Trade Alert - (AAPL) April 26, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (AAPL) – BUY

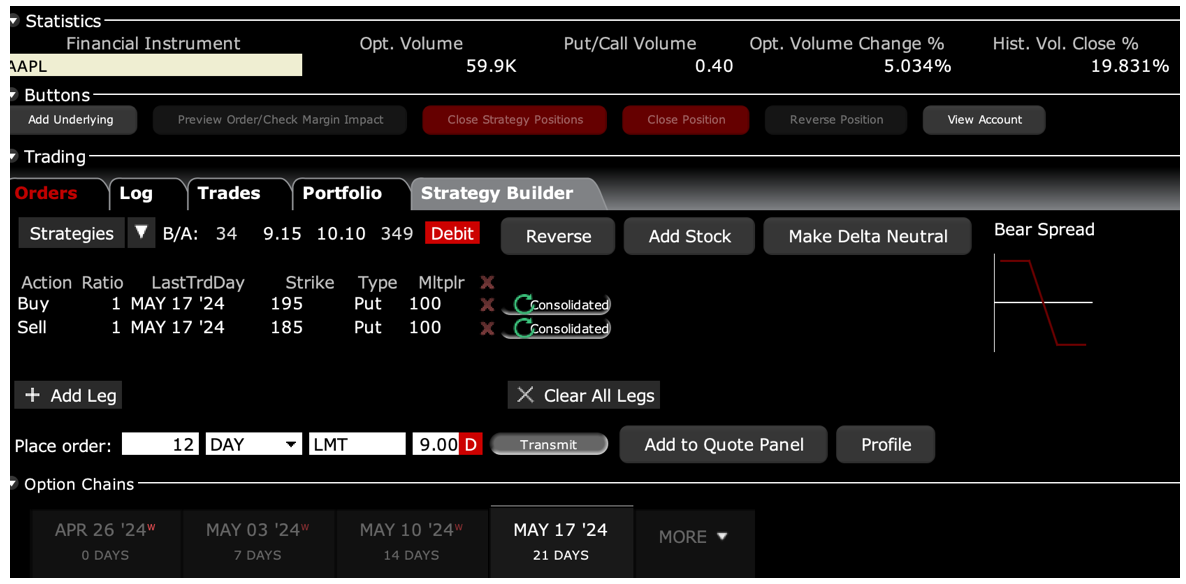

BUY the Apple (AAPL) May 2024 $185-$195 in-the-money vertical Bear Put debit spread at $9.00 or best

Opening Trade

4-26-2024

expiration date: May 17, 2024

Number of Contracts = 12 contracts

As we enter the summer doldrums, I am willing to bet that Apple will not go to a new all-time high in three weeks. (AAPL) also now has a rare 30% implied volatility for its options. Usually, it is much more boring than that, around the 23% level. I believe that (AAPL) is entering the trading range along with the rest of the AI world. Apple is the slowest growing of the big tech stocks.

I can also use this short position to partially hedge the four long positions already in my trading portfolio. There are no big macro numbers for the economy until we get the April Nonfarm Payroll Report in a week. There will be no dramatic announcements regarding Apple itself until the developers’ conference in June. The 50-day moving average is now at $173.30 and the 200-day moving average at $181.36 has proved substantial resistance for the past six weeks.

I am therefore buying Apple (AAPL) May 2024 $185-$195 in-the-money vertical Bear Put debit spread at $9.00 or best.

Don’t pay more than $9.50 or you’ll be chasing on a risk/reward basis.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

To learn more about the company, please visit their website at www.apple.com

This is a bet that Apple will not rise above $185 by the May 17 option expiration in 15 trading days, a new all-time high.

Apple Inc. (formerly Apple Computer, Inc.) based in Cupertino CA is the second largest publicly listed company in the United States (after Microsoft) with a market capitalization of $2.64 trillion. It dominates smartphones with a 66% US market share and accounts for 90% of global profits.

It designs, develops, and sells a variety of consumer electronics, computers and their software, and online services. Its products include the iPhone, iPad, Apple Watch, Mac computers, the artificial reality Vision Pro headset, and Apple TV. It is also entering the movie production and distribution business. In my early days, I knew the co-founders Steve Jobs and Steve Wozniak.

Here are the specific trades you need to execute this position:

Buy 12 May 2024 (AAPL) $195 puts at………….…….…$24.00

Sell short 12 May 2024 (AAPL) $185 puts at……………$15.00

Net Cost:………………………….………….…........................$9.00

Potential Profit: $10.00 - $9.00 = $1.00

(12 X 100 X $1.00) = $1,200 or 11.11% in 15 trading days.

If you are uncertain about how to execute a bear put options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.