This is What a Lost Decade Gets You

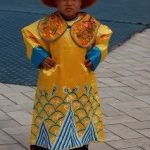

With all of the handwringing about the zero return on US equities for the last decade, I thought I'd better take a look at the long term charts. It's very clear that we have been trading in a gigantic sideways narrowing wedge for the last 18 years, defined by 14,000 on the upside and 6,000 on the downside.

The clever investors out there, like hedge funds, have been selling every big rally and buying every dip, laughing all the way to the bank and leaving your average Joe pension fund beneficiary, 401k owner, and mutual fund investor holding the malodorous bag.

What's more, I believe that this state of affairs is going to continue for another few years. You get what you deserve. This view is consistent with an economy that isn't inventing anything new, spends more than it borrows, and lets foreigners take the technological lead through sheer indolence and complacency. We aren't going to Twitter our way to prosperity.

It also fits with 80 million baby boomers withdrawing wealth from the system, downsizing their homes, and plopping everything into the Treasury market. This means that we are much closer to the end of this run in equities than the beginning.

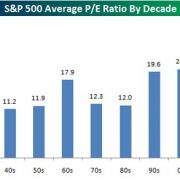

If you have any doubts, take a look at the chart below showing that stocks are more expensive now than at any time in the last nine decades. Should one of the world?s? more structurally impaired economies be commanding one of the highest PE multiples? I think not. This is why I have been using my electric cattle prod and my kangaroo skin bullwhip to herd investors to the sidelines.

The Sidelines Are a Good Place to Be