Trade Alert - (BAC) December 11, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (BAC) ? STOP LOSS

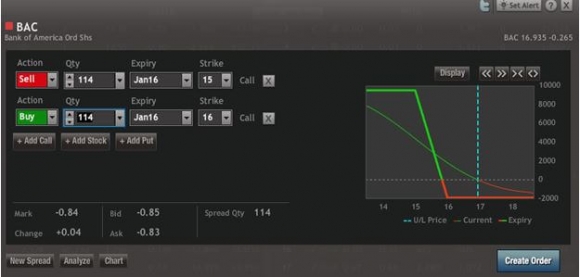

SELL the Bank of America (BAC) January, 2016 $15-$16 in-the-money vertical bull call debit spread at $0.84 or best

Closing Trade

12-11-2015

expiration date: January 15, 2016

Portfolio weighting: 10%

Number of Contracts = 114 contracts

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

If the price of this spread has moved more than 5% by the time you receive this Trade Alert, don?t chase it. Wait for the next one. There are plenty of fish in the sea.

Here are the specific trades you need to execute this position:

Sell 114 January, 2016 (BAC) $15 calls at?????$2.07

Buy to cover short 114 January, 2016 (BAC) $16 calls at..??.$1.23

Net Proceeds:??????????????????.....$0.84

Loss: $1.00 - $0.88 ? 0.84 = -$0.04

(114 X 100 X -$0.04) = -$456 or -0.46% profit for the notional $100,000 portfolio.