Trade Alert - (DHI) November 4, 2024 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (DHI) – TAKE PROFITS

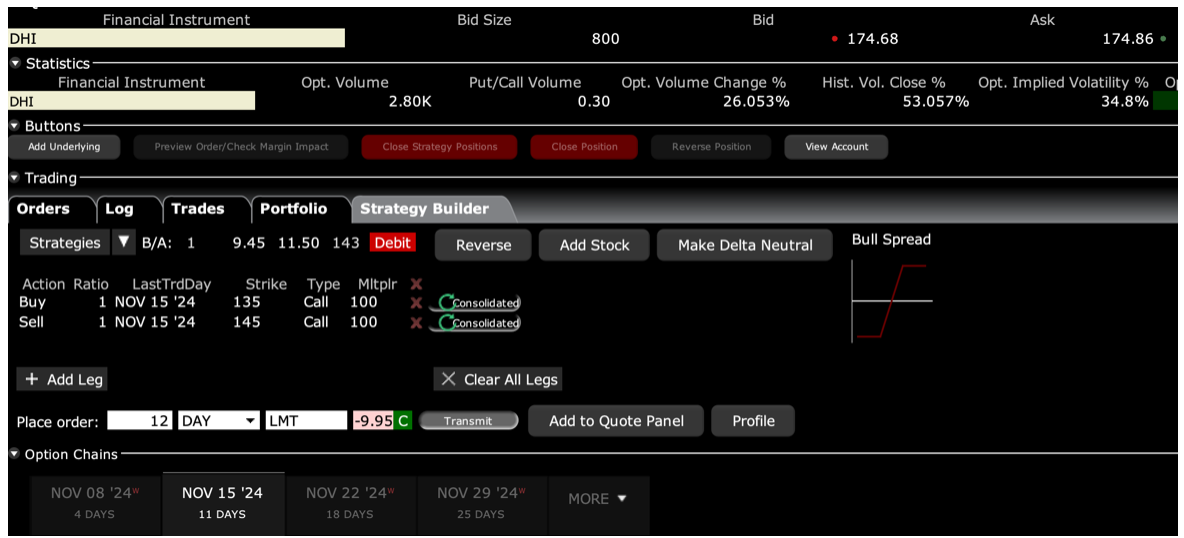

SELL the DH Horton (DHI) November 2024 $135-$145 vertical BULL CALL debit spread at $9.95 or best

Closing Trade

11-4-2024

expiration date: November 15, 2024

Portfolio weighting: 10%

Number of Contracts = 12 contracts

All interest rate plays are rocketing today, and first and foremost are the new home builders.

DH Horton bombed last week, with the stock dropping some 11% on Tuesday morning trading after the U.S.'s largest homebuilder issued its fiscal 2025 guidance for revenue that fell short of Wall Street expectations, following worse-than-expected headline numbers for fiscal Q4 2024.

Buying high-quality names on temporary earnings shortfalls and weak guidance certainly has been far and away the winning strategy of 2024. It’s worked every time we have executed it. (DHI) is now up $20.6, or 13.46% of the $153 low in only 20 trading days.

I am using the spike in the share price to take profits on my long to avoid election risk. With only a few cents left in the position, hanging on to the November 15 option expiration in 9 trading days with 95% of the maximum potential profit in hand would be the height of lunacy.

If you can’t do options, buy the stock. My long-term target for (DHI) is $250, up 43%. If you want a less volatile position, you can buy the SPDR S&P Homebuilders ETF (XHB), a basket of stocks in the industry.

Therefore, I am selling the DH Horton (DHI) November 2024 $135-$145 vertical BULL CALL debit spread at $9.95 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

If you live in a foreign time zone when the US stock market is closed, such as Australia, simply enter a spread of Good-Until-Cancelled orders overnight, like $9.95, $9.90, $9.85, and $9.80. You should get done on some or all of these.

As a result, you get to take home $1,140 or 10.56% in 4 trading days. Well done, and on to the next trade.

The company revenue of $36.0B-$37.5B, trailing the $39.5B average analyst estimate. Homes closed by homebuilding operations are expected to be 90K-92K, and cash flow provided by operations are anticipated to be greater than fiscal 2024. Also, for the year, it expects to buy back about $2.4B of its common stock and provide dividend payments of ~$500M.

The bull case for homebuilders is very simple. They are Catching on Fire with the prospect of falling interest rates. The US has a structural shortage of 10 million homes with 5 million Millennial buyers. Homebuilders have been underbuilding since the 2008 Great Financial Crisis, seeking to emphasize profits and share buybacks over to development land purchases.

Buy (DHI), (LEN), (PMH), (KBH) on any dips. (DHI) is the largest of these, with a market capitalization of $53 billion.

For details about DH Horton, please visit their site at https://www.drhorton.com

This is a bet that the (DHI) will not fall below $145.00 by the November option expiration in 13 trading days.

Here are the specific trades you need to exit this position:

Sell 12 November 2024 (DHI) $135 calls at………….….............……$30.00

Buy to cover short 12 November 2024 (DHI) $145 calls at…………$20.05

Net Proceeds:……………………………...….….......................................$9.95

Profit: $9.95 - $9.00 = $0.95

(12 X 100 X $0.95) = $1,140 or 10.56% in 4 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.