Why Doctors Make Terrible Traders?

At one of my recent Strategy Luncheons, I had the pleasure of sitting next to an anesthesiologist who was a long-time reader of my research.

As much as he loved the Diary of a Mad Hedge Fund Trader, he confided in me that his trading results were awful.

I told him I knew why.

Doctors, scientists, aircraft pilots, and even anesthesiologists all share the same bedeviling problem as trading dilettantes.

As smart as they are to plow through 12 years of college studying subjects of mind-numbing difficulty, obtaining MDs, PhDs, and ATPL licenses, they are terrible when it comes to trading their own stock portfolios.

A doctor friend once confessed to me that as fast as he was taking money in at his seven-digit a year private practice, he was shoveling it out the door in trading and investment losses.

And if he got mad at it, or grew stubborn, the losses then compounded. He considered it a disease, or an addiction.

I have to admit that I once suffered from the same malady, as I was originally trained as a scientist and mathematician.

That is until I identified the problem and dealt with it.

And here is the dilemma.

Science, medicine, and flying high performance aircraft all require tremendous degrees of precision. The practitioners have to be exactly right about everything all the time.

If they aren’t, people die.

Let me give you some examples.

I happen to know that the daily dosage for the heart drug, Digitalis, is 0.25 mg per day. If you accidentally raise that to 0.50 mg, you die, especially if you have a small body weight.

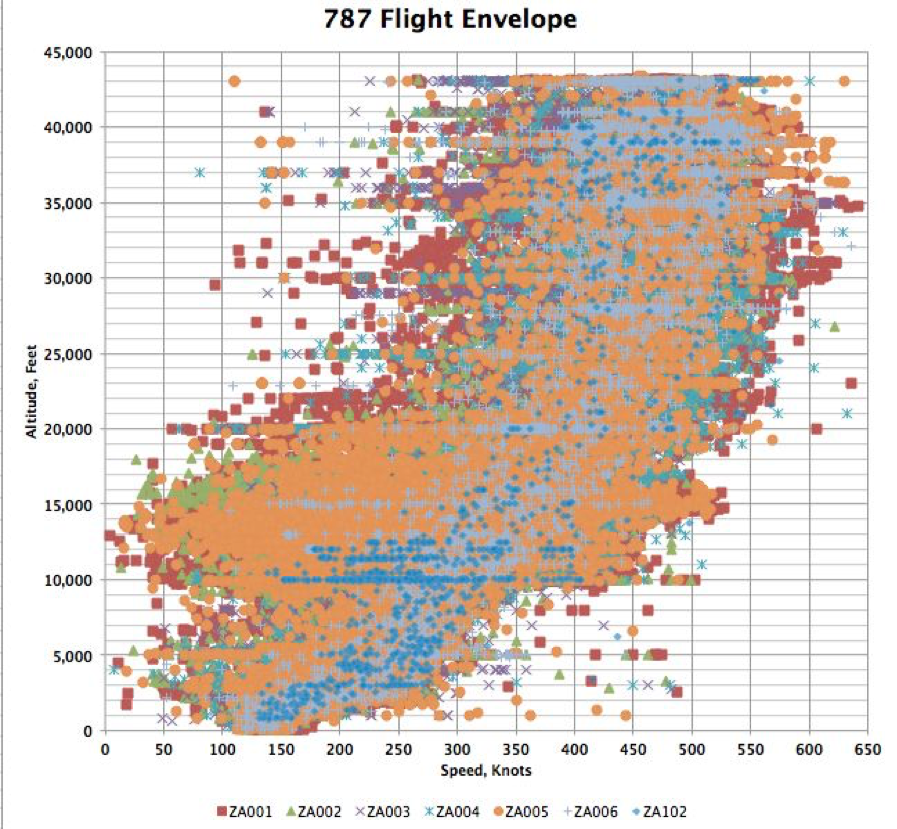

I also happen to know that the stall speed of a Boeing 787 Dreamliner is 125 miles per hour. At 126 miles per hour, everything is fine.

But at 124 miles per hour, you risk stalling on approach, crashing, and killing everyone aboard, especially if it is hot and humid, wind shear is present, and you are overweight.

So as far as doctors are concerned, the premium is on precision.

This absolutely does NOT work in the stock market.

For precision means buying stocks at their absolute lows and selling them at the perfect top ticky highs. The problem is that this is impossible.

I have been trading stocks for 55 years and can think of only a handful of times when I nailed the perfect highs and lows. When I did, it was purely because of random chance.

By insisting on perfection in his stock execution, doctors miss every trade. They then get frustrated and chase the market, throwing all discipline out the window. This is where the losses ensue.

I can almost see the knowing nods of agreement out there.

It gets worse.

Doctors are used to working with a perfect set of facts, a lab report, a pulse rate, a temperature, or an MRI scan.

In the stock market, you have to deal with the fog of war.

The facts you have at hand may or may not be true. New, contradictory information is getting dumped on you all day long. And the guy on TV is usually telling you the exact opposite of what you should be doing.

After a couple of decades, you get used to operating in a world of uncertainty.

You learn which information sources to trust and which ones to ignore when the fur starts to fly.

After much practice, you learn how to make the right decision when push comes to shove.

Unless doctors work in an emergency room or in combat with the military, they don’t get to learn how to make decisions in the fog of war.

To them, it all seems like a mass of confusing and conflicting information. For the perfectionist, it’s their worst nightmare.

No wonder they lose money.

So doctors have three choices when it comes to their investment portfolio.

They can index, balance stocks against bonds, and get used to subpar returns.

They can hand it over to a professional financial advisor, out of harm’s way.

Or they can learn the tricks of the trade that I have, which is the purpose of this newsletter. If you learned from my own half-century accumulation of mistakes, you don’t have to repeat them yourself.

Your portfolio will love it!

Now that I have your attention, I have this new pain in my right hip that has been bothering me ever since I was in Ukraine.

Trading in the Fog of War