Trade Alert - (AAPL) March 12, 2019 - SELL-STOP LOSS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (AAPL) – SELL-STOP LOSS

SELL the Apple (AAPL) March 2019 $180-$185 in-the-money vertical BEAR PUT spread at $3.77 or best

Closing Trade

3-12-2019

expiration date: MARCH 15, 2019

Portfolio weighting: 10%

Number of Contracts = 22 contracts

It looks like we are going to get robbed from taking the maximum profit in our Apple short. It’s a heartbreaker to lose this position three days before expiration. But we have to trade the market we have, not the one we want.

A trifecta of events has since conspired to drive the shares up $11 since Friday. We got an out of the blue upgrade of the shares from a broker that only downgraded them months ago.

Fed governor Jay Powell gave the broader market a boost when he said in his 60 minutes interview that interest rates will stay lower for longer.

Then the company itself said it would make an announcement of a new service, probably a streaming service to compete with Netflix, on March 25.

As a result, we have hit our upper strike price and the risk/reward of continuing with the position has turned shapely against us.

I am therefore selling the Apple (AAPL) March 2019 $180-$185 in-the-money vertical BEAR PUT spread at $3.77 or best.

If you sold short the shares come out from a loss.

Here are the specific trades you need to exit this position:

Sell 22 March 2019 (AAPL) $185 puts at…………...........………$5.00

Buy to cover short 22 March 2019 (AAPL) $180 puts at….....$1.23

Net Cost:……………………..…….………..…………................….....$3.77

Loss: $4.60 - $3.77 = -$0.83

(22 X 100 X -$0.83) = -$1,826.

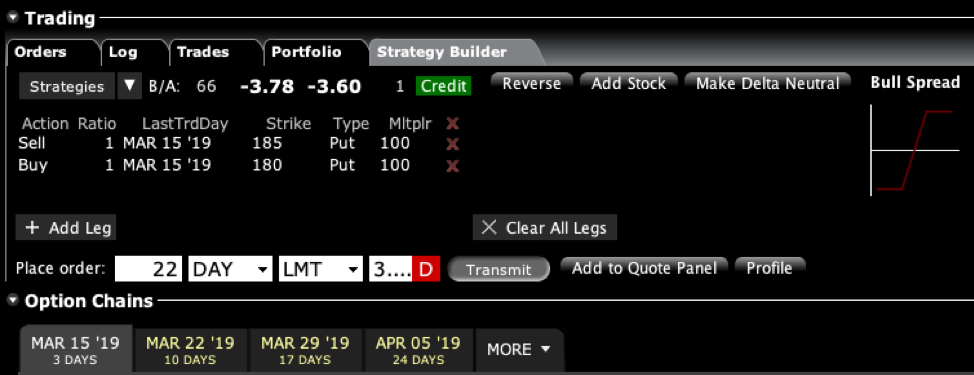

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.