Trade Alert - (AMZN) April 6, 2020 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (AMZN) – TAKE PROFITS

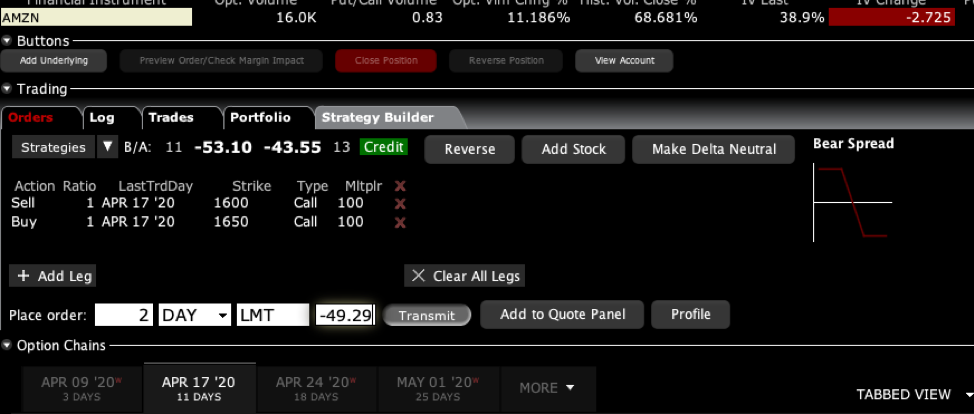

SELL the Amazon (AMZN) April 2020 $1,600-$1,650 in-the-money vertical BULL CALL spread at $49.00 or best

Closing Trade - NOT FOR NEW SUBSCRIBERS

4-6-2019

expiration date: April 17, 2020

Portfolio weighting: 10%

Number of Contracts = 2 contracts

I love taking a one-day profit.

I like even more buying one of the BEST stocks in America and then see the Dow Average rocket by 1,000 points the next day.

It reaffirms once again my argument that the markets are paying you enormous premiums to carry risk over the weekend. “He who dares, wins.”

Also helping all our positions is the dramatic 5.43% drop in the Volatility Index (VIX).

Stocks are soaring on falling death rates. Chinese cases are plunging after the border close, Italy and Madrid are going flat, and San Francisco is looking good. There is still a massive, but extremely nervous bid under the market.

Amazon is far and away the biggest beneficiary of the Corona pandemic. Its business is exploding, and it has just hired 100,000 new workers to accommodate this hyper-growth. Much of this hypergrowth is permanent. Those sales are never returning to legacy retailers.

(AMZN) is one of the few stocks that is unchanged on the year. That’s because it is the safest stock on the market.

I am therefore selling the Amazon (AMZN) April 2020 $1,600-$1,650 in-the-money vertical BULL CALL spread at $49.00 or best. Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done cancel your order and reduce your offer by 20 cents with a second order.

By coming out here, you get to earn a welcome $1,800, or 22.50% in one trading day.

Here are the specific trades you need to exit this position:

Sell 2 April 2020 (AMZN) $1,600 calls at…….…...……$346.00

Sell short 2 April 2020 (AMZN) $1,650 calls at……….$297.00

Net Proceeds:……………...........…………….…………..…….….....$49.00

Profits: $49.00 - $40.00 = $9.00

(2 X 100 X $9.00) = $1,800 or 22.50% in one trading day.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.