Trade Alert - (BRKB) June 18, 2021 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (BRKB) – TAKE PROFITS

SELL the Berkshire Hathaway B Shares (BRKB) June 2021 $260-$270 in-the-money vertical Bull Call spread at $9.80 or best

Closing Trade – NOT FOR NEW SUBSCRIBERS

6-18-2021

expiration date: JUNE 18, 2021

Portfolio weighting: 10%

Number of Contracts = 12 contracts

With the markets in freefall, especially in financials, and the Dow down $500, I am not going to take a chance running this position a few more hours into expiration. Not helping was Fed governor Bullard’s hawkish comments pouring a bucket of water on our parade.

I am therefore selling the Berkshire Hathaway B Shares (BRKB) June 2021 $260-$270 in-the-money vertical Bull Call spread at $9.80 or best.

By coming out here you get to take home $1,560 or 15.29% in 22 trading days. Well done and on to the next trade. This takes me to a rare 90% cash position, and at the close today, I’ll be 100% in cash.

Berkshire Hathaway is the investment vehicle managed by Oracle of Omaha Warren Buffet. The 40-year average annualized increase in book value is 19.0%. It is heavily weighted in high cash flow financials and domestic recovery stocks. Its sole major technology stock is Apple, which it has recently been selling.

The top holdings of (BRKB) are Apple (AAPL), Bank of America (BAC), Coca-Cola (KO), American Express (AXP), and Kraft Heinz (KHC).

Berkshire Hathaway “B” shares are the seventh-largest component of the S&P 500 (SPY) with a market capitalization of $478 billion, and the only class of shares that trade options. It is a great play on the domestic cyclical recovery half of the US economy. For more about Berkshire Hathaway please read my extended research piece below.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done cancel your order and lower your offer by 10 cents with a second order.

This was a bet that Berkshire Hathaway (BRKB) will not fall below $270 by the June 18 option expiration day in 22 trading days. For more about (BRKB) please click here for their website at https://berkshirehathaway.com

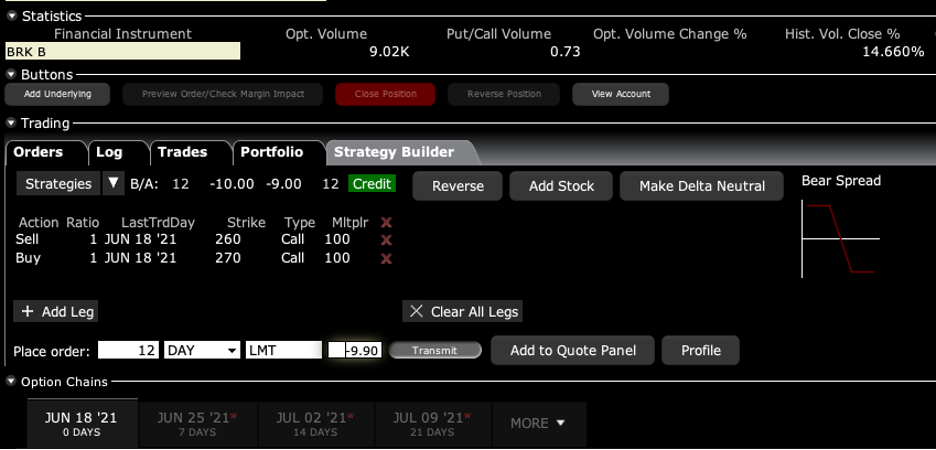

Here are the specific trades you need to exit this position:

Sell 12 June 2021 (BRKB) $260 calls at….........……….…$13.00

Buy to cover short 12 June 2021 (BRKB) $270 calls at....$3.20

Net Proceeds:……………….......……….………..………….….....$9.80

Profit: $9.80 - $8.50 = $1.30

(12 X 100 X $1.30) = $1,560 or 15.29% in 22 trading days.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

The Barbell Play with Berkshire Hathaway

It’s time to give myself a dope slap.

I have been pounding the table all year about the merits of a barbell strategy, with equal weightings in technology and domestic recovery stocks. By owning both, you’ll always have something doing well as new cash flows bounce back and forth between the two sectors like a ping pong ball.

After all, nobody gets sector rotation right, unless they have been practicing for 50 years, like me.

Full disclosure: I have to admit that after 50 years of following him, I love Buffet. He was one of the first subscribers to my newsletter when it started up in 2008. Some of his best ideas have come from the Mad Hedge Fund Trader, like buying Bank of America for $5 in 2008.

Oh, and he hates Wall Street for constantly fleecing people. Ditto here.

In reading Warren Buffet’s annual letter (click here for the link), it occurred to me that his Berkshire Hathaway (BRKB) shares were in effect a one-stop barbell investment.

For a start, Warren owns a serious slug of Apple (AAPL), some $120 billion worth, or 2.5% of the total fund. That gives (BRKB) some technology weighting. It cost him only $20 billion. The dividends he received entirely paid for the initial cost. So he owns 4% of Apple for free.

I remember the battle over the initial “BUY” five years ago. Warren fought it, insisting he didn’t understand the smartphone business. In the end, he bought Apple for its global brand value alone.

That is Warren Buffet to a tee.

The next five largest publicly listed holdings are Bank of America (BAC), Coca-Cola (KO), American Express (AXP), and Verizon Communications (VZ). These are your classic domestic recovery sectors. And with a heavy weighting in other banks (BK) (USB), Buffet is effectively short the bond market (TLT), another position I hugely favor.

Also included in the package is a liberal salting of pharmaceuticals, Merck (MRK) and AbbVie (ABBV). He has a small energy weighting with Chevron (CVX). He even has a position in old heavy metal America with General Motors (GM).

Berkshire is also one of the world’s largest property & casualty insurance owners. Its current “float” is $138 billion. You all know his flagship holding, GEICO. And the gecko mascot isn’t going anywhere as long as Warren lives. It was Warren’s idea.

It all seems to work for Warren. In 2020, he earned a staggering $42.5 billion. All told, Berkshire’s businesses employ 360,000, second to only Amazon (AMZN), and is the largest taxpayer in the United States, accounting for 3% of government revenues. Berkshire is also the largest owner of capital goods & equipment in the US worth $156 billion, topping (AT&T).

Many of Warrens's early 1956 $1,000 investors are millionaires many times over….and over 100 years old, prompting him to muse if ownership of his shares extended life.

Warren’s annual letter, which he spends practically the entire year working on, is always one of the best reads in the financial markets. There isn’t a better 50,000-foot view out there. He also admits to his mistakes, such as his disastrous purchase of Precision Castparts (PCC) in 2016 for $37 billion, which later suffered from the crash in the aerospace industry. In 2020, Buffet wrote off $11 billion of that acquisition.

He can do worse. In 1993, he bought the Dexter Shoe Company for $433 million worth of Berkshire stock. The company went under, but the Berkshire stock today is worth $8.7 billion.

Buffet’s letters always refer back to some of his “greatest hits,” today legends in the business history of the United States: GEICO, Furniture Mart, Berkshire Hathaway Energy, and See’s Candies, one of the largest employers of women in the US using 150-year-old recipes. Its peanut brittle is to die for.

In 2009, Buffet snatched away from me BNSF for a song, now the most profitable railroad in the country, an amalgamation of 360 railroads over 170 years. I say “snatched away” because it was my favorite railroad trading vehicle for decades until he bought the entire company. I hear its trains run by my home every night as a grim reminder.

Another benefit to owning (BRKB) is that Buffet is far and away the largest buyer of his own shares, soaking up $25 billion worth in 2020. And he is buying the shares of other companies that are also aggressively buying their own shares, like Apple ($200 billion with last year). It all sounds like the perfect money creation machine to me.

It gets better. Berkshires “B” shares trade options, meaning you can buy LEAPS (Long Term Equity Anticipation Securities), which by now, you all know and love. I’ll run some numbers for you.

With (BRKB) now trading at $254, you can buy the January 2023 $300-$310 call spread for $2.50. If the shares close anywhere over $310 by the 2023 expiration, the position will be worth $10.00, giving you a gain of 300%. And you only need an appreciation of $56, or 22% in the shares to capture this blockbuster profit, giving you upside leverage of an eye-popping 13.63X in the best-run company in America.

See, I told you you’d like it.

This is how poor people become rich. In fact, my target for (BRKB) is $300 for end of 2021 and $400 for 2022, right when the two-year LEAPS expire.

One question I often get about Berkshire is what happens when Warren Buffet goes to his greater reward, not an impossible concept given that he is 90 years old.

I imagine the shares will have a bad day or two, and then recover. Buffet has been hiring his replacements for a decade or more, and he handed off day-to-day operation years ago (I didn’t want to move to Omaha, no mountains).

When that happens, it will be the best buying opportunity of the year. And another chance to load up on those LEAPS.