Trade Alert - (COST) March 24, 2025 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (COST) – BUY

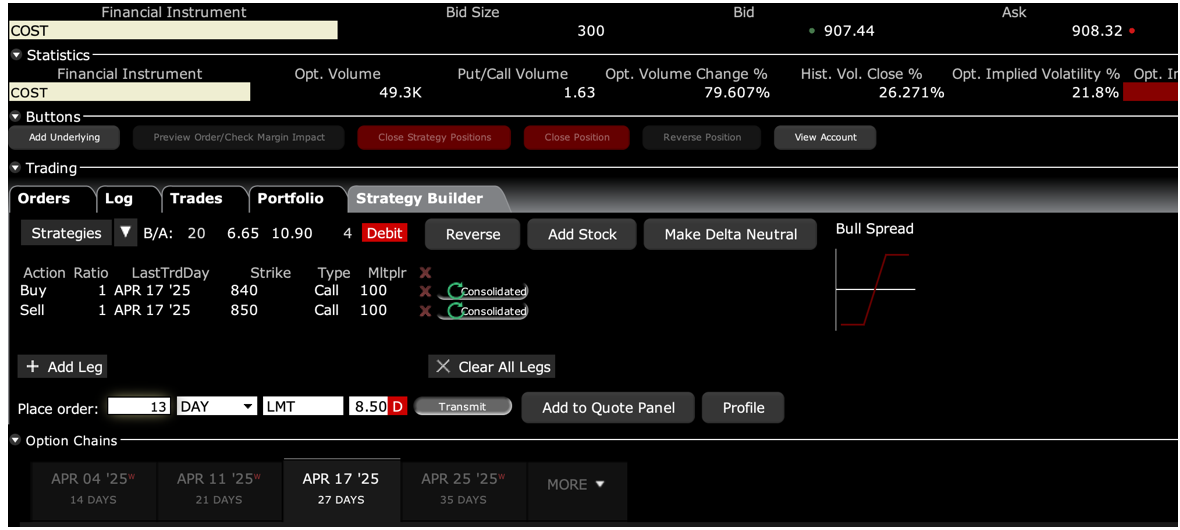

BUY the Costco (COST) April 2025 $840-$850 in-the-money vertical Bull Call debit spread at $8.50 or best

Opening Trade

3-24-2025

expiration date: April 17, 2025

Number of Contracts = 13 contracts

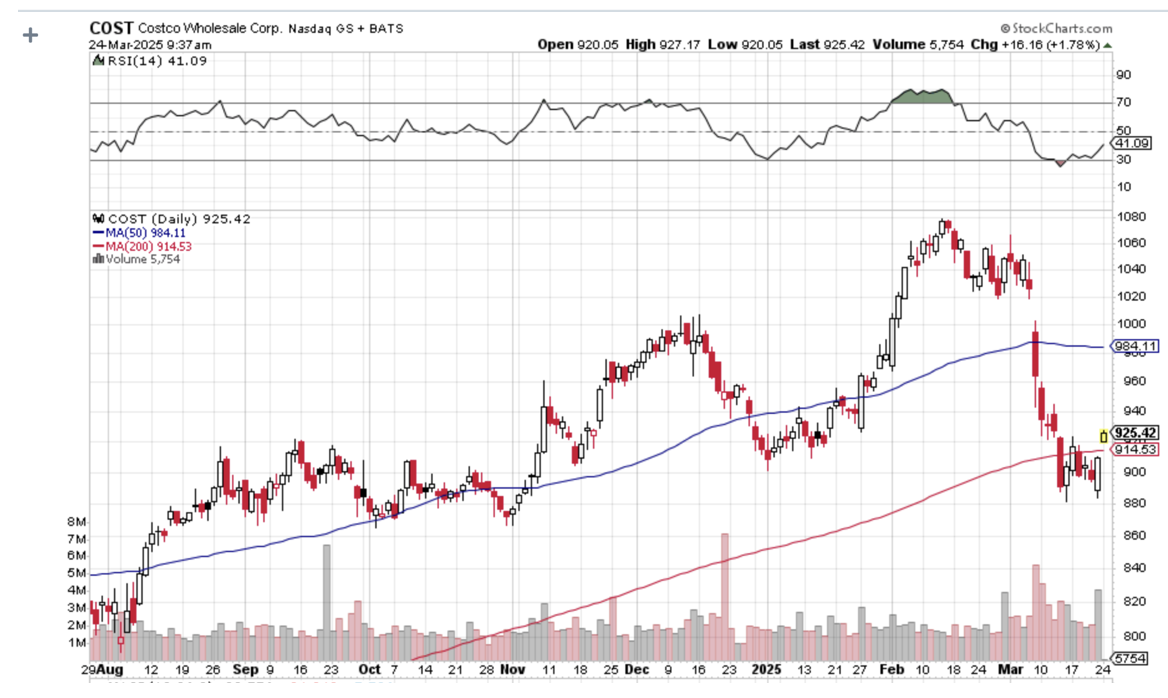

I have been trying to buy Costco for years, but it has always been insanely expensive. Investors are willing to pay big premiums for reliable dividends and earnings compounders like (COST).

However, after a 20% decline in a month, the shares are no longer expensive, just expensive. I am going to get into Costco because they are an absolutely outstanding company.

My late mentor at Morgan Stanley was a grizzled old Marine named Barton Biggs, who created the now hugely profitable asset management division some 40 years ago. He was close friends with Sam Walton, the founder of Walmart, and Sam Walton was a huge admirer of Costco, which was just starting up then. Sam used to sneak into Costco and take notes on everything they were doing right and then call the founders and compliment them on a job well done. I’m surprised Wal-Mart never took over the company, which is too big to take over now. Costco is still the same company today.

If we had a different president of the United States I would be recommending a two-year LEAPS on Costco right now. But the world is too uncertain and unstable to contemplate such long-term risk now. I‘ll wait for the recession versus the depression to get settled first.

As far as I know, Costco has no government contracts that can get called any day without notice, a great risk to any share price these days.

I am therefore buying the Costco (COST) April 2025 $840-$850 in-the-money vertical Bull Call debit spread at $8.50 or best.

Don’t pay more than $9.00 or you’ll be chasing on a risk/reward basis.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order. If that gets you nothing, try raising your strike prices by $1.00.

If you don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $8.50, $8.60, $8.70, $8.80, and $8.90. You should get done on some or all of these.

Costco Wholesale Corporation operates a chain of membership-only big box warehouses (I am a member). As of 2021, Costco is the third largest retailer in the world. As of 2024, Costco is the world's largest retailer of beef, poultry, organic produce, and wine, and just under one-third of American consumers regularly shop at Costco warehouses. Costco is ranked #11 on the Fortune 500 rankings of the largest United States corporations by total revenue.

Costco originally began with a wholesale business model aimed at enrolling businesses as members, then also began to enroll individual consumers and sell products intended for them, including its own private label brand.

Costco's worldwide headquarters are in Issaquah, Washington an eastern suburb of Seattle, although its Kirkland Signature house label bears the name of its former location in Kirkland, WA. The company opened its first warehouse (the chain's term for its retail outlets) in Seattle in 1983. Through mergers, however, Costco's corporate history dates back to 1976, when its former competitor Price Club was founded in San Diego, CA.

As of November 2024, Costco operates 890 warehouses worldwide: 616 in the United States and Puerto Rico, 109 in Canada, 41 in Mexico, 36 in Japan, 29 in the United Kingdom, 19 in South Korea, 15 in Australia, 14 in Taiwan, 7 in China, 5 in Spain, 2 in France, 1 in Iceland, 1 in New Zealand, and 1 in Sweden.

To learn more about the company please visit their website at https://www.costco.com

This is a bet that Costco will not fall below $850 by the April 17 option expiration in 19 trading days.

Here are the specific trades you need to execute this position:

Buy 13 April 2025 (COST) $840 calls at………….……..…$89.00

Sell short 13 April 2025 (COST) $850 calls at……………$80.50

Net Cost:………………………….………..………....................…$8.50

Potential Profit: $10.00 - $8.50 = $1.50

(13 X 100 X $1.50) = $1,950 or 17.64% in 19 days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.