Trade Alert - (ADSK) October 22, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - (ADSK) - BUY

BUY Autodesk, Inc. (ADSK) November 2019 $125-$130 vertical BULL CALL spread at $4.32 up to $4.35

Opening Trade

10-22-2019

expiration date: November 15, 2019

Portfolio weighting: 10%

Number of Contracts = 23 contracts

This is a short-term bet that Autodesk’s shares won’t drop more than 8% in the next 26 days.

The risk reward justifies making this trade and our upper strike of $130 should hold.

Andrew Anagnost, Autodesk president and CEO said, “While we continue to execute well and are not materially impacted by current trade tensions and macro uncertainty, we are taking a prudent stance to our second half fiscal 2020 outlook.”

The trade war isn’t hurting Autodesk’s business, but is creating uncertainty.

That means the stock won’t go up in a straight line but shouldn’t go down in a straight line either.

Autodesk (ADSK) is a solid design software company headquartered in Marin County just north of the Golden Gate Bridge.

It sells a whole host of visualization software for engineering, manufacturing, and construction.

Autodesk’s narrative is still robust – its conversion into a SaaS model will prove lucrative and the lack of competition and stickiness will bode well.

Autodesk became best known for AutoCAD, but now boasts a broad range of software for design, engineering, and entertainment—and a line of software for consumers, including Sketchbook.

The manufacturing industry uses Autodesk's digital prototyping software—including Autodesk Inventor, Fusion 360, and the Autodesk Product Design Suite—to visualize, simulate, and analyze real-world performance using a digital model in the design process.

The company's Revit line of software for building information modeling is designed to let users explore the planning, construction, and management of a building virtually before it is built.

I fancy second tier software stocks - they still prove their worth in a late cycle economy.

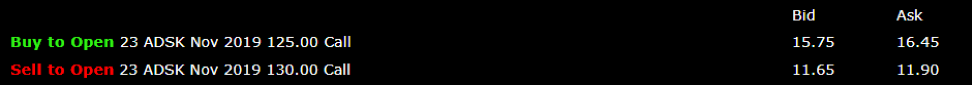

Here are the specific trades you need to execute this position:

BUY 23 November 2019 (ADSK) $125 calls at………….……$16.10

SELL short 23 November 2019 (ADSK) $130 calls at….....$11.78

Net Cost:………………………............….………..………….….......$4.32

Potential Profit: $5.00 - $4.32 = $.68

(23 X 100 X $0.68) = $1,564 or 15.64% in 26 days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.