Trade Alert - (AAPL) November 11, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (AAPL)- STOP LOSS

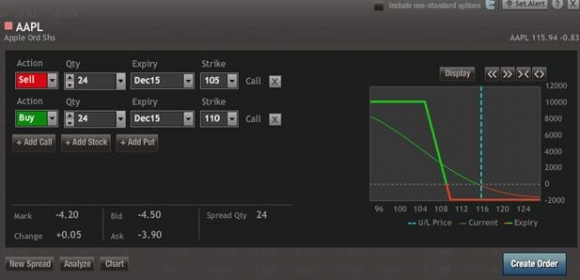

SELL the Apple (AAPL) December, 2015 $105-$110 in-the-money vertical bull call debit spread at $4.20 or best

Closing Trade

11-11-2015

expiration date: December 18, 2015

Portfolio weighting: 10%

Number of Contracts = 24 contracts

I was a bit too hasty on this one.

As we run into yearend, my toleration for losses runs to zero. In a market that isn?t giving you much, you always rush to protect your profits.

So I am stopping out of my Apple (AAPL) December, 2015 $105-$110 in-the-money vertical bull call debit spread at $4.20, close to my cost. The November correction could run towards the end of the month.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 24 December, 2015 (AAPL) $105 calls at???...$11.20

Buy to cover short 24 December, 2015 (AAPL) $110 calls...$7.00

Net Proceeds:???????????????????.?.....$4.20

Loss: $4.27 - $4.20 = $0.07

(24 X 100 X $0.07) = $168 or 0.17% profit for the notional $100,000 portfolio.