Trade Alert - (AAPL) April 27, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (AAPL)- BUY

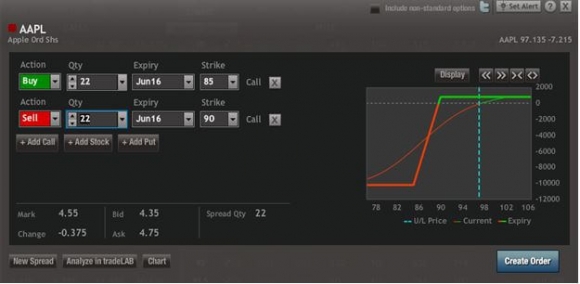

Buy the Apple (AAPL) June 2016 $85-$90 in-the-money vertical bull call spread at $4.55 or best

Opening Trade

4-27-2016

expiration date: June 17, 2016

Portfolio weighting: 10%

Number of Contracts = 22 contracts

I have been holding back from buying Apple shares (AAPL) for the past 10 months, back in June, 2015, the last time the shares peaked at $132.50.

That was when the stock fully discounted the launch of the iPhone 6s, its last blockbuster product. I knew then that the company was about to enter a wide parched desert of falling sales, declining earnings, and sliding share prices.

We have just reached the end of that desert.

I have been saying for all of 2016 to buy (AAPL) after the disastrous Q1 earnings. So I am going to put my money where my mouth is and do exactly that.

From today?s $95.20 low the share have to gain 28.15% to match their old high. I expect them to do exactly that by the end of the year.

The driver will be the launch of the iPhone 7 in September, which the entire world is obviously holding back to buy.

From this point on, Apple is a long play. Put you buying boots only, stop those buy rights, sell short some puts, can salt away some shares in your 401k. I?m talking about a total risk reversal here.

Worst case, you lose $5, best case, you make $37.30. A risk/reward ratio like that is hard to find these days in this indifferent market.

With a PE multiple of 9X and $280 billion in cash on the books, every value player in the world is going to forced to load up on these shares, or get fired.

If you buy the stock, you will be competing with the company to do so, which announced a further $50 billion in buy backs yesterday.

You can pay all the way up to $4.70 for this spread and it still makes sense.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 22 June, 2016 (AAPL) $85 calls at????.?.??$11.85

Sell short 22 June, 2016 (AAPL) $90 calls at.????..$7.30

Net Cost:?????????????????..?..$4.55

Potential Profit: $5.00 - $4.55 = $0.45

(22 X 100 X $0.45) = $990 or 9.89% profit in 37 trading days

?

?