Trade Alert - (AAPL) September 18, 2017

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (AAPL) - BUY

BUY the Apple (AAPL) October, 2017 $167.50-$172.50 in-the-money vertical BEAR PUT spread at $4.40 or best

Opening Trade

9-18-2017

expiration date: October 20, 2017

Portfolio weighting: 10%

Number of Contracts = 23 contracts

Yes, I know you think I am completely MAD selling short Apple shares here.

However, I think we are in for at least one more month of sideways action in the FANG stocks.

Let's face it. The good news on Apple is OUT. It has shot its wad.

There won't be any deliveries for two more months.

The only possible news that can come out for now will be of the negative variety, like there are supply chain glitches, or the phone doesn't work at all once the large shipments go out.

If Armageddon doesn't happen to Apple, then at least we are entering a quiet time until they start to ship, in which case we STILL make out maximum profit.

I am therefore buying the Apple (AAPL) October, 2017 $167.50-$172.50 in-the-money vertical BEAR PUT spread at $4.40 or best.

This is a bet that Apple shares will NOT rise above $167.50 by the October 20 option expiration in 24 trading days, compared to the current $159.81.

To lose money on this trade Apple would have to rocket to a new all time high quickly, which it isn't going to do during these uncertain, volatile times.

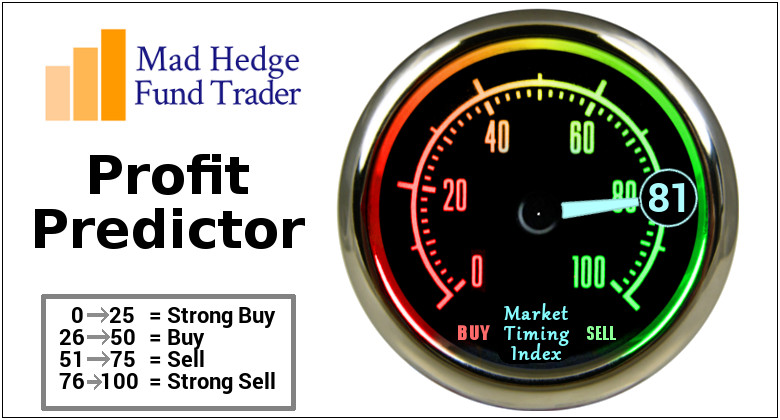

The market in general is now in wildly overbought territory, with my Mad Hedge Market Timing Index at a nosebleed 81.

Don't pay more than $4.65 for this position or you'll be chasing.

It goes without saying that this is not a riskless trade. But up 62% over the past 12 months, we can afford to take the occasional flier.

If you don't do options, stand aside. Longer term, I think Apple will continue to appreciate, possibly to $200 by some time in 2018.

This is a short-term trade only.

We just have to give the market a chance to have at least one more heart attack.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video at

http://members.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Here are the specific trades you need to execute this position:

Buy 23 October, 2017 (AAPL) $172.50 puts at..........................................$13.50

Sell short 23 October, 2017 (AAPL) $167.50 puts at..................................$9.10

Net Cost:............................................................................................................$4.40

Potential Profit: $5.00 - $4.40 = $0.60

(23 X 100 X $0.60) = $1,380 or 13.63% in 24 trading days.