Trade Alert - (FB) September 7, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (FB)- BUY

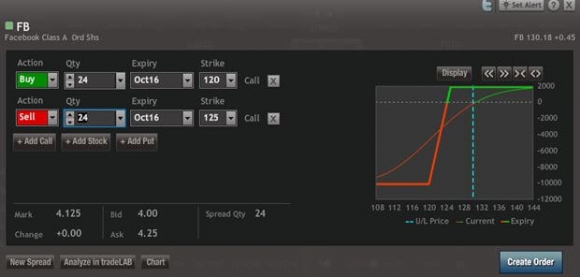

Buy the Facebook (FB) October, 2016 $120-$125 in-the-money vertical bull call spread at $4.12 or best

Opening Trade

9-7-2016

Expiration Date: October 21, 2016

Portfolio Weighting: 10%

Number of Contracts = 24 contracts

This is a bet that (FB) won?t trade below $125 by the October 21nd expiration date in 33 trading days.

You can pay up to $4.40 for this position and it still makes sense.

I have been trying to buy this stock for the past two months, but it never gave me the dip I wanted.

Now that it has clearly broken out on the charts, it?s time to just close your eyes and buy.

If you can?t do the options trade, then buy the stock. I think it could double over the next three years.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain about how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking https://www.madhedgefundtrader.com/ltt-executetradealerts/. You must be logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the mid market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 24 October, 2016 (FB) $120 calls at????.?.??$11.60

Sell short 24 October, 2016 (FB) $125 calls at.????..$7.48

Net Cost:???????????????????........$4.12

Potential Profit: $5.00 - $4.12 = $0.88

(24 X 100 X $0.88) = $2,112 or 21.35% in 33 trading days

?

?