Trade Alert - (AAPL) May 2, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

?

Trade Alert - (AAPL)- SELL-STOP LOSS

SELL the Apple June 2016 $85-$90 in-the-money vertical bull call spread at $3.80 or best

Closing Trade

5/2/16

expiration date: June 17, 2016

Portfolio weighting: 10%

Number of Contracts = 22 contracts

I had a winner here. Then Carl Icahn peed on my trade, unloading his substantial holding the day after I went long. Then he went very public with the move.

Time to step to the sidelines and reassess.

By the way, Carl hasn?t liked the market for three years.

Carl, call me!

However, too many technical levels have been broken to ignore this move down. Better to preserve capital for easier times.

And my iron clad stop-loss strategy has saved my bacon too many times this year. There is no reason to ignore it? now.

Apple is still a great company. It still has $220 billion in cash. It is still launching the iPhone 7 in four months. But as a short-term trade, the risk/reward in Apple has decidedly moved against us.

Better to let all the haters and non-believers to get out of the way before we step back on the long side. Every time Apple disappoints, a ton of research comes out saying the stock is done, finished, kaput, and going to zero.

Then it goes to new all time highs. Steve Jobs laughs from his grave.

We?ll make it all back on the next trade.

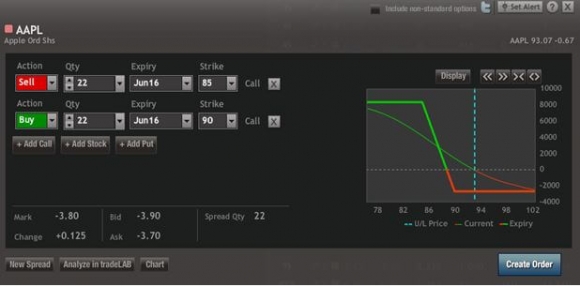

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at https://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 22 June, 2016 (AAPL) $85 calls at????.?.??$13.00

Buy to cover short 22 June, 2016 (AAPL) $90 calls at...$9.20

Net Cost:???????????????..??..?..$3.80

Loss: $4.55 - $3.80 = -$0.75

(22 X 100 X -$0.75) = -$1,650 or -16.48% loss

?