Trade Alert - (BABA) November 23, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (BABA) – BUY

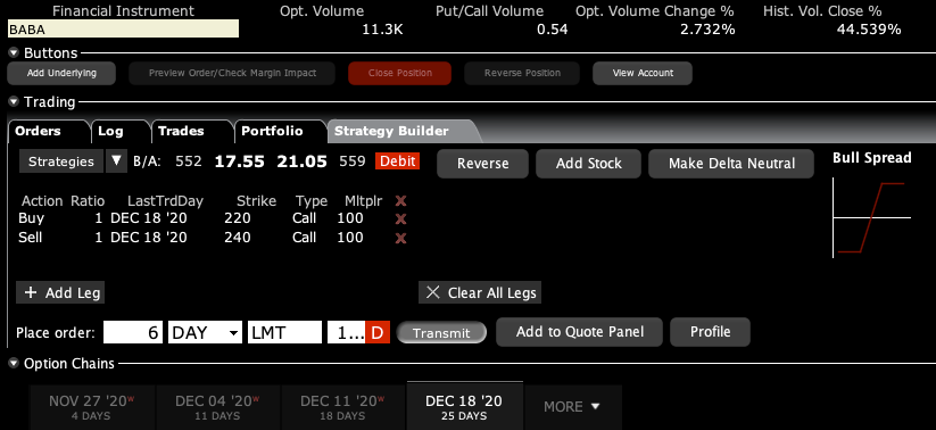

BUY the Alibaba (BABA) December 2020 $220-$240 in-the-money vertical Bull Call spread at $17.60 or best

Opening Trade

11-23-2020

expiration date: December 18, 2020

Portfolio weighting: 10%

Number of Contracts = 6 contracts

Over the past few months, record amounts of money have been pouring into China and emerging market ETFs. The reasons are very simple.

First, into the pandemic, China was first out. With the most draconian lockdown yet seen, the Middle Kingdom was able to cap total deaths at 4,000. The US is now losing that number of people every two days….with one fourth the population! As a result, China now has the world’s strongest economy, growing at a 6.6% annual rate.

The incoming Biden administration will lead to a major improvement in trade relations, bringing us back to globalization. All of this is hugely positive for Alibaba (BABA).

Alibaba is the giant of Chinese online commerce. Think of it as a combination of Amazon, Google, and PayPal. Its stock recently took a big $70, or 22% hit from the cancelation of the Chinese fintech giant Ant Group IPO, expected to be the largest in history at $37 billion.

As a 33% owner of the Ant Group, Alibaba was to receive a major payout from this. Eventually, the Ant IPO will go through somewhere, if not in China then in Hong Kong, or even the US next year. This will be hugely positive for Alibaba stock.

I am therefore buying the Alibaba (BABA) December 2020 $220-$240 in-the-money vertical Bull Call spread at $17.60 or best.

Don’t pay more than $18.50 or you will be chasing.

If you can’t do options, buy the (BABA) stock. I expect Alibaba to make it to $400 over the next two years.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 20 cents with a second order.

This is a bet that Alibaba (BABA) will not trade below $240 by the December 18 option expiration day in 19 trading days.

Here are the specific trades you need to execute this position:

Buy 6 December 2020 (BABA) $220 calls at………….……...…$51.50

Sell short 6 December 2020 (BABA) $240 calls at…………...$33.90

Net Cost:……………………................…….………..………….….....$17.60

Potential Profit: $20.00 - $17.60 = $2.40

(6 X 100 X $2.40) = $1,440 or 13.63% in 19 trading days.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.