Trade Alert - (ADBE) September 11, 2019 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Trade Alert - (ADBE) – SELL

TAKE PROFITS the Adobe Inc. (ADBE) September 2019 $255-$260 in-the-money vertical BULL CALL spread at $4.45 or best

Opening Trade

9-11-2019

expiration date: September 20, 2019

Portfolio weighting: 10%

Number of Contracts = 23 contracts

I used a dip in prices to roll down my strikes as I had faith in Adobe that it would stick it out until September’s expiration but I am taking profits on the lower strike prices to half my exposure as we head into Adobe’s earnings on September 17th.

I will also be looking to exit the higher strike call spread (the other Adobe position) before that as well but that being said, I do believe Adobe will have a good earnings report and at the $278 price right now, Adobe still has a 63% chance of expiring above $270.

The time decay is essentially how we made money on this one, Adobe has been grinding slowly lower but we have missed out on the major carnage like growth stocks such as Okta (OKTA) losing 10% and other tech growth stocks that fared just as bad.

Adobe has a pristine balance sheet, but the multiple is still considered high which is why there has been a consolidation in this recent rotation.

Let the exit point come to you as shares zig and zag throughout the day

Adobe is a great non-China software play.

They are a diversified software company worldwide. Its Digital Media segment provides tools and solutions that enable individuals, small and medium businesses, and enterprises to create, publish, promote, and monetize their digital content. Its flagship product is Creative Cloud, a subscription service that allows customer to download and access the latest versions of its creative products.

The bull rally isn’t dead – that is the biggest takeaway from Adobe’s (ADBE) overperformance and recent earnings beat.

They will keep posting positive earnings results unless there is some type of seismic shift that deteriorates its competitive advantage.

The company continues to show no mercy by expanding revenue 25% year-over-year.

Adobe’s portfolio of solutions is the gold standard for creating and managing the world’s digital experiences through its apps and cloud products.

Software stocks are the optimal late cycle stocks and I have been whacking every bush in the outback to spread the message that instead of opting for hardware, software protects investors from many of the treacherous traps out there now.

But the most regenerative trends out there are many companies are bypassing or delaying, exorbitant capital projects like new chip factories or new hardware product lines because of the high-risk nature of the economy peaking, in place of fine-tuning processes that are directly correlated to higher software procurement.

This stock fits that procurement bill with millions of consumers dependent on critical apps like Adobe Photoshop and PDF for personal and professional endeavors.

I know I am!

A ceaseless pipeline of enterprises the world over is relying on Adobe every day to help them transform their businesses and the success is vividly showing up in the numbers.

The branding power and the continuous product innovation and services, the deep investment in technology platforms, and a robust ecosystem of partners are enabling Adobe to serve millions of customers swelling the top line.

The expanding addressable markets in the creativity, document, and customer experience management categories are an opportunity that has never been greater.

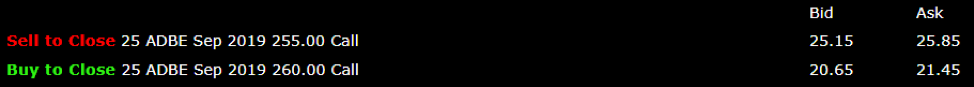

Sell 23 September 2019 (ADBE) $255 calls at………….…..............……$25.50

Buy to cover short 23 September 2019 (ADBE) $260 calls at………….$21.05

Net Proceeds:……………..........…………….………..……….............….….....$4.45

Profit: $4.45 - $4.13 = $0.32

(23 X 100 X $0.32) = $736 or 7.36%

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.