Time to Pick Up Some Gold

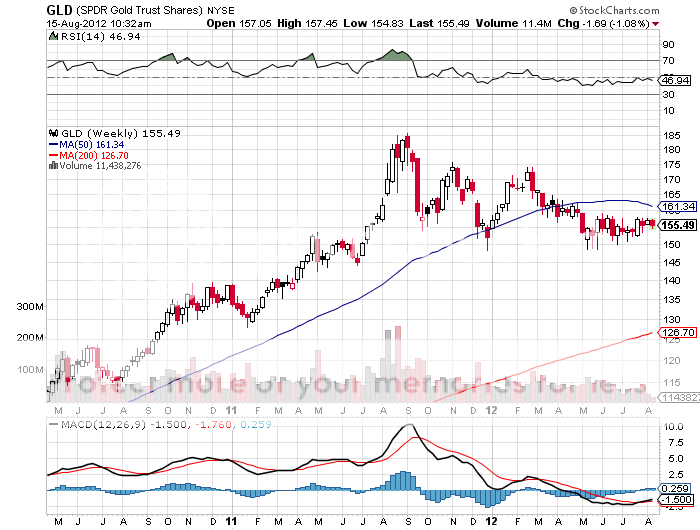

Gold has clearly evolved into a call option on global quantitative easing. Don?t think of it just as the stuff your dentist puts in your teeth or the thing your girlfriends gets you to wrap around her finger anymore. I don?t think that the Federal Reserve will implement QE3 at its September 16-17 meeting, or even next year. This shocking realization will be bad for gold prices.

However, Europe is a completely different kettle of fish. Having just spent two months there, I can tell you with great certainty that the economic conditions are far more extreme than any economic data releases are indicating so far.

So the ECB has to launch its own QE through a second tranche of the LTRO or some other vehicle of at least ?500 billion ? ?1 trillion. While most of this money will be used to buy high yield European sovereign bonds, some will spill over into the gold market, and that will be good for prices.

I can?t tell you how bad things are in Italy. I just visited the main middle class shopping district in Milan. The sales were offering discounts of 70%, 80%, and 90%. They were literally throwing inventory out the door. I?m talking pants for $5 and overcoats for $25. I ended up buying four suitcases, those at 50% off, and filing them up with clothes for everyone I know. I got clothes for the kids, cloths for distant relatives, even clothes for people I don?t like. And it barely made a dent on my credit card.

The attraction of the September 2012 $148-$151 call structure is the following. The $151 strike is just below rock solid support for gold that has held for several months. The September expiration allows us to take out 90% of the profit before the Fed gives us the bad news on no QE3 next month. Gold could well keep moving sideways until then, which is why I am not rushing out and buying out-of-the-money calls. This all happens going into the traditional seasonal strength of the Indian wedding season, Christmas in the West, and the Chinese Lunar New Year.

By leveraging up an out of the money call spread in a limited risk position, I get an outsized return. This is a bet that gold will move up, sideways, or down no more than 3% over the next four weeks. If this happens, the call spread will rise in value from $2.42 to $3.00, a gain of 24%. This is why I went for a heavy 10% weighting.

Better Bring an Extra Suitcase