The Streaming Wars Wind Down

For certain segments of the technology sector, it sure does feel like they are fully saturated.

I am not referring to AI, because that is in the early innings of a seismic movement.

However, let’s take a look at streaming.

This category was invented by Netflix (NFLX) and now the whole country pays for streaming.

Netflix had the first-mover advantage and took the initiative.

For the leftovers, the pain and struggle with creating a profitable streaming business is real.

Is the year 2024 the year when streaming management has that Aha moment?

Many have instructed us to stay on board the ship while losses bleed uncontrollably.

Everyone is fighting to be one of the three or four streaming services people can’t live without.

Paramount Global (PARA) is under pressure to abandon its namesake streaming service, and Warner Bros. Discovery (WBD) is desperate for partners that offer Max a better chance to compete with the likes of Netflix.

Let’s look at Disney right now.

Streaming grew quickly from launch in 2019 — we’re talking now about Disney+, ESPN+, and Hulu — but even with strong sales, they are sitting on big losses.

Disney board member Nelson Peltz is unhappy, as outlined in a 133-page manifesto published March 4, that Disney “belatedly” entered the streaming game and has a “poorly planned" strategy to catch up with the likes of Netflix.

He takes issue with Disney trying to achieve scale in streaming by buying Fox’s entertainment assets for $71 billion in 2019 because he thinks it exposed the company more to the dying linear TV business.

He also can’t believe that a company reporting more than $22 billion of run-rate streaming revenue annually is still losing money.

Peltz wants a digital strategy for the ESPN sports assets..

Peltz wants a succession plan put in place for current CEO Bob Iger, who extended his contract with Disney last year after a coming-out-of-retirement return to the company in 2022.

In February, Disney teamed up with Fox and Warner Bros. Discovery to create a streaming service for college and pro sports that you can currently only find on TV.

That seems like what Peltz was asking for. Disney also invested $1.5 billion in Epic Games and gave access to the Fortnite maker for gaming portrayals of Star Wars, Marvel, and Avatar.

The bottom line here is that streaming is not nearly as profitable as many insiders first thought.

Streamers thought they could scale up and acquire subscribers at a loss and then raise prices.

That business model was only for Netflix to accomplish because they started so much earlier than anyone else.

The best of the rest are now saddled with loss-making companies and the cost of content post-covid has never been pricier.

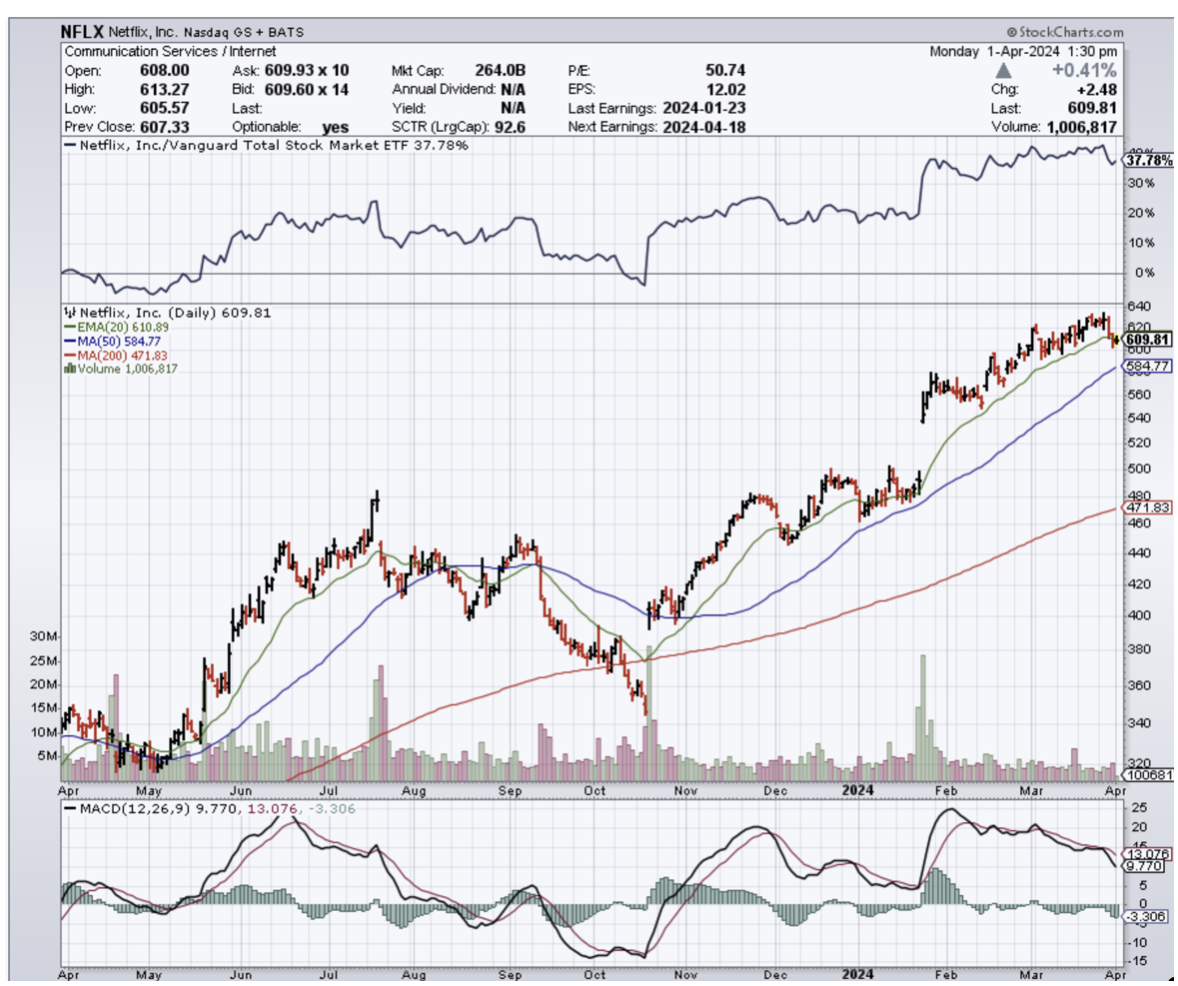

Netflix shares have had a nice run in the last 365 days going from $180 per share to over $600 per share.

A lot of that price movement was an acknowledgement that they are dominating streaming compared to the other legacy corporations that have tried their hand in this game.

Instead of jumping into the legacy TV players turned streamers, I would tell readers to wait for Netflix on the dip.

It’s been tried and tested over time and any big dip should and will be bought by investors.

There is not a lot of room for stocks other than Netflix in a sub-sector of rather scarce any AI.