Trade Alert - (BOX) April 20, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - Box, Inc. (BOX) - BUY

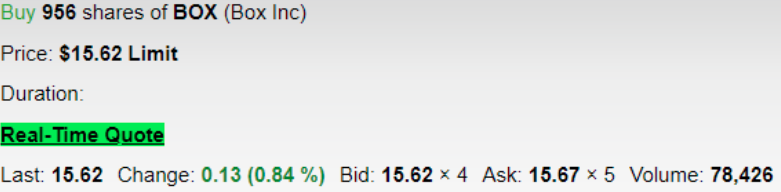

BUY Box, Inc. (BOX) at $15.62

Opening Trade

4-20-2020

Portfolio weighting: 15% (EQUITY)

Number of Shares = 956

This is an equity position in cloud company Box, Inc. (BOX) who have experienced a V-shaped recovery in shares from $9 to over $15.

This is an equity stake of 15% and I believe second-tier cloud shares still have more room to run as tech markets start to price in a “second wave” to this pandemic meaning cloud companies will be relevant for longer in the short-term.

Clearly many of these business models cannot survive on zero revenue like Neiman Marcus right now, but this is not the case for second tier cloud stocks who are experiencing a renaissance in not only revenue but just the sheer attention to their businesses by consumers and investors.

Just look at one of Box’s competitors Dropbox who is up over 4% this morning as oil prices crater to $11!

This is a dramatic rotation into everything tech and I forecast that Nasdaq shares will continue to increase its gap between the rest of the economy enabled by the Fed’s massive asset buying program.

The next in line to receive that “Amazon-like price action” are the cloud companies after the big boys.

Another cloud company that I have been keeping tabs on is Akamai.

Akamai Technologies, Inc. (AKAM) is a global provider of content delivery network and cloud infrastructure services. The company’s solutions accelerate and improve the delivery of content over the Internet, enabling faster response to requests for web pages, streaming of video and audio, and business applications among others.

I love this company.

This is a cloud name that should be bought on any and ever dip.

Another name in the same vein with a weaker balance sheet, lower revenue, and poorer profit profile is Dropbox.

Dropbox, Inc. (DBX) is a service company. It offers a platform which enables users to store and share files, photos, videos, songs and spreadsheets.

This is a time that second-tier stocks are starting to get the first-tier treatment in a shutdown economy.

The most important message here is that there will be very big losers and very big winners.

Pile into the winners and let the losers empty out the gyms, malls, and salons because the losers are anything that has a physical presence.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES

Here are the specific trades you need to execute this position:

Buy 956 X (BOX)………….…………....…………...…….……$15.62

Net Cost:………………………….………..………….….....$14,932.72

dollar cost = (956 X $15.62) = $14,932.72

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.