Trade Alert - (AAPL) August 21, 2020 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (AAPL) – TAKE PROFITS

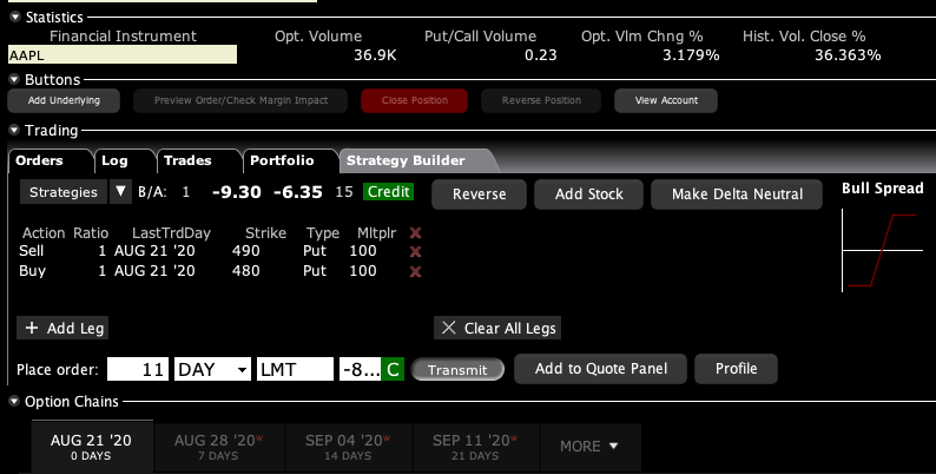

SELL the Apple (AAPL) August 2020 $480-$490 in-the-money vertical Bear Put spread at $9.30 or best

Closing Trade

8-21-2020

expiration date: August 21, 2020

Portfolio weighting: 10%

Number of Contracts = 11 contracts

While this position expires in a few hours, we are too close to the lower strike price to take the risk.

I am therefore selling the Apple (AAPL) August 2020 $480-$490 in-the-money vertical Bear Put spread at $9.30 or best. By coming out here, you get to take home $330, or 3.33% in 9 trading days.

I love Apple for the long term, and I believe we are going to break to new highs in the coming months. We are on the eve of 5G iPhones, which will become the greatest moneymaker of all time.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and reduce your offer by 10 cents with a second order.

This was a bet that Apple (AAPL) will not trade above $480 by the August 21 option expiration day in 9 trading days.

Here are the specific trades you need to exit this position:

Sell 11 August 2020 (AAPL) $490 calls at…......……….………$11.50

Buy to cover short 11 August 2020 (AAPL) $480 puts at…...$2.20

Net Proceeds:……….……..…….………................………….….....$9.30

Profit: $9.30 - $9.00 = $0.30

(11 X 100 X $0.30) = $330, or 3.33% in 9 trading days.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.