Trade Alert - (TLT) September 25, 2017

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) - BUY

BUY the iShares Barclays 20+ Year Treasury Bond Fund (TLT) October, 2017 $129-$131 in-the-money vertical BEAR PUT spread at $1.67 or best

Opening Trade

9-25-2017

expiration date: October 20, 2017

Portfolio weighting: 10%

Number of Contracts = 66 contracts

More talk, no do.

I think we can expect more of the same from two bombastic leaders in the war of words between North Korea and the United States.

The Great Leader has threatened to shoot down a B-52 that makes a daily run to the Hermit Kingdom's borders every day for the last 67 years.

Did I mention that I flew one of those missions once?

I thinks bombs of a different sort are much more important for the markets here.

Those would be of the bond sort, the $6 billion a month, or $200 million a day, that Fed governor Janet Yellen plans to start dropping on the bond market in the very near future.

That should take bonds down to new 2017 lows. What we could be seeing here is the setting up for the perfect head and shoulders top of the (TLT) for 2017.

Take the two-point rally since last week as a gift.

With bonds now at a 2.22% yield, a mere 20 basis points above the 2017 low, I am willing to bet that they won't go much lower, at least within the next 19 trading days to the October 20 options expiration.

So I am going to pick some low hanging fruit here and buy the iShares Barclays 20+ Year Treasury Bond Fund (TLT) October, 2017 $129-$131 in-the-money vertical BEAR PUT spread at $1.67 or best.

To lose money on this position the (TLT) would have to rise above $129, and yields would have to drop below 2.05%, which they absolutely won't ahead of a new deluge of bond selling from the Fed.

Don't pay more than $1.80 for this position or you'll be chasing.

If you don't do options, this would be a great level to scale into a long in the ProShares Ultra Short 20+ Treasury Bond Fund (TBT), a bet that bonds will fall.

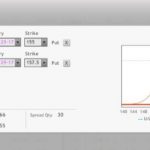

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute a Vertical Bear Put Spread by clicking here at

http://members.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Here are the specific trades you need to execute this position:

Buy 66 October, 2017 (TLT) $131 puts at............................................$5.75

Sell short 66 October, 2017 (TLT) $129 puts at....................................$4.08

Net Cost:...........................................................................................

Potential Profit: $2.00 - $1.67 = $0.33

(66 X 100 X $0.33) = $2,178 or 19.76% in 19 trading days.