Trade Alert - (BAC) December 20, 2024 - EXPIRATION AT MAX PROFIT

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

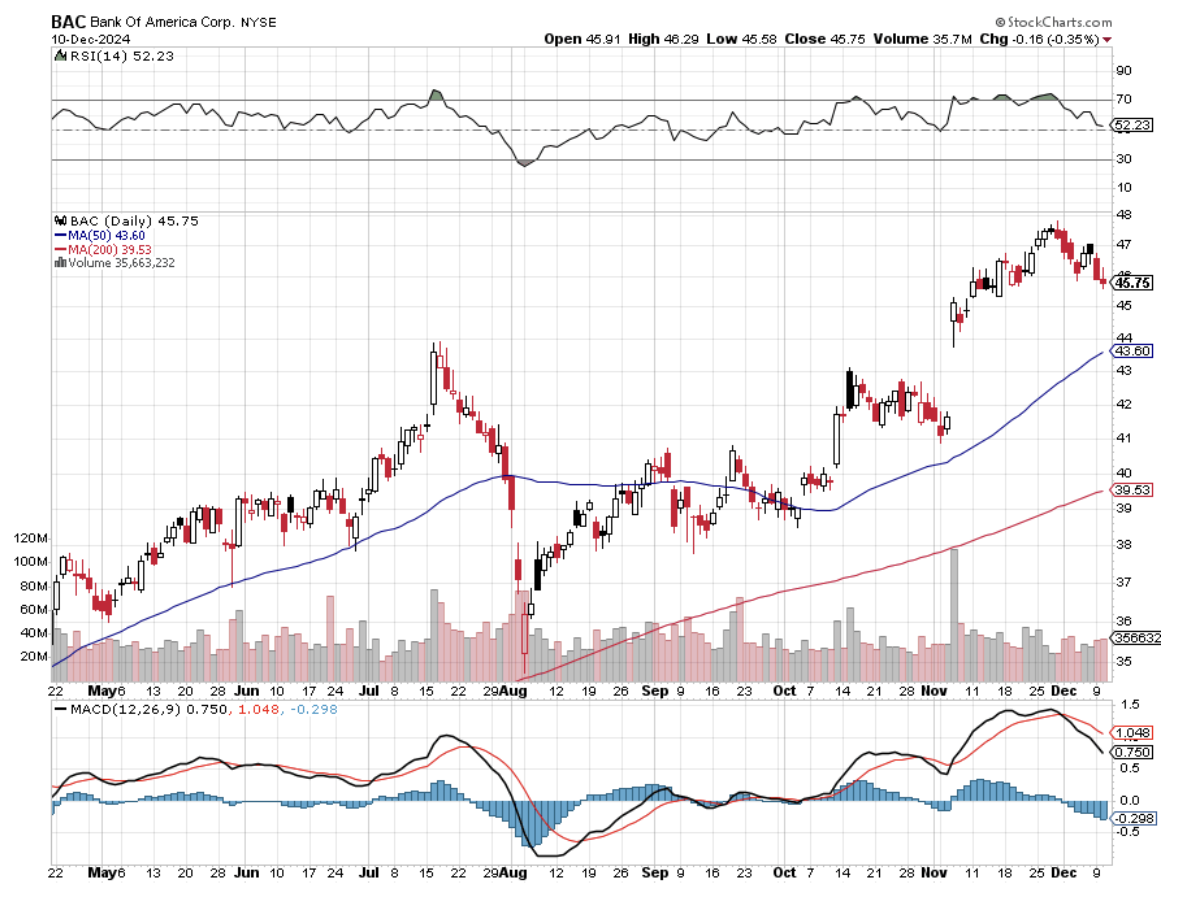

EXPIRATION of the Bank of America (BAC) December 2024 $41-$44 in-the-money vertical Bull Call debit spread at $3.00

Closing Trade

12-20-2024

expiration date: December 20, 2024

Number of Contracts = 40 contracts

Since I have a record of ten positions expiring at max profit on the Friday, December 20 options expiration, I am going to start sending out the closing trade alerts so you don’t get overwhelmed.

Since I issued it 26 trading days ago, the shares have risen by 3.97% above the nearest $44 strike price.

Just to be clear, this position does not expire until after the close on Friday, December 20.

As a result, you get to take home $1,600 or 16.00% in 26 days.

Well done, and on to the next trade.

You don’t have to do anything with this expiration.

Your broker will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning, December 23, and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

The flight of money right now is from small, undercapitalized, and questionable to large, overcapitalized, and rock-solid balance sheets.

There is a new theme in the post-election market. Falling interest rates are out, deregulation is in.

There is no more regulated industry than financials, as many of you in the industry already know. Any lightening of the burden flows straight to the bottom line. It also opens up new business for (BAC) in that antitrust is out the window.

To learn more about the company, please visit their website at https://www.bankofamerica.com

This was a bet that Bank of America would not fall below $44 by the December 20 option expiration in 20 days.

Here is the specific accounting you need to close out this position:

EXPIRATION of 40 December 2024 (BAC) $41 calls at………….………$4.75

EXPIRATION of short 40 December 2024 (BAC) $44 calls at…………$1.75

Net proceeds:………………………….………..………….…...........................$3.00

Profit: $3.00 - $2.60 = $0.40

(40 X 100 X $0.40) = $1,600 or 16.00% in 26 days.