort Knox in 2018. The door to the vault at Fort Knox had not been opened since September 23, 1974.

But then Steve Mnuchin says a lot of things. Persistent urban legends and internet rumors claim that the vault is actually empty or filled with fake steel bars painted gold.

But is it Really Gold?

You Can See the Upside Breakout Coming Clear as Day