The Trump Insurance Trade

I have spent a lifetime analyzing risk for major hedge funds, and what I can always rely on is that firms staffed by the smartest people in the industry never fail to underestimate the threats to their business.

Often, they are totally ignorant of the biggest risks of all.

My friend, mathematician Nassim Taleb, explained all of this in his widely read tome, The Black Swan, a few years ago, .

He mentioned the example of a major casino that hired him to analyze their business risk. Management was expecting to find ways to frustrate card counters at black jack, or cash grab-and-run thieves at the roulette wheels.

After doing some simple research, Nassim informed the company that it completely missed the four biggest risks to gambling in Nevada.

For a start, their state gambling license was about to expire, resulting in a potential immediate shutdown and a long and expensive reapplication process.

Next, an irate gambler who lost money parked a truck bomb in front of the casino. It failed to blow up because, not only was the man a poor gambler, he was incompetent at building timers and fuses.

In fact, the casino?s main concerns didn?t even rank in the top ten of business risks and were minor affairs at worst.

As I learned in karate school in Tokyo half century ago, it?s the punch you don?t see coming that knocks you out.

We have another one of those potential punches coming up on November 8th.

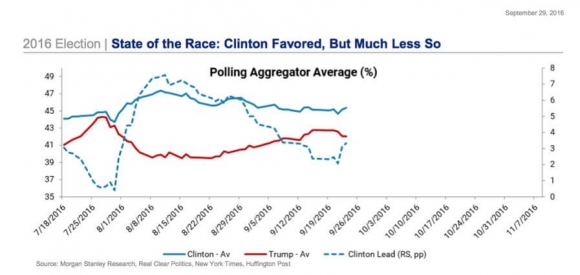

Donald Trump is so pitifully behind in the polls that his chances of wining are less that 100:1. You can get 90:10 odds at the betting pools in London. He now has less than five weeks to pull his campaign out of the fire.

But what if he does win?

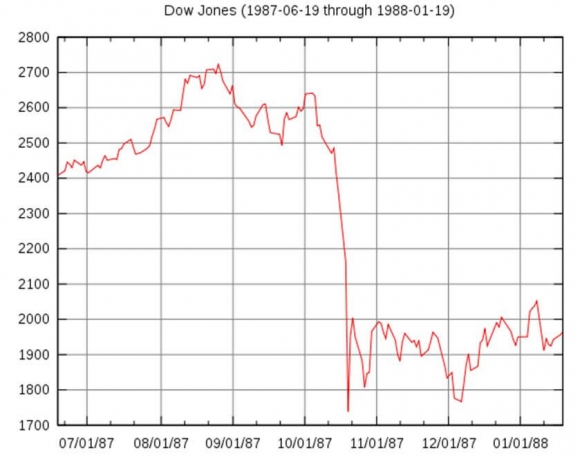

You can expect the Dow Average to open down 1,000 points at the opening, possibly as much as 2,000 points. I don?t see firm support until we hit 17,000, down 9.1%, or off 1,700 points from the recent high.

Below that, we are looking at the February, 2016 low of 15,500, or a 3,200 point, 17.1% plunge.

When I mention this to subscribers, they recoil in horror. It must be impossible!

I respond, ?No Way Jose!?

I was standing on the equity trading floor at Morgan Stanley on October 19, 1987 when the Dow Average collapsed an incredible 22.1% in one day (from 2,500 to 1,750).

And there really wasn?t anything special happening that day, just the execution of the hedges for an arcane strategy called ?portfolio insurance? that all hit at the same time.

So it behooves us to take out some insurance against the unlikely 100:1 event actually occurring.

I know many hedge funds that are already strapping on this position right now. It is a truly "asymmetric trade" which hedge funds happen to love, one with a very low risk, but a very high possible return.

In fact, there are funds now that are solely devoted to this kind of trade.

This is how you do it.

You buy the cheapest put options you can find deep out-of-the-money for the front month on stock market indexes.

For example, at the October 5th close you could buy the S&P 500 (SPY) November 195 puts for 50 cents. They expire on November 18, 2016.

If Trump loses, you write off your entire investment.

However, if he wins, it?s another story completely.

Let?s say the (SPY) opens on November 9th down 10 points. The November 195 puts should rocket by 265%, from 50 cents to $1.32.

And they should rise much more than that, as there will also be a simultaneous explosion in options implied volatility and the Volatility Index (VIX).

If the (SPY) opens down 15 points, not inconceivable, your November 195 puts should soar by 420% to $2.10 or more.

You can play around with the numbers to see what works for you. You can buy (SPY) put options for as little as five cents.

It gets better.

Dozens of hedge funds are already putting this trade on to protect existing long-term core positions.

So you should get a generalized rise in deep out-of-the money put options going into the election even if the stock market continues to trade in a narrow range.

You could make a decent profit on that rise alone, and then take the profit before Election Day.

And what if the election is still undecided by the November 9 opening? Put options will be extremely well bid, even if Clinton eventually wins in a recount (remember 2000), in a tied Supreme Court, or wherever?

A friend of mine did exactly this kind of trade in the run up to the 1987 crash. He had started working at Morgan Stanley only two weeks before. He saw the crash coming on his first day at work.

He then borrowed $10,000 from his dad and bought very deep out of the money (SPY) put options. Everyone thought he was nuts.

On crash day his $10,000 turned into $15 million! He then said ?It?s been great guys,? and retired to start his own hedge fund.

Ask any old timer at Morgan Stanley, and they know the story. Some might even remember his name.

Don?t expect to make $15 million on this trade. However, you should get the kind of asymmetric return you can brag about to your friends for the rest of your life.

That is, unless Hillary Clinton wins first.

Looks Like a Good Bet to Me

They DO Bite

They DO Bite

They DO Bite

They DO Bite