Trade Alert - (AKAM) November 20, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - Akamai Technologies, Inc. (AKAM) – BUY

BUY Akamai Technologies, Inc. (AKAM) December 2019 $80-$83 in-the-money vertical BULL CALL spread at $2.40

Opening Trade

11-20-2019

expiration date: December 15, 2019

Portfolio weighting: 10%

Number of Contracts = 40 contracts

The cloud company dropped on threats of increased tariffs and it seems that the market is becoming more and more immune to bad news because of the shallowness of the sell-off.

Akamai dropped 2.5% in intraday trading and we aren’t getting the bottom of the barrel prices, the stock is off session lows and prices of this call strike were taken on the rebound up.

Let the prices come to you by putting on limit orders, Akamai are the prototypical profitable cloud company that should be part of any tech trader portfolio.

Akamai Technologies Inc (AKAM) beat estimates for quarterly earnings and raised its full-year forecast, helped by strong demand in its cloud security unit, as well as growth in its traditional business of faster web content delivery.

The company has been focusing on its security unit as its traditional business has come under pressure with large media customers such as Apple Inc and Amazon.com Inc building their own networks.

Revenue from the segment, which helps data centers operate and deliver content securely, rose 28% to $216 million.

Cambridge, Massachusetts-based company also raised its full year forecast and now expects revenue in the range of $2.85 billion to $2.87 billion and adjusted profit between $4.36 to $4.42 per share.

The only companies raising full year guidance are companies that perennially overdeliver.

The uncertain outlook has forced the bulk of tech firms to guide down.

The commentary was also favorable with CEO Tom Leighton saying “"There are several major OTT launches coming up over the next several months. And, you know, that has the potential to generate a lot of traffic and business for us. And so we are very optimistic about the future growth of the content delivery network business.”

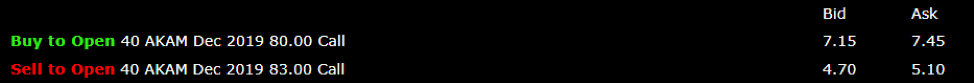

Here are the specific trades you need to execute this position:

Buy 40 December 2019 (AKAM) $80 call at………….………$7.30

Sell short 40 December 2019 (AKAM) $83 call at………….$4.90

Net Cost:……………....................………..…….………..…….....$ 2.40

Potential Profit: $3.00 - $2.40 = $.60

(40 X 100 X $.60) = $2,400 or 24.00% in 31 days

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.