Trade Alert - (CCJ) May 6, 2022 - STOP LOSS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (CCJ) – STOP LOSS

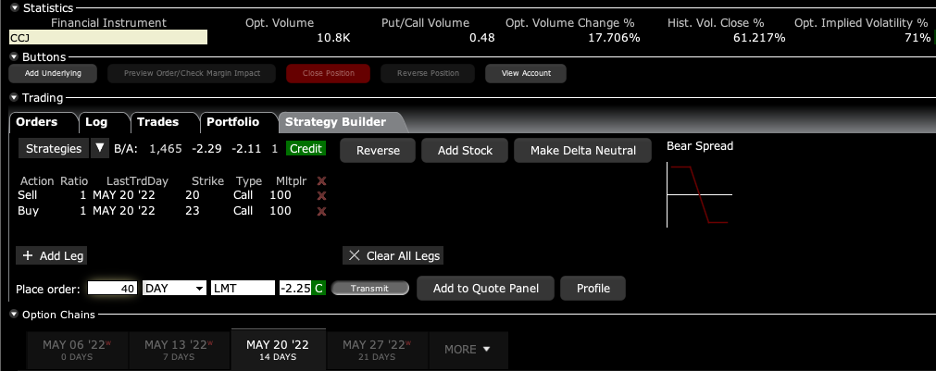

SELL the Cameco (CCJ) May $20-$23 vertical BULL CALL spread at $2.25 or best

Opening Trade

5-6-2022

expiration date: May 20, 2022

Portfolio weighting: 10%

Number of Contracts = 40 contracts

Last week was definitely not the week to own energy stocks. As we are approaching my mandatory stop loss at the upper strike price of $23, I am going to pull the trigger now.

Therefore, I am selling the Cameco (CCJ) May 2022 $20-$23 vertical BULL CALL spread at $2.25 or best

Saskatchewan, Canada based (CCJ) is the world’s second largest uranium producer, accounting for 18% of the total world supply.

After being bearish in uranium plays for the last 11 years, since the 2011 Fukushima disaster, I am turning bullish on uranium plays.

The need for Germany to slow its own shutdown of its nuclear industry is overwhelming, as they have to replace Russian gas imports asap, which accounts for 50% of its total electricity supply.

In addition, as climate change and clean energy gain momentum, there is a new push towards nuclear power as a non-carbon energy source.

China is still going pedal to the medal, with 100 new nuclear power plants under construction.

The world’s largest uranium producer is in Kazakhstan, Kazatomprom, with 28% of global production, so you can forget about that.

Today’s selloff was triggered by cautious forecasts that yellow cake demand in China, the world’s largest copper consumer, is fading. This is due to the Shanghai Covid lockdown, which is temporary at best.

Yellow cake is the refined concentrate powder form of U3O8 (triuranium octoxide) used by nuclear power plants.

This was a bet that the (CCJ) would not fall below $23.00 by the May 20 options expiration in 18 trading days.

If you are looking for other uranium plays, please look at the Global X Uranium ETF (URA) and the Van Eck Vectors Uranium+Nuclear Energy ETF (NLR).

To learn more about Cameco, please visit their website by clicking here at https://www.cameco.com

Here are the specific trades you need to execute this position:

Sell 40 May 2022 (CCJ) $20 calls at…………..............………$3.65

Buy to cover short 40 May 2022 (CCJ) $23 calls at…………$1.40

Net Proceeds:………………………….…….......…..………….….....$2.25

Loss: $2.40 - $2.25 = -$0.15

(40 X 100 X -$0.15) = -$600 or 6.67% in 7 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can behad by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.