The “Exploding National Debt” has been overhanging the markets for as long as I can remember and has had absolutely zero effect. Those who cashed out of markets, sold their homes, and hid everything under their mattress have missed the investment opportunity of the Millennium since 2009.

Why is that?

With ten-year Treasury bond yields grinding up from 0.32% to 5.10% during this period, there is some cause for concern.

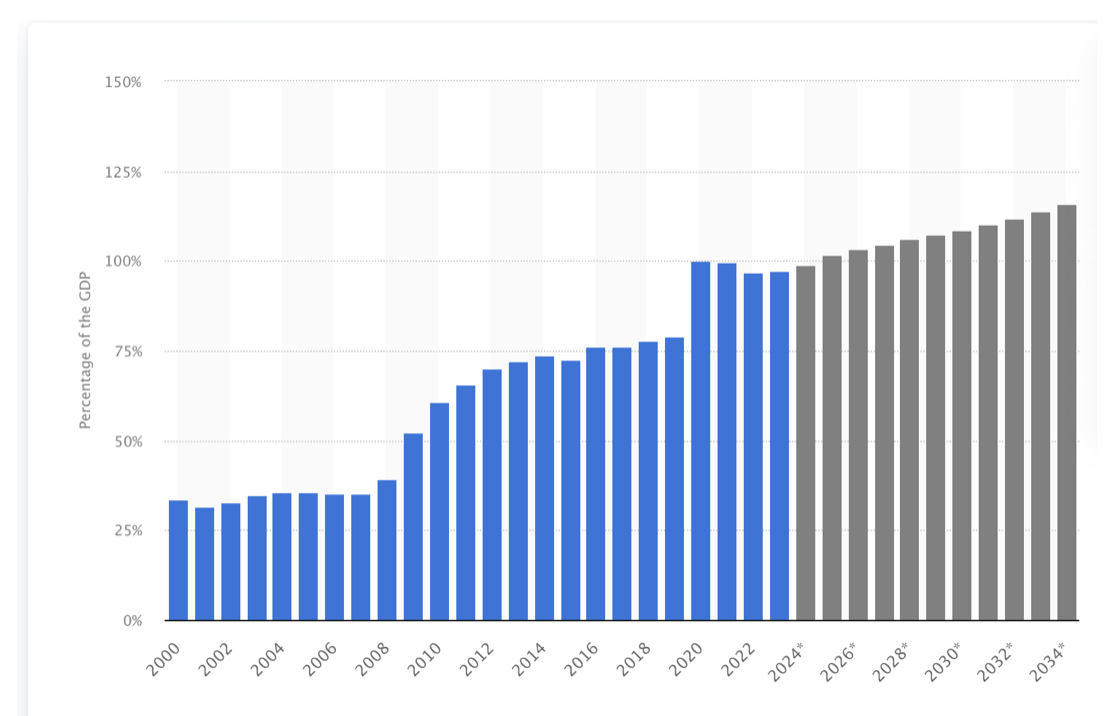

The fact is that America has taken advantage of its reserve currency status to become an industrial-strength borrower. The US National Debt now stands at an incredible $34.5 trillion, up from $10.8 trillion in 2008 when Mad Hedge Fund Trader was first published. The United States is now on the hook for more money than any other country in history. That works out to an eye-popping $102,985 per US citizen.

We have, in fact, become the United States of Debt. The debt now accounts for 136% of America’s $25.44 trillion GDP, far more than was seen during the 106% WWII peak. And they were worried then.

What’s worse? Over the next decade, the national debt is expected to soar to $43 trillion, assuming that we don’t get into any new wars where it will become much more.

Current US Secretary of the Treasury Janet Yellen recently confided to me that, “It’s the kind of thing that should keep you awake at night.”

It gets worse.

According to the Federal Reserve Bank of New York, total personal debt topped $17.50 trillion by the end of 2023. An overwhelming share of personal consumption is now funded by credit card borrowing.

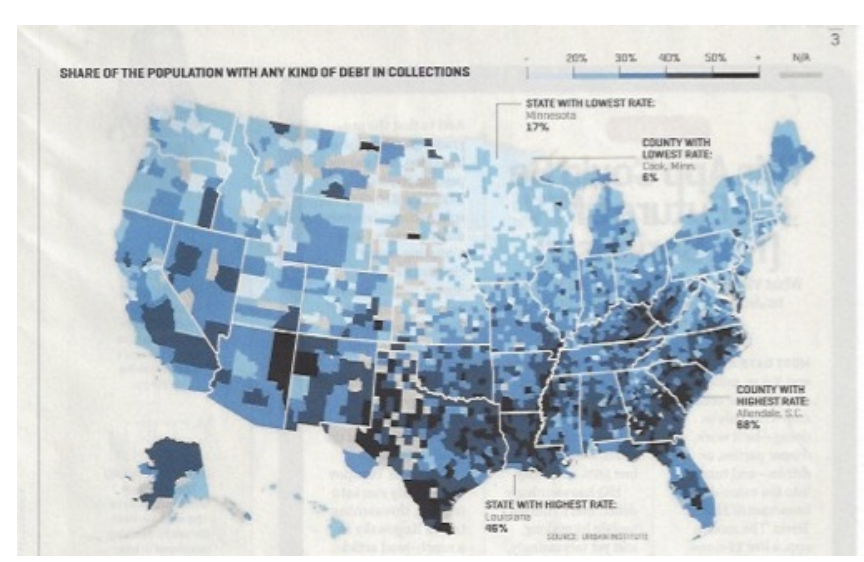

Some 33% of Americans now have debts in some form a collection, and that figure reaches an astonishing 50% in many southern states (see map below). Call it the Confederacy of Debt.

Corporations have also been visiting the money trough with increasing frequency. The rating agency Standard & Poor’s has said there could be hard times ahead for corporate America, which, according to the Federal Reserve, is carrying a $13.7 trillion debt load. Company debt has jumped 18.3% since 2020 as companies took advantage of the Fed's slashing interest rates in the early days of the Covid-19 pandemic.

The debt-to-capital ratio of the top 1,000 companies has ballooned from 35% to more than 54% and is now the highest in 20 years.

Automobile debt now tops $1.6 trillion and with lax standards has become the new subprime market, accounting for 9.2% of all consumer debt.

And remember that other 800-pound gorilla in the room? Student debt now exceeds $1.6 trillion and is rising, as is the default rate. Provisions in the last tax bill eliminate the deductibility of the interest on student debt, making lives increasingly miserable for young borrowers.

Of course, you can blame the low-interest rates that have prevailed for much of the past decade. Who doesn’t want to borrow when the inflation-adjusted long-term cost of money is FREE?

That explains why Apple (AAPL), with $170 billion in cash reserves held overseas, borrowed via ultra-low coupon 30-year bond issues, even though it didn’t need the money. Many other major corporations have done the same.

And while everything looks fine on paper now, what happens if interest rates rise from here?

The Feds will be in dire straight very quickly. Raise short-term rates to the 6% seen at the peak of the last cycle, and the nation’s debt service rockets from 4% seen at the last low to a bone-crushing 10%. That’s when the sushi really hits the fan.

You can expect the same kind of vicious math to strike across the entire spectrum of heavily leveraged borrowers going forward, including you and me.

Rising rates are increasingly shutting first-time buying Millennials out of the housing market, as extortionate 7.25% interest rates prove a formidable barrier.

We are also witnessing the withdrawal of the Chinese as major Treasury bond buyers, who along with other sovereign buyers historically took as much as 50% of every issue.

Don’t expect them back until the dollar starts to appreciate again until relations between the two countries improve.

Rising supply against fewer buyers sounds like a recipe for much higher interest rates to me.

With these kind of exponential numbers staring us in the face, why hasn’t financial Armageddon happened already?

I’ll explain.

While at first look American debt is rising, it has in fact been falling in terms of purchasing power. I’ll use 2022 as an example where the trends are most clear. The National Debt rose by $1.5 trillion. But the inflation rate that year was 9.1%. That means the outstanding debt shrank by 9.1%, from then $31 trillion to only $28.2 trillion. Compound this over 30 years, the maturity of the longest debt issued by the US Treasury and how much is the existing national debt?

Zero.

That’s what happened to the Revolutionary War debt, the Civil War Dent, and the debts from WWI and II. It all goes to debt Heaven.

Of course, we’ll never get the national debt down to zero because the government keeps spending. Neither American poetical party wants to own a recession for fear of losing elections. The last one who suffered that fate was George W. Bush, who opened the door for Barrack Obama with the Great Financial Crisis. So politicians have learned to spend whatever they must to avoid a similar fate.

If you have a better economic theory as to why we can’t keep borrowing I’m all ears. But you be going against the long-term trend of history.

You may think that I’ve been smoking California's biggest export to come up with such a hair-brained theory. But there is one person who heartily agrees with me and that is Mr. Market. If we really had a debt crisis stocks and the US dollar would NOT be at all-time highs, the economy would NOT be growing at a robust 3.4%, an inflation this year would NOT be down to only 3.2% against a long-term average of only 3.0%. Nor would foreign investors and central banks still be buying half our new bond issues with both hands, as they are.

No Armageddon here, no debt crisis, nothing t see here.

That’s what Mr. Market thinks anyway and he is always right.