Trade Alert - (BA) October 22, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (BA) – BUY

BUY the Boeing (BA) November 2019 $300-$310 in-the-money vertical BULL CALL spread at $8.75 or best

Opening Trade

10-22-2019

expiration date: November 15, 2019

Portfolio weighting: 10%

Number of Contracts = 11 contracts

You would think that with all the bad news out Boeing shares would finally hit bottom.

Wrong!

All Boeing 737 Max 8 planes have been grounded. The 58 new $100 million planes a month scheduled for delivery have been suspended. That means one of the largest companies in the United States is banned from selling far and away its most important product.

This morning, we learned that Federal prosecutors are investigating Boeing as to whether it was criminally negligent in obtaining the troubled aircraft’s original FAA certification, and then lied to cover it up! Subpoenas for emails and documentation have been issued, and a general ruckus created.

This was a guaranteed outcome. You want deregulation? This is what you get. You cut budgets? This is also what you get. I highly doubt that Boeing will be found criminally culpable for the two crashes. This is all an outcome from the US government’s withdrawal from oversite of the private sector.

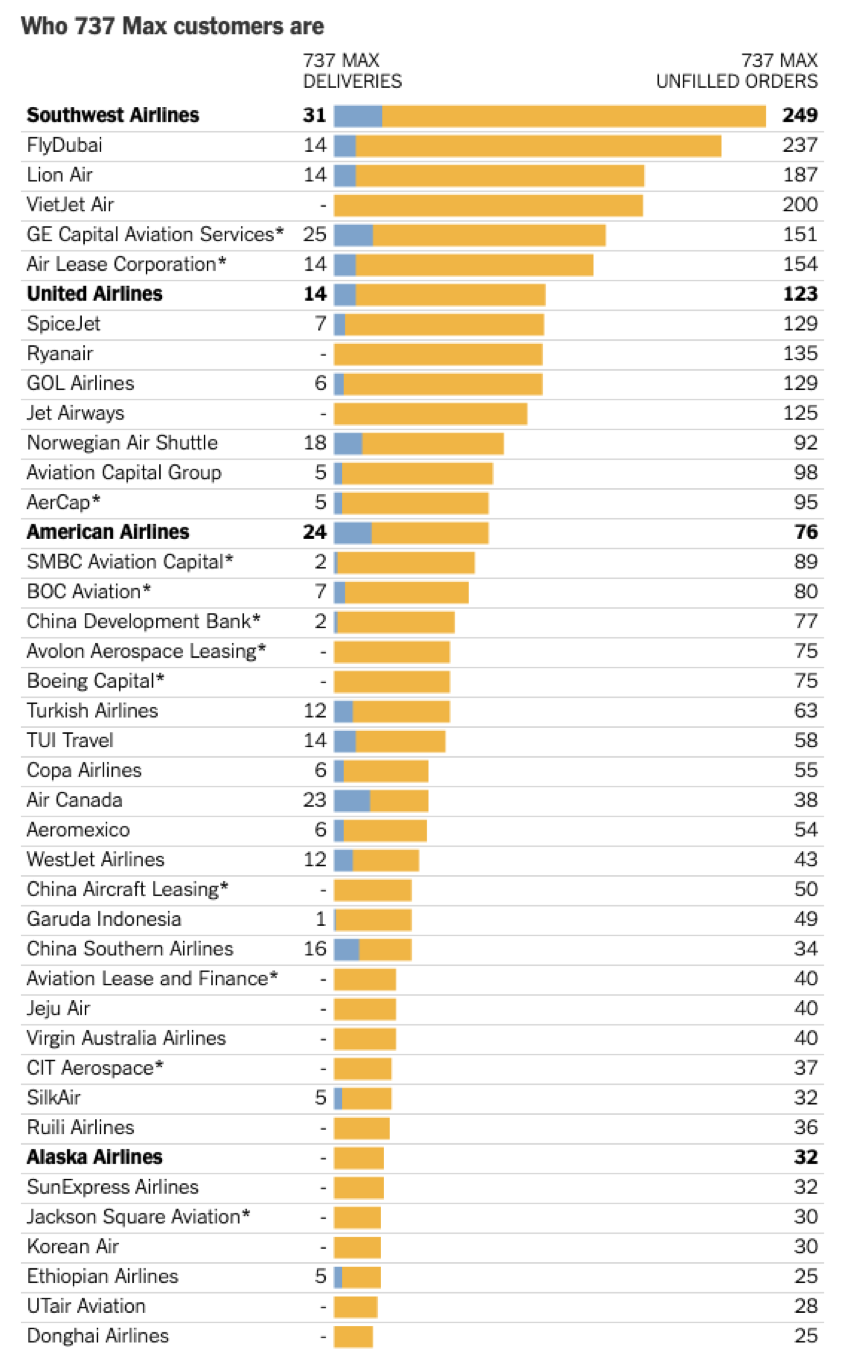

The truth is that the technological and cost advantages of the Boeing 737 Max are so enormous that airlines can’t compete without them. That explains why Boeing has a ten-year, 4,636 plane orderbook for the plane. Boeing has to fix this problem or there will be NO aircraft industry.

This is also why Southwest Airlines (LUV) has ordered 249 of the cutting edge planes, followed by 123 for United (UAL) and 76 for American (AAL).

Having been a commercial pilot for most of my life, and once owned a European air charter company, so I have some insights into this issue.

These two crashes are not just a software problem, which can be fixed in days. It is a pilot training issue. And I have been subjected to this training myself hundreds of times until I can do it blindfolded and in my sleep. Whenever you have a runaway autopilot problem, you PULL THE DAMN CIRCUIT BREAKER!

However, if you are poorly trained, as are many emerging airline pilots, and can’t remember which of the 100 circuit breakers you need to pull with a runaway autopilot then the plane will crash. The harsh truth here is that MOST modern-day pilots can’t hand fly a plane without an autopilot.

I therefore will to bet that Boeing stock is not going to fall another 8% over the next 18 trading days. So, I am buying the Boeing (BA) November 2019 $300-$310 in-the-money vertical BULL CALL spread at $8.75 or best.

This is a bet that Boeing shares will not fall below the $310 strike price by the November 15 options expiration date.

Don’t pay more than $9.25 or you will be chasing.

If you don’t do options, buy a small position the stock outright for a quick trade.

Here are the specific trades you need to execute this position:

Buy 11 November 2019 (BA) $300 calls at….…….………$40.00

Sell short 11 November 2019 (BA) $310 calls at………….$31.25

Net Cost:……………………...........…….………..………….….....$8.75

Potential Profit: $10.00 - $8.75 = $1.25

(11 X 100 X $1.25) = $1,375 or 14.28% in 18 trading days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.