Trade Alert - (BAC) March 13, 2023 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (BAC) – BUY

BUY the Bank of America (BAC) April 2023 $20-$23 in-the-money vertical Bull Call debit spread at $2.50 or best

Opening Trade

3-13-2023

expiration date: April 21, 2023

Number of Contracts = 40 contracts

I hate to make money at someone else’s expense. Buy hey, a buck is a buck. In karate school in Japan, they always teach you to kick a man when he is down because that is when they are least likely to hit you back.

Silicon Valley Bank fails to sell, but the FDIC stepped in to guarantee all deposits. The FDIC took over Signature Bank in New York as well. If they hadn’t, there would be lines snaking out the doors of every small bank in America Monday morning. The cost is being born by steeper deposit insurance premiums for the banking industry, which will no doubt cause some grumbling.

There are 100 banks that would leap to buy Silicon Valley Bank to gain the franchise in the world’s fastest growing technology center. They just need a few hours to get a handle on the bank’s loan portfolio, which only the former management really understand.

It is in that mean spirit that I am taking advantage of the Silicon Valley Bank crisis to dive in on Bank of America, which has cratered 40% in a week. As far as I can tell, the only connection (SCHW) has with Silicon Valley Bank is that they have branches on the same coast. They don’t even have any deposits there at (SVB).

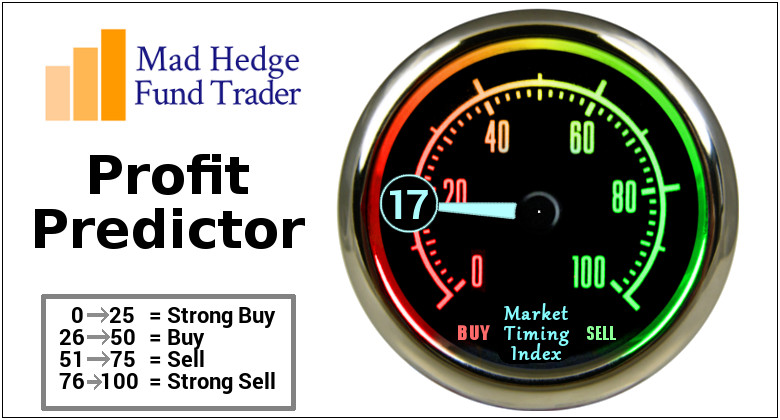

It helps also that the Volatility Index ($VIX) has just rocketed to $31 and a Mad Hedge Market Timing Index that just plunged to only 17.

I am therefore buying the Bank of America (BAC) April 2023 $20-$23 in-the-money vertical Bull Call debit spread at $2.50 or best.

The volatility is so extreme this morning that I am having to guess on this price. Just do the best you can. Many stocks have halted trading.

Don’t pay more than $2.70 or you’ll be chasing on a risk/reward basis.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

To learn more about the company, please visit their website at https://www.bankofamerica.com

This is a bet that Bank of America will not fall below $23 by the April 21 options expiration in 24 days.

Here are the specific trades you need to execute this position:

Buy 40 April 2023 (BAC) $20 calls at………….………$9.00

Sell short 40 April 2023 (BAC) $23 calls at…….……$6.50

Net Cost:………………...………….………..………….….....$2.50

Potential Profit: $3.00 - $2.50 = $0.50

(40 X 100 X $0.50) = $2,000 or 20.00% in 24 days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.